Today is Wear Red Day, supporting the American Heart Association’s “Go Red for Women” movement, which raises awareness about cardiovascular disease in women. And in honor of the nationwide movement, Stony Brook Medicine rocked their red gear to make a heart of their own during American Heart Month. Each year millions of people unite for a common goal: the eradication of heart disease and stroke.

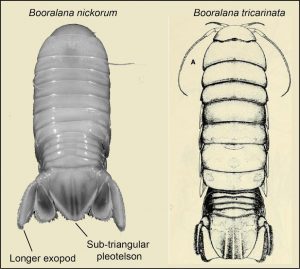

SBU’s Oliver Shipley identifies new creature in deep Bahama waters

By Daniel Dunaief

Oliver Shipley recently shared one of the mysteries of the heavily photographed but lightly explored deep sea areas near the Bahamas’ Exuma Sound.

A Research Assistant Professor at Stony Brook University, Shipley and his colleagues published a paper in the journal Zootaxa describing a new species of isopod they named Booralana nickorum.

A few inches long, this isopod, which was found at a depth of about 1,600 feet, sheds light on some of the mysteries in these waters, offering a glimpse into areas mostly too deep for sunlight to penetrate.

“The level of knowledge on deep sea biodiversity anywhere in the Caribbean is very poor,” said Shipley. The scientists were specifically studying the biomass housed areas around The Exuma Sound.

In the Bahamas, the researchers are interested in preserving species biodiversity and identifying links between the shallow and deep-sea ecosystems, which can inform management of marine resources and help conserve biodiversity.

Shipley suggested it was “exciting” and, perhaps, promising that this area has already produced two isopods that are new species, both of which he described with low-cost technologies deployed off small boats.

“We haven’t even genetically sequenced 95 percent of the creatures that we’ve captured” which includes fish and sharks, Shipley said.

Brendan Talwar, a co-author on the paper describing the isopod and a Postdoctoral Scholar at Scripps Institution of Oceanography at UC San Diego, added that “this discovery is representative of the lack of knowledge” in this area. “You can swim from one environment, where almost every species is known or has been studied, to a place where almost nothing is known and almost nothing is studied.”

Finding new species could have numerous benefits, including in the world of drug discovery. To be sure, such findings require “many years of work and analysis” he said.

Still, such a possibility for future benefits exist, particularly as researchers catalog and study these creatures.

In the meantime, understanding individual species and the ecosystems in which they live can reveal information about how, depending on the biomass of various species, different places affect the cycling of gases such as carbon dioxide.

“When you find high biomass of a new species, it could have potentially huge implications for mitigating climate change,” said Shipley. “We have a primitive understanding of the Caribbean deep sea ecosystem. We don’t know the full effects or benefits and services of organisms that live in the deep ocean environment.”

In addition to finding organisms that might provide various benefits, scientists are also hoping to understand the “food web dynamics of the eastern Bahamas,” said Talwar.

Long road to identification

Shipley first saw an individual of this isopod species in 2013. Over time, he has since identified numerous other individuals.

The region in which Shipley identified this isopod has several potential food or energy sources. The deep sea area is in close proximity to shallower sea grass beds, which are closer to the surface and use light to generate food and energy through photosynthesis.

The tides and currents wash that sea grass into the deeper territory, sending food towards the deeper, darker ocean.

Energy also likely comes from coral reef productivity as reefs line the edge of the drop off.

Additionally, animals that traverse the shallower and deeper areas, whose poop and bodies sink, can provide food sources to the ecosystem below.

“There may be multiple sources of productivity which combines to promote a high level of biodiversity” in the ecosystem below, said Shipley.

The isopod Shipley and his collaborators identified lives in a pressure that is about 52 times the usual atmospheric pressure, which would be extremely problematic for organisms like humans. Isopods, however, have managed to live in most major ecosystems around the planet, including on mountains, in caves and in the deep sea.

“There’s something about that lineage that has supported their ability to adapt to a variety of environments,” said Shipley.

To bring the creatures back to the surface for study, researchers have used deep sea traps, including crustacean and eel traps, that are attached to a line. People working on boats then retrieve those traps, which can take one to two hours to pull to the surface.

When they are brought to the surface, many animals suffer high mortality, which is a known sensitivity of deep-sea fisheries.

“We must gain as much knowledge as possible from each specimen,” Shipley explained

Scratching the surface, at depth

Talwar and Shipley have each ventured deep into the depths of The Exuma aboard a submersible.

The journey, which Talwar described as remarkably peaceful and calm and akin to an immersive aquarium experience, is “like a scavenger hunt,” he said.

When scientists or the sub pilot see a new species of sea cucumber, the pilot can move the sub closer to the organism and deploy the manipulator arm to store it in a collection box. Shipley and others hope to explore deep sea creatures under conditions akin to the ones in which they live in high pressure tanks on land.

Talwar described Shipley as “an extremely productive scientist” who works “incredibly hard.” Talwar also appreciates how Shipley will put collaborative projects at the top of his list, which is “fairly unique in a field where people are so busy with their own stuff.”

Shipley, who lives in Austin, Texas with his girlfriend Alyssa Ebinger, explained that researchers are pushing to support scientific leadership by Bahamians to conserve marine resources threatened by climate change.

Looking under rocks

As a child, Shipley, who grew up in York, England, spent about three years in Scotland, where they spent time at a beach called Trune.

“I remember looking in rock pools, picking up stuff and inspecting it,” he said. He was naturally inquisitive as a child.

While Shipley enjoys scuba diving and is a committed soccer fan — his favorite team is Leeds United — he appreciates the opportunity to build on his childhood enthusiasm to catalog the unknowns of the sea. He’s so inspired by the work and exploration that it “doesn’t feel like a job,” he said. He’s thrilled that he gets paid “to do all this exciting stuff.”

Making Democracy Work: Passing the NYS Equal Rights Amendment will protect all New Yorkers

By Nancy Marr

An Equal Rights Amendment for the United States was first drafted in 1923 by two leaders of the women’s suffrage movement, Alice Paul and Crystal Eastman, who believed that the ERA was the next logical step following the campaign to win access to the ballot.

While the text of the amendment has changed over the years, its focus has remained the same. Article V of the U.S. Constitution requires that a proposed amendment be passed by the Senate and the House in a two-thirds majority in two consecutive legislative sessions in order to be sent to the states for ratification by their legislatures or conventions.

The version approved by Congress in 1972 and sent to the states with a deadline of 1979 reads: “Equality of rights under the law shall not be denied or abridged by the United States or by any state on account of sex. The Congress shall have the power to enforce, by appropriate legislation, the provisions of this article.” Although the deadline was extended to 1982, only 37 of the required 38 states ratified the amendment.

Opposition to it came from conservative Phyllis Schlafly, saying it would require women to serve in the military or lose protections for alimony or child custody cases. The result? Five states voted to revoke their ratifications, but these reversals were not counted as part of the result, and the count of ratifications remained at 37. The amendment was not passed.

In the absence of a national equal rights law, the constitutions of twenty-five states now do provide guarantees of equal rights on the basis of sex. The New York State Legislature, in 2022 and 2023, passed an ERA bill that has looked further. Currently, our state constitution only protects against racial and religious discrimination.

The proposed bill would protect all those who have been discriminated against based on ethnicity, national origin, disability, age, and sex, including sexual orientation, gender identity, gender expression, pregnancy, and a person’s reproductive autonomy or access to reproductive care. The new ERA bill explicitly includes language to clarify that discrimination based on a person’s pregnancy or pregnancy outcomes would be sex discrimination, protecting women from punishment. It will also ensure comprehensive and inclusive equal protection that will guard against attacks on our rights from the federal government or federal judges, including threats to the legal equality of LGBTQ1+ people.

Do we need protection if the Fourteenth Amendment already guarantees equal protection of the laws? The Fourteenth Amendment, passed in 1868, added the word “male” to the Constitution but failed to include women in the right to vote. The proposed New York State ERA is not “a women’s equality amendment” but seeks to protect women as a class and men as a class against discrimination under the law for any reason.

The Brennan Center has commented that the amendment process is an ineffective way to correct shortcomings in our United States Constitution. Given the difficulties and delays that have been faced by those who have fought for amendments, is our Constitution unamendable?

Congressman Jamie Raskin (D-MD) is the leading constitutional scholar serving in Congress today. Reflecting on the progressive activism that “built the modern Constitution,” Raskin urges reform-minded Americans to shed their fear of advancing reform through Article V. “It’s a betrayal of our history if we don’t talk about amending the Constitution in order to create a more perfect union,” he says. “We need to be planting flags in the unfolding history of democracy. That’s what the constitutional amendment process is all about.”

Voting to amend the New York State Constitution with the New York State ERA will provide protection for New Yorkers who have faced discrimination through the years. Make a plan to turn your 2024 ballot over and vote yes on the proposed amendment.

Nancy Marr is Vice-President of the League of Women Voters of Suffolk County, a nonprofit nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. Visit www.lwv-suffolkcounty.org or call 631-862-6860.

Holtsville Hal predicts an early spring in Brookhaven Town

Suffolk County’s most famous weatherman did not disappoint. This morning, at 7:25 a.m., before a crowd of several hundred spectators, Holtsville Hal awoke from his slumber and did not see his shadow, predicting an early spring for the Town of Brookhaven.

According to tradition, if a groundhog sees its shadow after emerging from his burrow on Groundhog Day, there will be six more weeks of winter weather; if not, spring should arrive early.

Brookhaven Highway Superintendent Dan Losquadro read from Hal’s official prognostication: “…At sunrise, the sky was filled with more than one cloud, And so I hope your cheers will be quite loud. I did NOT see my shadow in the early morning hours, And so the wait will not be long until we see flowers. Sun and warm temperatures the next few weeks will bring, I hope everyone enjoys this year’s early Spring!”

“Thankfully, after a wet and rainy January, Hal has given us a sunny outlook for the remainder of this winter season,” Losquadro said. “Regardless, the Brookhaven Highway Department is prepared, as always, for whatever Mother Nature sends our way.”

Holtsville Hal is just one of the more than 100 animals who reside at the Holtsville Ecology Site and Animal Preserve. The center, which is open all year-round, includes a wildlife preserve, greenhouses, gardens, and jogging and exercise trails. For more information, visit www.brookhavenny.gov or call 631-451-5330.

Gurwin Assisted Living commemorates International Holocaust Remembrance Day

Holocaust survivors and residents living at Gurwin Jewish ~ Fay J. Lindner Residences assisted living community in Commack paid homage to the victims of the Holocaust with a candle lighting vigil on Friday, January 26 in advance of Saturday’s commemoration of International Holocaust Remembrance Day.

“Today’s ceremony honors the 79th anniversary of the liberation of Nazi concentration camp Auschwitz-Birkenau,” said Dina McDougald, Assistant Administrator at Gurwin Jewish ~ Fay J. Lindner Residences. “Over the years we have been honored to care for many Holocaust survivors and are privileged to currently have 13 such residents in our care. As time passes, the numbers of those who can recount their experiences are dwindling. Each year we share their stories as a reminder of the effects of indifference to hatred, in the hope that these atrocities never happen again.”

Among the survivors living at Gurwin is Polish-born Cilia Borenstein. At 97 years old, Cilia vividly recalls her encampment at Auschwitz and the brutality of the Nazis. The only member of her family to survive, Cilia holds their memories in her heart, telling their story so that the world will never forget.

Despite the horrors perpetrated against her, Cilia chooses to see the beauty in life and people and is thankful for the gifts she was given. Her faith buoyed her spirits throughout her days at Auschwitz, “God came to me in the worst times and helped me to survive,” she said.

The memorial ceremony was led by Gurwin Assisted Living’s staff and chaplain Rabbi Israel Rimler, who called upon residents to each light a candle in remembrance of the friends and family who died at the hands of the Nazis.

Shelter Pet of the Week: Chops

MEET CHOPS!

This week’s featured shelter pet is Chops, a 2-year-old male German Shepherd available for adoption at the Smithtown Animal Shelter.

This handsome boy needs a very specific home. He is working on trust issues and is obedient and loyal to people that he knows and trusts. He will need an experienced home, both with working breed dogs and with training. He is an intelligent guy who loves to learn and play. He will need a home that can manage his introductions to new people and needs to be the only pet in an adult only home.

If you are interested in meeting Chops, please call ahead to schedule an hour to properly interact with him in a domestic setting, which includes a Meet and Greet Room, the dog runs, and a Dog Walk trail.

The Town of Smithtown Animal & Adoption Shelter is located at 410 Middle Country Road, Smithtown. Visitor hours are Monday to Saturday from 10 a.m. to 3 p.m. (Sundays and Wednesday evenings by appointment only). For more information, call 631-360-7575 or visit www.townofsmithtownanimalshelter.com.

SBU Sports: Men’s basketball takes down UNC Wilmington in overtime thriller

The Stony Brook university men’s basketball team took down UNC Wilmington in overtime, 86-78, on Jan. 27 at Island Federal Arena. Tyler Stephenson-Moore (22 points) and Aaron Clarke (21 points) paced the offense in a statement victory for the Seawolves.

Four players scored in double figures in total for the Seawolves to end the Seahawks’ five-game winning streak. Keenan Fitzmorris contributed 15 points, seven rebounds and four blocks off the bench and Dean Noll scored 10 points, knocking down a key three down the stretch.

Stony Brook used a 10-0 run with midway through the first half, culminating in a deep three from Jared Frey to grab a 23-19 lead.

The Seawolves then lost some of that lead, but still entered halftime with a 39-37 advantage. Stony Brook got a great contribution from its bench in the period, as non-starters accounted

UNC Wilmington proceeded to take the lead back, using a 19-2 run that stretched between the end of the first half and the beginning of the second. Stony Brook then scored six straight points, finished off by Stephenson-Moore’s three, to shrink the deficit to 54-53 with 8:43 to go in the contest.

The Seawolves rally continued as they outscored UNC Wilmington 13-12 the rest of the way to tie it at 66-66 and send the game to overtime. Noll connected on a game-tying trifecta, evening the score at 64-64, with 41 seconds to play, before Trazarien White scored on the other end. Stephenson-Moore was then fouled with one second and change, sinking a pair of free throws to send the contest to an extra period.

Stony Brook started overtime with a bang, going on an 8-0 run, finished off by Clarke’s three, to seize a 74-66 lead with 2:50 to go in the period. The lead moved to 79-71 after another Clarke trifecta, this time a stepback in front of the Stony Brook bench.

The triple all but sealed the win, as the Seawolves held onto that lead for the rest of the game to come away with the 86-78 win in overtime.

Up next, the team stays on Long Island, heading to Nassau County on Thursday, February 1 to face Hofstra. Tip-off between the Seawolves and Pride is scheduled for 7 p.m. in the second iteration of the Battle of Long Island. The contest will stream live on FloHoops and locally on MSG Sports Network.

SBU Sports: Defensive effort leads women’s basketball over Drexel 62-41

The Stony Brook women’s basketball team kept Drexel to just 23.7% from the field and held the Dragons scoreless in the first quarter on the way to a 62-41 victory at Island Federal Arena on Jan. 28.

The Seawolves (16-2, 6-1 CAA) had two players score in double figures, led by Gigi Gonzalez, who had 20 points and five assists. Khari Clark added a double-double with 14 points and career-high 15 rebounds and Sherese Pittman added eight points and seven rebounds.

The squad utilized excellent ball movement in Sunday’s game, piling up 15 assists on 24 made field goals. Gonzalez’s five assists led the distribution list for the Seawolves. Defensively, Stony Brook forced 16 Drexel turnovers and turned those takeaways into 15 points on the other end of the floor. Clark’s six steals led the way for Stony Brook.

The Seawolves started out the game with 14-0 run that spanned the entire first quarter, culminating in a three from Victoria Keenan at the 1:06 mark. Stony Brook knocked down a pair of three-pointers for six of its 14 points in the quarter. It was the first time in program history that the Seawolves held a team to zero points in a regulation quarter.

The squad build on that first-quarter lead and held a 21-1 advantage 13 minutes into the game. The Seawolves proceeded to tack on one point to that lead and enjoyed a 32-11 advantage heading into halftime. Stony Brook dominated in the paint, scoring 12 of its 18 points close to the basket. Gonzalez led the Seawolves with seven points in the frame.

Stony Brook continued to preserve its halftime lead before going on a 9-0 run, punctuated by a three from Keenan, to expand its lead further to 51-21 with 1:34 to go in the third, and held a comfortable 51-25 advantage through 30 minutes. Stony Brook again scored 12 points in the paint in the quarter, and Gonzalez and Clark combined for 11 of SBU’s 19 points in the third.

The Seawolves cruised the rest of the way for the 62-41 win, with the lead never falling below 17 in the fourth. Stony Brook again scored the majority of its points in the paint in the final quarter.

The team will return to the court next week when they head to Hempstead to face Hofstra for the battle of Long Island on Feb. 2 at 7 pm. The Seawolves are 7-6 all-time against the Pride, as they’ve won their last six meetings against Hofstra.

Volunteer Fair heads to Middle Country Public Library’s Selden branch

Middle Country Public Library, 575 Middle Country Road, Selden will host a Venues for Volunteering Fair on Thursday, Feb. 8 from 6 to 8 p.m. Come find out what volunteer opportunities are available in our area and how you can help!

The following organizations are scheduled to be at the event: All American Assisted Living – Coram, Atlantic Marine Conservation Society, Bethel Hobbs Community Farm, Big Brothers, Big Sisters, EAC Chance to Advance, Family Service League Long Term Care Ombudsman Program, Federation of Organizations/Senior Companion Program, Fire Island Light House Preservation Society, Friends of the Middle Country Public Library, Girl Scouts of Suffolk County, Great Strides LI, Kids Need More, Legal Hand, Literacy Suffolk, Inc., Long Island State Veterans Home at Stony Brook, Mercy Haven Inc., Middle Country Public Library, NY Blood Center, Rebuilding Together Long Island, Save-A-Pet Animal Rescue, Selden Fire Department, Suffolk County Police Explorers, Town of Brookhaven Dept. of Environmental Education and the Three Village Historical Society.

No registration required. For more information, call 631-585-9393.

Harbor View Medical Services, PC is now Mather Medical Group

Mather Hospital, 75 North Country Road, Port Jefferson recently announced in a press release it is changing the name of its physician practices from Harbor View Medical Services, PC to Mather Medical Group.

“This name change better connects Mather’s medical practices with the hospital’s excellent community reputation. We look forward to having our physician practices continue to provide the same high-quality service to the communities we serve as Mather Medical Group,” read the press release.

Mather Hospital is rated a five-star hospital by CMS (the Centers for Medicare & Medicaid Services), a top 250 hospital nationally by Healthgrades, and consistently receives top A ratings for patient safety from the Leapfrog Group, among many other recognitions and accolades.