By Michael E. Russell

Two weeks ago I had the scary experience of watching 60 Minutes on CBS. The majority of the telecast pertained to A.I. (artificial intelligence). Scott Pelley of CBS interviewed Google CEO Sandar Pichai. His initial quote was that A.I. “will be as good or as evil as human nature allows.” The revolution, he continued, “is coming faster than one can imagine.”

I realize that my articles should pertain to investing, however, this 60 Minutes segment made me question where we as a society are headed.

Google and Microsoft are investing billions of dollars into A.I. using microchips built by companies such as Nvidia. What CEO Sundar has been doing since 2019 is leading both Google and its parent company Alphabet, valued at $1.3 trillion. Worldwide, Google runs 90% of internet searches and 70% of smartphones. It is presently in a race with Microsoft for A.I. dominance.

Two months ago Microsoft unveiled its new chatbot. Google responded by releasing its own version named Bard. As the segment continued, we were introduced to Bard by Google Vice President Sissie Hsiao. The first thing that hit me was that Bard does not scroll for answers on the internet like the Google search engine does.

What is confounding is that with microchips built by companies such as Nvidia, they are more than 100 thousand times faster than the human brain. In my case, maybe 250 thousand times faster!

Bard was asked to summarize the New Testament as a test. It accomplished this in 5 seconds. Using Latin, it took 4 seconds. I need to sum this up. In 10 years A.I. will impact all aspects of our lives. The revolution in artificial intelligence is in the middle of a raging debate that has people on one side hoping it will save humanity, while others are predicting doom. I believe that we will be having many more conversations in the near future.

Okay folks, where is the economy today? Well, apparently inflation is still a major factor in our everyday life. The Fed will probably increase rates for a 10th time in less than 2 years.

Having been employed by various Wall Street firms over the past 4 decades, I have learned that high priced analysts have the ability to foresee market direction no better than my grandchildren.

Looking back to May 2011, our savvy elected officials increased our debt-ceiling which led to the first ever downgrade of U.S. debt from its top triple A rating from S&P. This caused a very quick 19% decline in the S&P index. Sound familiar?

It appears that the only time Capitol Hill tries to solve the debt ceiling impasse is when their own portfolio is affected.

This market rally has been led by chatbot affiliated companies. These stocks have added $1.4 trillion in stock market value this year. Keep in mind that just 6 companies were responsible for almost 60% of S&P gains. These are the 6 leaders: Microsoft, Alphabet, Amazon, Meta Platform, Salesforce and of course, Nvidia.

In the meantime, the Administration states that inflation has been reined in. What stores are they shopping in? Here is the data release from Washington. Year over Year changes March 2022-March 2023:

• Food and non-alcoholic beverages up 8.1%

• Bread and cereal products up 10.8%

• Meat and seafood up 4.3%

• Electricity up 15.7%

When 1 pound of hot dogs rises from $3.25 to $7.50, that is not 8.1%. When Froot Loops go from $1.89 to $5.14 we are in trouble. The bureaucrats in D.C. make up numbers worse than George Santos.

On a positive note, the flowers are starting to bloom, the grass is starting to grow and we live in a special place. Of historic significance, we happen to be home to the second oldest active Episcopal Church in the United States. This year Caroline Church in Setauket will be celebrating its 300th anniversary. Congratulations.

Michael E. Russell retired after 40 years working for various Wall Street firms. All recommendations being made here are not guaranteed and may incur a loss of principal. The opinions and investment recommendations expressed in the column are the author’s own. TBR News Media does not endorse any specific investment advice and urges investors to consult with their financial advisor.

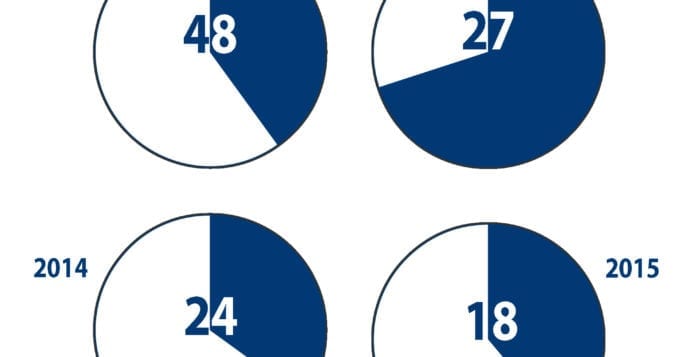

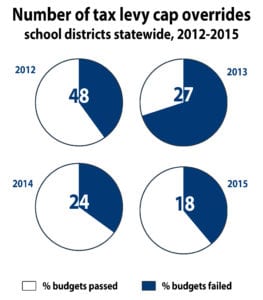

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.