Over 500 students from 32 Suffolk County public and private high schools are currently participating in the 2025 New York State High School Mock Trial Program, the largest the Suffolk County program has ever seen. The Suffolk County Coordinators, Glenn P. Warmuth, Esq. & Leonard Badia, Esq., head up this annual educational program co-sponsored by The Suffolk County Bar Association and The Suffolk Academy of Law.

The New York State High School Mock Trial Program is a joint venture of The New York Bar Foundation, the New York State Bar Association, and the Law, Youth and Citizenship Program. In this educational program, high school students gain first-hand knowledge of civil/criminal law and courtroom procedures. Thousands of students participate each year. Objectives of the tournament are to: Teach students ethics, civility, and professionalism; further students’ understanding of the law, court procedures and the legal system; improve proficiency in basic life skills, such as listening, speaking, reading and reasoning; promote better communication and cooperation among the school community, teachers and students and members of the legal profession, and heighten appreciation for academic studies and stimulate interest in law-related careers.

The 2025 Mock Trial case is a civil case entitled Leyton Manns vs. Sandy Townes. In this hands-on competition, the teams argue both sides of the case and assume the roles of attorneys and witnesses. Each team competes to earn points based on their presentation and legal skills. “Judges”, usually local judges and attorneys who volunteer their time, score the teams based on ratings on preparation, performance, and professionalism.

While the Mock Trial program is set up as a “competition,” emphasis is placed on the educational aspect of the experience which focuses on the preparation and presentation of a hypothetical courtroom trial that involves critical issues that are important and interesting to young people.

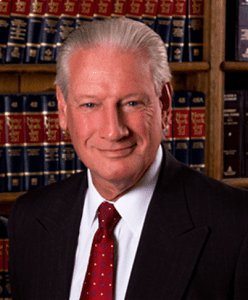

The first round of the competition began on February 5, 2025 with four weeks of random team matchups. The top 16 teams will then head to Round 2 at the John P. Cohalan, Jr. Courthouse in Central Islip, New York, for three weeks of “Sweet 16” style competition leading to the Finals on April 2, 2025 at Suffolk County Surrogate’s Court in Riverhead with the Honorable Vincent J. Messina, Jr., Surrogate, presiding. The Suffolk County champion will then compete in the New York State Finals in Albany on May 18-20, 2025.

The Suffolk County High Schools involved in the 2025 High School Mock Trial competition are: Bay Shore High School, Babylon High School, Brentwood High School, Central Islip High School, Commack High School, Walter G. O’Connell Copiague High School, Comsewogue High School, Connetquot High School, Deer Park High School, East Hampton High School, East Islip High School, Eastport-South Manor High School, John H. Glenn High School, Greenport High School, Half Hollow Hills High School East, Half Hollow Hills High School West, Hampton Bays High School, Harborfields High School, Huntington High School, Kings Park High School, Lindenhurst High School, Mattituck High School, Miller Place High School, Newfield High School, Northport High School, Shoreham-Wading River High School, St. Anthony’s High School, St. John the Baptist Diocesan High School, Southampton High School, The Stony Brook School, Ward Melville High School, and West Islip High School.

For interest in joining the High School Mock Trial program for 2026, please contact Suffolk County Coordinator, Glenn P. Warmuth, Esq., at (631) 732-2000 or [email protected]. Mock Trial can be an after-school club, an elective class, or part of your school’s curriculum. An attorney will be provided to you to help coach the students in the matters of the legal profession.

The Suffolk County Bar Association, a professional association comprised of more than 2,600 lawyers and judges, was founded in 1908 to serve the needs of the local legal community and the public. For more information about these or other Suffolk County Bar Association programs or services, call 631-234-5511 x 221 or visit www.scba.org

Welcome to the 24th edition of Paw Prints, a monthly column for animal lovers dedicated to helping shelter pets find their furever home.

Welcome to the 24th edition of Paw Prints, a monthly column for animal lovers dedicated to helping shelter pets find their furever home.