By Lynn Hallarman

A newly-released interim report from the Port Jefferson Citizens Commission on Erosion offers a candid appraisal of mounting risks and financial pressures surrounding the East Beach Bluff Stabilization.

The report cites worsening erosion, persistent drainage challenges and the likelihood of rising construction costs as factors that could drive up the long-term expenses of Phase 2. In light of these concerns, the commission urges officials to conduct a thorough cost-benefit analysis of alternative strategies before moving forward.

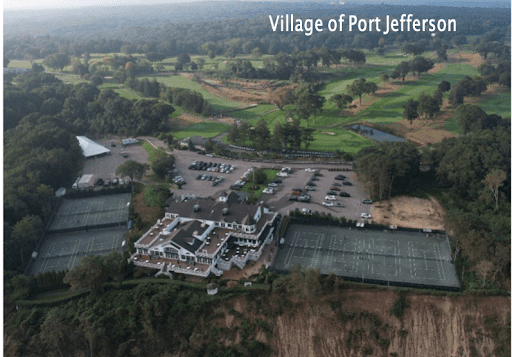

The planned wall of Phase 2 will be constructed seaward of the club building, which sits near the edge of East Beach Bluff on the municipally-owned Port Jefferson Country Club property. According to officials, Phase 2 construction is tentatively scheduled for the fall of this year.

Any strategy moving forward, the commission argues, should recognize that the club building — perched dangerously close to the bluff’s crest — will ultimately need to be moved in the wake of rising sea levels, increasing storms and accelerated global erosion of Long Island’s shoreline.

“The report outlines multiple pathways forward,” Village Trustee Kyle Hill said on his Facebook page. “But each underscores a shared reality — we must begin planning for a strategic retreat [of the club building].”

Overview of the project

In 2017, the village hired GEI Consultants, an engineering firm based in Huntington Station, to develop a plan designed at curbing the rapid erosion of the East Beach Bluff. In recent years, wind, surf and storms have scoured the bluff of vegetation and steadily eaten away at its edge, ultimately leading to the collapse of the club’s gazebo and a section of the tennis courts that once were set perilously close to the brink.

Phase 1, completed in June of 2023, included the construction of a reinforced steel and cement wall at the base of the East Beach Bluff, along with a series of terraces and native vegetation planted along its slope.

Destruction of costly Phase 1 work of the bluff face vegetation in the wake of a series of severe storms late in 2023 and early 2024 complicated the overall cost and timelines of the project. [For further information about Phase 1 see TBR News Media website, “Report finds no maintenance or repairs carried out on Port Jeff East Beach Project,” Feb. 6.]

Phase 2, includes the installation of a second wall landward of the bluff crest with the intention of preventing the building from collapsing onto the shoreline below.

The design of Phase 2 is currently being revised to address drainage issues complicating the wall build, according to GEI Consultants’ 2024 Annual Bluff Monitoring Report, submitted to the village this May.

As of yet, the village has not received the updated engineering plans, trustee Bob Juliano confirmed during a recent commission meeting.

Financial questions linger

In 2021, village trustees projected the initial cost at around $10 million for the Phase 1 and 2 wall build and bluff restoration. This figure assumes at least three decades of structural stability to justify the investment. However, these cost estimates now appear to be outdated with recent inflation spikes and unaccounted expenditure, including a large drainage project, bluff repair and long-term maintenance costs.

The commission report calls for an updated cost analysis factoring these additional projects as well as costs related to potential supply chain uncertainty and tariffs on critical construction materials such as steel.

Phase 2 is supported in part by FEMA money. The commission expressed concern that this funding may be rescinded in the current political climate, leaving local taxpayers to make up the difference.

“The commission is concerned over the reliability of FEMA funding and whether those funds could be withdrawn,” the report states.

Despite calls for a cost analysis of all options, village officials have not yet initiated a publicly vetted fiscal plan for relocating the facility or other options — something that the commission deems a critical omission in its findings.

GEI report warns of new damage

The recently-released 2024 Bluff Monitoring Report in May, paints a mixed picture. Conducted by GEI, the monitoring period covers from February 2024 to this March.

While the lower bluff wall — reinforced with a steel bulkhead, stone armor and vegetative plantings — has held up, the upper slope is showing new signs of distress, according to the report.

Three storm events in 2024 exacerbated erosion along the western slope. Further displacement of coir logs and terracing, expansion of gully formation, vegetation destruction and signs of internal sediment movement were all documented in the report’s inspections. GEI notes that drainage remains a major vulnerability.

Recommendations include temporary seeding and erosion control matting over denuded areas of the bluff face, sand backfill in certain sections of the lower wall, repairing cracks in the lower wall, inspection and maintenance of the lower wall, replacement of the displaced coir logs and a soil boring analysis at the bluff crest to help define drainage issues.

The report emphasizes the need for permanent drainage landward of the club building and reconfiguration of the current building drainage system southward.

A drainage plan and long-term maintenance plan were not part of the initial design or cost analysis for the entire project — Phase 1 and 2 — according to the commission research on the history of the project.

CCE’s concerns

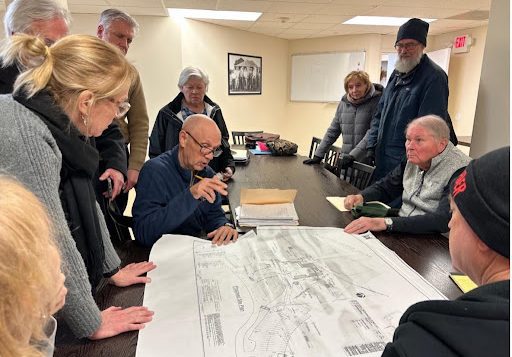

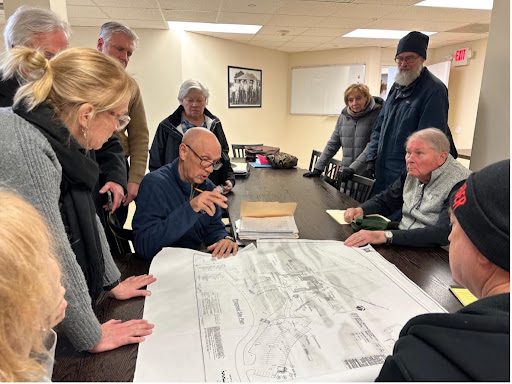

The commission reviewed the recent GEI report in detail at the June 19 meeting held at the club building. Members appreciated the comprehensive summary and visual timeline of project work but had many concerns about the recommendations.

“What is this [GEI] report trying to accomplish besides complying with the state?” one member asked. “The report should help the village identify problems but also guide the corrective action.”

Members point to vague directives without clear implementation plans, missing details in technical specifications for reconstituting bluff damage, and unexplained rationales for root causes of problems such as why the gullies formed in the first place and are now expanding. One member wants to see a priority ranking of potentially costly recommendations made in the report.

“Does it even make sense to do all these recommendations? Or are we just shoveling against the tide?” another member said.

The commission plans to submit questions to GEI and the village board of trustees about the report recommendations, requesting a priority list, cost estimates and a clear funding plan.

Long-term outlook

Trustee Juliano, at a recent Meet the Candidates night, said: “We don’t even know how much the next phase [Phase 2] will cost, and the loss of long-term revenue from the catering facility [that runs private events at the clubhouse] should be taken into account when weighing the monetary pros and cons.”

However, some longtime residents express frustration over the use of millions in taxpayer dollars to subsidize a building that is underutilized by the broader community, with little evidence that it generates sufficient revenue to justify the expense of the stabilization project.

Over the years, many residents say they have seen the club building evolve from a vibrant municipal community center hosting local activities to a catering hall primarily serving private events. There is currently no restaurant at the clubhouse.

“Sadly, this valuable piece of public parkland continues to be underused by our village residents,” resident Myrna Gordon said. She has repeatedly called for a reimagining of the site where the clubhouse sits, including rebuilding inland to protect the bluff and the long-term viability of a club facility as a community asset.

The village board, under newly reelected Mayor Lauren Sheprow, appears to be moving forward with plans for Phase 2 construction to install an upper wall.

“Protecting public assets and ensuring our approach is sustainable — not just structurally, but economically and environmentally,” Sheprow said at a recent public meeting.

Residents are encouraged to review the interim commission report and the GEI Bluff Monitoring Report, which are publicly available on the village website, and to share their input with the board of trustees. To view the CCE report, visit the village website and search for “Citizens Commission on Erosion.” To view the GEI 2024 Annual Monitoring Report search for “East Beach Bluff.”

“This is a moment for long-term thinking,” Hill said. “It’s a chance not just to respond to erosion — but to reimagine how this space can better serve the entire community.”