By Elana Glowatz

Desperate times call for desperate budget measures.

For the first time in four years, a northern Suffolk County school district is taking aim at its tax levy cap, looking to bust through that state budget ceiling as more districts around New York do the same in tight times.

The New York State School Boards Association said the number of school districts seeking a supermajority of voter approval — 60 percent — to override their caps has doubled since last year. The group blames that trend on inflation.

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.

This year, the rate of inflation was calculated at just 0.12 percent and, after other calculations, the statewide average for an allowed tax levy increase will be 0.7 percent, according to NYSSBA.

“The quirks and vagaries of the cap formula mean it can fluctuate widely from year to year and district to district,” Executive Director Timothy G. Kremer said in a statement.

More school districts are feeling the pressure — a NYSSBA poll showed that 36 districts will ask voters to pass budgets that pop through their caps, double the number last year.

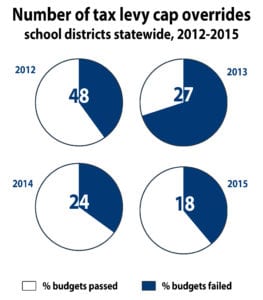

It may be easier said than done: Since the cap was enacted, typically almost half of proposed school district budgets that have tried to bust through it have failed at the polls. That’s compared to budgets that only needed a simple majority of support, which have passed 99 percent of the time since the cap started.

In 2012, the first year for the cap in schools, five districts on Suffolk’s North Shore sought to override it, including Mount Sinai, Comsewogue, Three Village, Rocky Point and Middle Country. Only the latter two were approved, forcing the others to craft new budget proposals and hold a second vote.

Middle Country barely squeaked by, with 60.8 percent of the community approving that budget, and Comsewogue just missed its target, falling shy by only 33 votes.

Numbers from the school boards’ association that year showed that more Long Island school districts had tried to exceed their caps and more budgets had failed than in any other region in the state.

But four years later, Harborfields school district is taking a shot.

Officials there adopted a budget that would increase its tax levy 1.52 percent next year, adding full-day kindergarten, a new high school music elective and a BOCES cultural arts program, among others. Harborfields board member Hansen Lee was “optimistic” that at least 60 percent of the Harborfields community would approve the budget.

“We’re Harborfields; we always come together for the success of our kids and the greater good,” Lee said.

The school boards’ association speculated that more school districts than just Harborfields would have tried to pierce their levy caps if not for a statewide boost in aid — New York State’s own budget increased school aid almost $25 billion, with $3 billion of that going specifically to Long Island.

Now that New York school districts have settled into the cap, Long Islanders’ eyes are on Harborfields, to see whether it becomes an example of changing tides.

Next Tuesday, Harborfields will see if it has enough public support to go where few Long Island districts have ever gone before, above and beyond the tax levy cap.