By Sabrina Artusa

At the March 3 Three Village Civic Association meeting, Town of Brookhaven Receiver of Taxes Louis Marcoccia gave members valuable advice on how to wade through the thick of this year’s tax season.

Facing a group of residents who are in the midst of tackling their taxes, Marcoccia had his work cut out for him. He was quick, however, to appeal to the group, reminding the civic that Mathew the tax collector was one of Jesus’ apostles.

“The tax collector, out of all the elected officials, is closest to Jesus,” he said. “The most read gospel is Mathew, which is actually converted to tax code,” he added.

Marcoccia is proud of his department and the changes they have made over the years, including taking advantage of technology, thereby saving money on envelopes and allowing people to pay and view their taxes instantly. He also reduced his staff by 40% by simply not rehiring after employees left.

This year, many Three Village residents were alarmed to see a 5.47% increase in their school taxes. In the year prior, the assessor’s office mistakenly included about 30 properties in the calculations, resulting in a lower tax increase percentage for that year, so constituents paid less in taxes to the school.

“The percent was 1.27% but it should have been 2.8 so people who live there paid less than they should have and the town had to eat that,” Marcoccia said.

The bill was never sent to those 30 properties, mainly Stony Brook properties, since the tax office caught the mistake shortly after filing, but the incorrect assessment caused a shortfall that amounted to “millions,” according to Marcoccia, causing the bill to be $125 less per household.

After being filed with New York State, the tax bills are finalized. As a result, this year, the bill represents the correction from last year in the percentage, even though constituents will not be actually paying that percentage increase, as it would have broken the tax cap of 2.84%. That correction is the cause of 1.47% of the increase represented on the bill and is not the taxpayer’s responsibility.

In a letter sent by the Three Village Central School District explaining their mistake, Superintendent of Schools Kevin Scanlon explains that 0.54% of the percentage is due to a decrease in the assessed values of some properties, causing the other properties to take on more taxes. The remaining 0.32% increase is due to the senior citizen exemption. The actual tax rate increase, disregarding the correction, would be exactly 2.84%.

“Once you file it and send it to the state you are stuck,” Marcoccia clarified. “A mistake happened, but it didn’t cost you any money.”

Other News

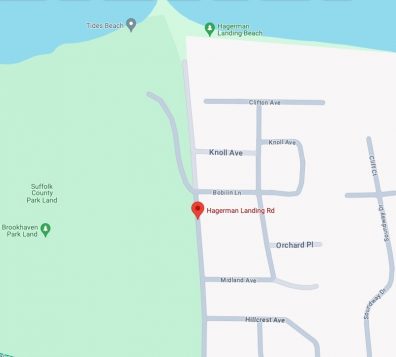

According to Legislator Steve Englebright (D, Setauket), the Town of Brookhaven, the Village of Head of the Harbor and the Ward Melville Heritage Organization are continuing to navigate the convoluted and uncertain ownership of Harbor Road.

“A part of the controversy is who owns the road. Now the town highway department says [they] don’t own the road. It joins one village and one town together. Does Smithtown own half of the road?” Englebright asked, emphasizing the complicated discourse surrounding the issue. “Does ownership of the road mean ownership of the liability? Does the owner of the road also mean they are the owners of the land and the dam?”

Under pressure to meet the Federal Emergency Management Agency deadline to file for aid, officials met to discuss a plan forward last month.

“Time is short and now it is kind of a high wire act,” Englebright said.

For more information, visit www.3vcivic.org.