Happy Mother’s Day to all the wonderful moms out there from the staff at TBR News Media! May your day be filled with love and laughter!

TBR Staff

Joe Erland and Harry Heywood honored for their contributions to Village of Port Jefferson

By Sofia Febles

The sun was beaming down on parkland located on Caroline Avenue in Port Jefferson May 3, where two families gathered to honor their fathers. Two pillars of Port Jefferson were honored today: Joe Erland and Harry Heywood.

Joe Erland, also known as Mr. Port Jefferson, was a Port Jefferson Fire Department commissioner, village trustee and deputy mayor. A lover of softball, the field in Heywood Park was rededicated as Joe Erland Field. As Port Jefferson Village Mayor Lauren Sheprow mentioned during the ceremony, “Joe Erland has been described by his peers as humble, kind-hearted, and approachable…He always wanted to help people around him.”

Harry and Lois Heywood were commended for their tremendous contributions to the village. Harry Heywood and his wife Lois were married in 1931 where they began developing their legacy. They were involved in many organizations including the Ground Observation Corps and the Aircraft Warning Service that Harry developed and volunteered at.

Harry Heywood developed Suassa park, where he constructed a 40-foot watchtower that serves as a lookout point for aircrafts during World War II. The Heywoods utilized the park for the town’s benefit, creating parks and athletic fields for kids and adults to play baseball, softball, and soccer for many years and more years to come. They donated the ballfield and creek to the community in the 1950’s.

Many people spoke at the dedication ceremony including Deputy Mayor Bob Juliano, Legislator Steven Englebright, former Parks & Recreation Director Ron Carlson, Pete Heywood and Steve Erland, Joe Erland’s son. The people who spoke talked very highly about Joe Erland and the Heywood family. Englebright said, “parks last forever.” Englebright said we want to “appreciate and remember these important people who contributed so much to Port Jefferson”.

Erland has a son named Steve and two daughters named Michelle and Andrea. Steve Erland said his father “dedicated his life to this village.”

Peter Heywood, Harry and Louis’ son, and Peter’s daughter Randi were amazed and honored to have the park named after their family. The mayor mentioned that this couple were” two pillars of Port Jefferson whose civic contributions and love story helped shape Port Jefferson Village for nearly a century.” Peter Heywood and his daughters Randi and Lisa have continued their legacy and have been contributing to the parks. Sheprow said, “All of Port Jefferson now proudly remembers this is not just a park, but as Heywood Park- where love, learning and legacy live on”.

The Joe Erland Field at Heywood Park will always be a reflection of the impact Erland and the Heywoods have made in Port Jefferson.

Three Village Civic Association hosts planning meeting for Setauket Harbor Park

In a recent meeting at Studio 268 in East Setauket, around two dozen community activists began planning for a new expanded park in the downtown area, which many hope will help Main Street become a place where residents can stroll, take in views of the harbor and learn about Setauket’s local history.

Organized by the Three Village Civic Association, headed by Charlie Tramontana, the participants included Brookhaven Councilmember Jonathan Kornreich (D-Stony Brook), Suffolk County Legislator Steve Englebright (D-Setauket) and members of the Thre Village Chamber of Commerce, the Three Village Rotary Club and the Setalcott Nation, among others.

The working group will be meeting over the next several months to develop a plan that will then be incorporated into the Town of Brookhaven’s park project plan.

Charlie Tramontana said, “today was the first meeting of the working and planning group where we walked the park and discussed features that we hope to incorporate into the eventual plan for the park.”

The Three Village Civic Association plans to take the ideas and incorporate them into a computer generated site plan that will be created by Joseph Betz, a professor of architecture at Farmingdale College and member of the civic association.

SBU students sail into mythology at 36th annual Roth Pond Regatta

By Mariam Guirgis

Stony Brook University students summoned the power of the Greek gods for the 36th Annual Roth Pond Regatta on May 2.

The long-standing tradition invites students to put their creativity, engineering skills and teamwork to the test. With final exams approaching, the Regatta offers a chance to step away from classes and take part in a spirited race across Roth Pond using only cardboard, duct tape and paint.

This year’s theme, Greek Mythology, encouraged participants to draw inspiration from gods, heroes and legendary creatures. Students reflected that spirit in their boat designs, whether it was through representing the wisdom of Athena, the speed of Hermes or the strength of Ares. Many participants blended humor with mythology in inventive ways, and the theme was evident in boat names, costumes and design details.

Boats were built to carry two to four team members across the 200-yard pond. Some groups spent weeks designing their boats, while others made last-minute improvements to ensure they stayed afloat. Once boats were in the water, the biggest challenge mentioned by many competitors was the ability to row. As boats started to fill up with water mid-race, success depended on coordination and timing.

The Motorsports Club, racing with their boat Noah’s Chariot, managed to win their heat despite the unexpected obstacle mid-race.

“I was in the middle of rowing, I felt my paddle jiggle a little, but I was like ‘I should be fine’ and I kept going. Two strokes later it snaps on me,” rower Jason Jiang said.

Judging was based on a variety of categories including Most Original, Best Titanic (for the most dramatic sink), Best Showcase, Most Team Spirited, and others. The titles of Best Speedster and Best Yacht were reserved for the final heat winners. This year’s Speedster trophy went to Scuderia Scooteroni, while The Spirit of Stony Brook took home the Yacht title.

This was Scuderia Scooteroni’s third consecutive win at the Regatta which continues their winning streak that has spanned for three years. The team credits one key factor: cardboard sourcing.

“We’ve been building the same boat for the past three years and clearly the design is effective,” the team said. “The trick is to contact warehouses because they have old waste of piles and piles of cardboard.”

For The Spirit of Stony Brook, they attributed their win to the improvements made to their boat design. “We made [the boat] too big [last year, so] we cut down on the size [and it was] perfect.”

Attendees were also able to participate by voting for Wolfie’s Favorite, selecting their top three boats in both the Speedster and Yacht categories. The entries reflected wide campus involvement, including residence halls, student organizations, academic departments and cultural groups. Some notable entries included The Sisyphus (Climbing Club), Cerberus (Douglass Hall), Apollo 11 (Aerospace Engineering Club), Poseidon’s Wave (Keller Hall), and Hydracraft (Marine Science Club).

Academic departments also joined the fun, with entries like The Organic Odyssey by the Molecular Science Teaching Assistants and Langmuir’s Chariot from the Langmuir Hall Council. The event was as much about participation and school spirit as it was about competition.

Beyond the races, attendees enjoyed a lively atmosphere around Roth Pond. Spectators gathered to watch as boats battled to stay afloat, while sampling food and exploring displays from various campus departments. The event served not only as a showcase of student creativity but also as a celebration of campus-wide community and spirit.

The Regatta was broadcast live on YouTube in collaboration with the School of Communication and Journalism, making it accessible to viewers beyond campus.

Now in its 36th year, the Roth Pond Regatta remains one of Stony Brook’s most distinctive traditions. By combining creativity, collaboration, and a bit of chaos, it continues to bring the campus community together in a uniquely memorable way.

Mariam Guirgis is a reporter with The SBU Media Group, part of Stony Brook University’s School of Communication and Journalism’s Working Newsroom program for students and local media.

Ward Melville grad Tom Theodorakis named athletic director at West Point

By George Caratzas

After a long career as a collegiate athletic executive, Ward Melville graduate Tom Theodorakis was recently named the athletic director of the United States Military Academy at West Point.

Theodorakis — who attended Ward Melville from 2000 to 2002 — was a standout on the lacrosse field, eventually going on to play at the collegiate level at Syracuse. As a member of the Orange, Theodorakis made four NCAA tournaments, making three final four appearances and won the national championship in 2004.

“Lacrosse afforded me a lot of opportunities,” Theodorakis said. “To go to a place like Syracuse as a student-athlete just had a really profound impact on my life … I don’t know where I’d be without them. I came in as a proverbial punk kid and left school as an adult.”

Still, Theodorakis credits much of his start to the place where he spent his early years.

“I am very fortunate to grow up in a fantastic part of Long Island that afforded me a lot of great opportunities,” Theodorakis said. “One of those was going to Ward Melville High School. Not only was I surrounded by great teachers, but also first-class athletics.”

Fast forward 20 years, Theodorakis was named West Point’s 31st Athletic Director in February of this year. Previously, he served as a deputy director under Mike Buddie who he credits as an instrumental piece in his transition into the new role.

“It was a sudden change,” Theodorakis said. “I was fortunate that Mike empowered me on a lot of initiatives and responsibilities in our department. He really helped prepare me for this role.”

Working at a service academy poses a unique set of challenges, especially on the athletic level. While some of Theodorakis’ career stops have prioritized athletic excellence, West Point’s top goal remains to prepare cadets for future military experience.

“You have to recruit the right individuals that are thinking long-term,” Theodorakis said. “It takes a special type of individual that is able to say, ‘this is the sacrifice that I want to make.’ Ultimately, these individuals want to serve their country and set them up for success.”

West Point is not the first service academy that Theodorakis has called home. In fact, his first job out of college was an internship in the athletic department of the United States Air Force Academy in Colorado Springs. This role gave him all sorts of different experiences, including some not so glamorous ones.

“Air Force is definitely a smaller athletic department which let me have my hands on a lot of things,” Theodorakis said. “Sometimes this included cleaning out the closet or being the mascot, but those are the things you do in an entry level position. For me, I just loved all of it because I was just so excited to be a part of college athletics.”

His tenure in Colorado Springs was a jumping off point for various roles at the University of Arizona, UCLA and Harvard, before landing in the Hudson Valley.

“I knew that if someone’s going to give me an opportunity — or at least crack the door open — I am going to work my tail off to turn that into a full-time job,” Theodorakis said. “I grew up in New York, went to school in New York. I think getting out of my comfort zone personally and professionally was a really good thing and that came from moving out west.”

All along, Theodorakis’ plan was to return to the East Coast, a move he made in 2022.

“Ultimately, I always had the goal of moving back to New York, but I realized that it may take some time,” Theodorakis said. “These careers are not linear, and for me it took close to 15 years to get to Harvard and get back to the East Coast.”

Despite a lengthy career, Theodorakis stays true to his roots on Long Island’s north shore.

“It’s hard for me not to look back on my time growing up on Long Island and not to thank the amazing moms and dads that understood the value of sports,” Theodorakis said. “Whether it be coaching teams or volunteering, I still rely on a lot of those lessons today. It had such an impact on my life and they believed in the community and what we were doing.”

George Caratzas is a reporter with The SBU Media Group, part of Stony Brook University’s School of Communication and Journalism’s Working Newsroom program for students and local media.

Present meets past at 17th Annual Antiques and Garden Weekend in Port Jefferson

By Sumaq Killari

The scent of rusted metal and aged cedar greeted visitors as they stepped inside the Port Jefferson Village Center this past weekend, where the past felt freshly alive.

The three-story venue was transformed for the 17th Annual Antiques and Garden Weekend, a community tradition and fundraiser for the Port Jefferson Historical Society, generously sponsored this year by Northwell Mather Hospital.

The building buzzed with activity as visitors explored vintage treasures and seasonal blooms. The Suwassett Garden Club showcased a vibrant display of hanging baskets, perennials and patio planters.

“It’s a time when the whole community comes together,” said Catherine Quinlan, a member of the Port Jefferson Historical Society board of trustees. “You see people you haven’t seen for maybe a year or so. People come together and just support each other. It’s really a wonderful event.”

The first floor featured at least 20 different vendors, many displaying jewelry in glass display cases, glassware, porcelain statues, old postcards and framed drawings and pictures.

Toward the south side of the first floor, Karen & Albert, a business owned by Karen and Albert Williams, a married couple, displayed furniture from different eras, including a 30-year-old wooden writing desk with a gently curved design. But there is a trick: hidden inside is a concealed bar. “You think it’s just a desk when you see it,” said Albert Williams with a smile.

“Part of our company is to be able to educate people about antiques and about vintage items and how they can incorporate that with their own style,” said Karen Williams. “We have been in business for over 40 years, so we go on buying trips all the time,” she said.

On the second floor, a booth displayed a collection of thrifted bags, including a beige Lauren Ralph Lauren handbag made of monogrammed fabric and featuring the LRL logo, priced at just $30. “This bag is so Y2K,” said Emelyn Ore, a college student attending the event. She noted its early 2000s aesthetic and monogrammed design matched current trends.

The friendly atmosphere reached the third floor, where the smell of baked goods filled the air. A group of ladies, members of the Suwassett Garden Club, sat behind a table displaying the treats.

“Money, we like money,” one woman joked when asked what they liked most about the event. “Yes, we like it,” another chimed in. The group’s co-president added that this was their major annual fundraiser.

Proceeds from the event support the Historical Society’s mission to discover, preserve and share knowledge of the Greater Port Jefferson Area’s rich history.

As the day drew to a close, the sound of chatter and the scent of fresh blooms lingered, reminding visitors that while antiques may be old, the community spirit in Port Jefferson is timeless.

Sumaq Killari is a reporter with the SBU Media Group, part of Stony Brook University’s School of Communication and Journalism’s Working Newsroom program for students and local media.

Letters to the Editor: May 8, 2025

Common sense approach

As the former chairman of the Huntington Town Zoning Board of Appeals, I worked tirelessly to balance the interests of residents, landowners and prospective applicants.

New York State Zoning Law requires that neighbors and other residents’ interests be represented in hearing applicant requests. The burden of consideration by the applicant, under the law, covers at least five explicit considerations for area variances requests: an undesirable change, feasible alternatives, substantiality, adverse effects and self-created hardship. As a board we emphasized careful review of potential undesirable changes to neighborhoods, always lending a sensitive ear to the neighbors.

You may have met me at your door during some of these applications, as I would often take the time to walk a neighborhood impacted and speak to residents instead of putting the burden on them to show up at a ZBA meeting.

Residents shouldn’t have to leave their house during a cold winter night, wait hours to speak at a public hearing to fight to defend their zoning and quality of life every time a development application comes up. That is a strict responsibility of the board; residents should not be on the defensive.

Our Town Board and the individuals they appoint have a duty and responsibility to represent us, not simply facilitate development.

The need for the Zoning Board and Planning Board’s independence in this Town is paramount if we are to restore trust in the Town’s zoning process.

Land-use rules and laws protect our most precious investment, our homes. Good zoning and land-use guidance is the most important responsibility of Town government, it is what knits our communities and neighborhoods together. Applications for exemptions from prevailing laws deserve careful review, but that review should never be at the disadvantage of neighbors and residents.

Now, more than ever, we need this balanced common sense approach.

John Posilico

Former Chairman of the Huntington Town Zoning Board of Appeals

Questioning ‘Elder Parole’ for cop killers

It’s common for politicians to send out “constituent surveys.” Ostensibly, the goal is to get feedback from local voters on specific issues. But it would be a rare survey indeed, that did not frame certain questions in ways aimed at getting politically desired responses.

Newly elected Assembly member Rebecca Kassay pretty much followed that template with her May mailer.

A couple of seemingly “feel good” proposals were the Second Look Act, and Elder Parole. Maybe state polls are looking to save some dollars on a staggering state budget that’s twice the size of Florida and Texas combined? Money aside, the goal is to give judges and parole boards the power to reconsider early release for “elderly individuals” so long as the felons have “demonstrated growth and rehabilitation.”

Here are two important unknowns. What would be the specific criteria for the above mentioned, and how it might be applied to those who’ve murdered law enforcement officers? This is especially critical because the PBA has cited 43 cop killers released by our NYS Parole Board in just the last 8 years,

As of this writing,waiting on the sidelines to possibly become lucky number 44, is David McClary. On Feb. 26, 1988, he snuck up behind rookie NYPD Officer Edward Byrne, and shot him five times in the head. The 22-year-old was guarding a witness waiting to testify against a notorious drug lord.

Edward’s brother Ken spoke to ABC News. “Referencing the murder he said, “’It was a horrible scene, we were in shock. It was just beyond devastation.…’ “This is always a difficult process because every two years with the parole board we have to reive everything.” It’s that family’s eighth time.

Who has had the most sway in picking and managing the group tasked with deciding which felons will be freed? That would be former governor Andrew Cuomo, and his Democrat heir, Kathy Hochul (D). This board is a direct reflection of their views on policing and made up of a majority of fellow Dems.

One of the members would be Tana Agostini, who was appointed by Cuomo in 2017. She married convicted killer Thomas O’Sullivan while he was still in prison. Tana used her influence as a staffer of the state Assembly committee overseeing prisons in 2013 to advocate for the parole of O’Sullivan. His stint in prison included an escape and biting off part of an inmate’s nose. It’s hard to see much “growth and rehabilitation” there.

Imagine the unrelenting heartache, revisited every 24 months by long “suffering NYPD families, who are sitting in front of an NYS Parole Board that has released an average of five cop killers yearly since 2017. We can bet these kinds of “feel good” proposals feel anything but good to them. Let’s remember and help protect slain, heroic police officers and their grieving loved ones,

Hard “No” on survey query number 7.

Jim Soviero

East Setauket

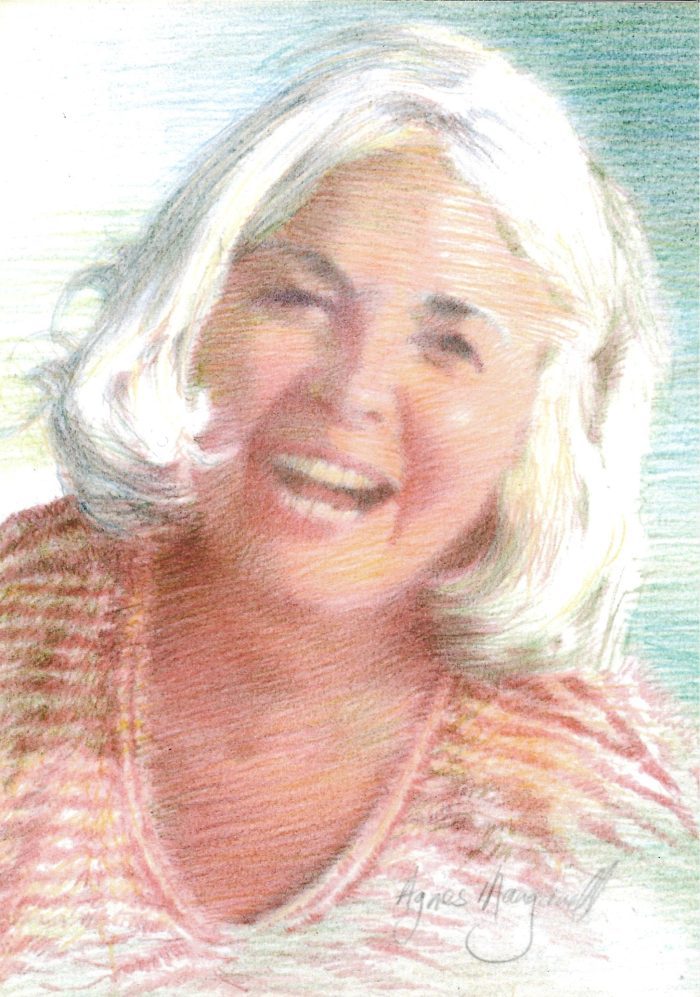

Obituary: In remembrance of Sunny Bateman

Sunny Bateman passed away peacefully on May 5, at age 80 after a courageous battle with cancer and later complications.

Born on Dec. 14, 1944 in Little Rock, Arkansas to Mildred and Howard Strecker, Sunny’s abundant love continues through her husband Lee Bateman; children Debbie, Michelle, Brad, Brooke, Kim and Scott; grandchildren Brady, Wyatt, Sunny, Quinn, Caroline, Hank, Matilda, Scarlett, Noa, Aden, Tyler, Kiersten, Charlie, Anna, Luke and Alex; and great grandchildren Jackson and Monroe. She is also survived by her brothers Robert and Billy Strecker, sister-in-law Jayne Strecker, nieces Megan and Janine, and nephews Robert and Derek.

The family extends their deepest gratitude to her friends, family and the incredible team at Stony Brook University Cardiac ICU for their compassionate care during Sunny’s final days.

In honor of Sunny’s love of art and her generous spirit, memorial donations to the Reboli Art Center (rebolicenter.org/donate) in her name would be greatly appreciated in lieu of flowers.

Sunny was welcomed into eternal peace by her beloved father and mother Howard and Mildred Strecker, her aunt and uncle Roy and Pearl Hoffer, her cousin Ronald Hoffer, her son Chad Bateman and her dear friends Catherine Loper and Lydia Simms, who all meant so much to her.

Service will be held this Friday May 9 from 3 to 7 p.m. at Bryant Funeral Home, 411 Old Town Rd, East Setauket. Please visit Bryant Funeral Home (https://www.bryantfh.com/) for details.

SBU Sports: Women’s lacrosse wins third consecutive CAA championship

For the third year in a row, the No. 19 Stony Brook women’s lacrosse team has won the CAA Championship after defeating the No. 2 seed Drexel, 12-10, on May 3. With the win, the Seawolves earn their 12th straight appearance in the NCAA Tournament, a streak that dates back to the 2013 season. Stony Brook captured its 11th conference championship title in program history (three CAA, eight America East) and won its 10th on the home turf of Kenneth P. LaValle Stadium.

Charlotte Wilmoth led all players with a game-high five points (three goals, two assists) to pace the scoring for the Seawolves. Isabella Caporuscio, Alexandra Fusco, and Kylie Budke registered a pair of goals, while Riley McDonald, Casey Colbert, and Courtney Maclay all tallied one goal apiece.

Defensively, Avery Hines continued her defensive dominance as she caused six more turnovers and set a new Stony Brook single-season record. With her 67 caused turnovers, she outdid her 66 caused turnovers last season for the most caused turnovers in a single season in program history.

Four Seawolves earned All-Championship Team honors for their standout play in the tournament. Caporuscio, Allie Masera, and Molly LaForge were named members of the All-Championship Team, with Budke taking home the Most Outstanding Performer honor.

The Seawolves opened scoring with a pair of goals from Caporuscio and Colbert before Drexel responded with three goals of their own. With 45.5 seconds left in the first quarter, Wilmoth was left wide open right outside the crease to even things up at three.

The back-and-forth affair would continue with a game-high seven goals through the second quarter. Wilmoth and A. Fusco dominated on the offensive front, tallying five points combined. With 1.1 seconds left in the half, Masera would go coast to coast dishing it out for a Wilmoth goal to take a 7-6 lead into intermission.

Coming back from the break, Drexel scored two goals to take an 8-7 lead before the Seawolves scored three straight for their first two-goal advantage since the start of the contest. Stony Brook would take a 10-8 advantage into the final quarter.

The Dragons scored a pair to start the fourth quarter and tie it up at 10 apiece. Budke’s standout performance began with just 3:27 remaining in the fourth quarter, breaking through her lone defender and finding the back of the net to give the Seawolves a 11-10 lead. She then scored back-to-back on an identical play, cutting through the eight-meter and dodging her defender for a two-goal advantage. With less than 30 seconds, Julia Fusco intercepted a wild pass from the Dragons to ice the clock and secure Stony Brook’s 11th conference championship.

Summer shopping opportunities at the Port Jeff Farmers Market

By Benjamin William Stephens

The Port Jefferson Farmers Market is a farmers market created by Port Jefferson Village 15 years ago that is still up and running to this day. The market has over 20 unique vendors selling everything from baked goods, fresh veggies and fresh honey to items you wouldn’t expect like skincare products.

“I think it’s really good because it allows people who have businesses who can’t afford to rent a space,” said Melissa Dunstatter, the market’s manager. Dunstatter had in fact been a vendor at the market before being chosen to run the market. “I started the second year of the market. I was just a vendor in the market and then the third year I took over the market and I’ve been market manager ever since,” she said. While Dunstatter is the market manager she is also with a stall for her business Sweet Melissa Dips selling dips and canned produce.

“Port Jeff is really great. I think the community here really likes to give back,” said Morgan Suchy who has run a stall for the business Pecks of Maine at the market for seven years. “People that come to the farmers market really appreciate local businesses, they’d rather get their fruit preserves, their cheese, their honey from local people instead of big businesses.” Pecks of Maine is a business with a stall at the market selling fruit preserves made from ingredients sourced from Long Island, upstate New York and Maine.

“We love the atmosphere here,” said Naela Zeidan of Naela’s Organics Inc, a vendor at the market which sells homemade traditional Mediterranean foods like Baba Ganoush, spinach pies and date cookies.

The farmers market is located at the Harborfront Park on East Broadway in Port Jefferson. The market has two seasons, winter and summer. During the winter season the farmers market is held indoors inside of the Port Jefferson Village Center but during the summer session the market moves outdoors onto the grassy park grounds. While during the winter session the market is mostly confined to inside of the Village Center there is also an ice-skating rink right next to the center that shoppers can visit during the colder months.

“It’s great that it’s open in the winter . . . we hope more vendors come,” said Anna Hayward who said she shops at the market weekly. “It’s very lovely, everyone is so nice and friendly,” said Megan Leriche, a shopper at the market who said that they weren’t from the area and wanted to see the market before heading home.

April 27 was the last day of the Port Jefferson Farmers Market’s winter session and the summer session will begin on May 18. The final day of the summer session will be November 23, and the winter session will begin sometime during January.

Benjamin William Stephens is a reporter with The SBU Media Group, part of Stony Brook University’s School of Communication and Journalism Working Newsroom program for students and local media.