By Lauren Feldman

At its Oct. 17 meeting, the Smithtown Town Board announced the 2025 preliminary town budget.

“I am pleased to present the 2025 tentative budget, which is both balanced and under the tax cap, despite years of inflation, national economic climate and costly unfunded state mandates that are forced upon local municipalities to manage,” said Supervisor Ed Wehrheim (R).

The supervisor said over the last year, the town completed significant upgrades to popular facilities.

“I am pleased to report that our path will continue forward to complete the total renovation of the Smithtown park system — expanding open-space preservation, tree planting and inventory efforts,” he said.

The town is also making efforts to increase cybersecurity and disability accessibility.

“We have accomplished all of this despite a 16.6 percent increase to health care insurance, New York State retirement contributions, minimum wage and other state mandates with over $2 million added in operating costs solely for health care insurance for our union employees,” Wehrheim continued.

“These vital investments have already proven to be a benefit for our community and will continue well into the future.”

The supervisor thanked his fellow town officers for their tireless work on the budget proposal.

The budget has been balanced with a focus on quality of life, which includes prioritizing essential services and local infrastructure.

The budget will result in a $29.60 increase for the average household for the year, which is under the tax cap limit.

An additional $3 million will be bonded for highway repaving and drainage projects.

Solid waste residential fees will increase by $4 from $540. The increase includes leaf and brush removal.

The supervisor also addressed the state’s minimum wage increase, set to take place in 2025, which will consequently increase the cost of services the town uses.

Extremely difficult budget

However, no reserve funds were used to balance the budget. “I will add that this was an extremely difficult budget,” Wehrheim said. “It gets more and more difficult every year.”

He said that increases and pressures from the state have contributed to the stress of the budget. While he was proud of the team for coming in with an increase under the tax cap, this may be even more challenging next year.

“I think you will find that getting more difficult for next year, but we’ll see what happens,” the supervisor said. “Perhaps the economy improves. But we did our due diligence, and I think we produced a budget that’s very fair to the Smithtown taxpayer while continuing to provide all the services that we do.”

At the end of the budget presentation, John Savoretti, came forward to say, “As a resident and business owner in Smithtown, I felt it was important for me to come out and thank you for the hard work that you did keeping this [budget] under the cap.”

Wehrheim thanked Savoretti for his kind words. “This was a lot of hard work by our department heads, our Comptroller’s Office and this Town Board. It was not easy to achieve at all, but we strived to achieve it and we made it work.”

The tentative 2025 budget is posted on the town’s website at www.smithtownny.gov.

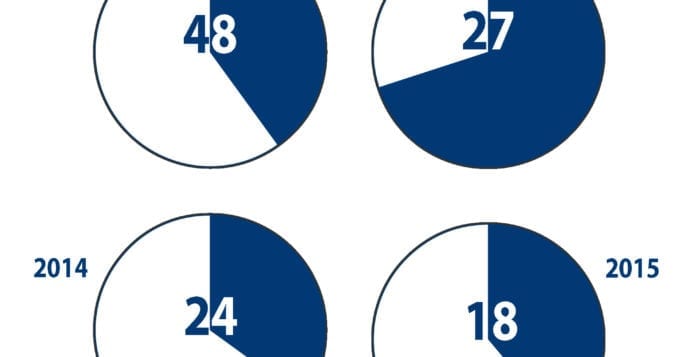

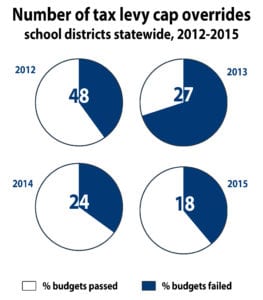

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.