By Donna Deedy

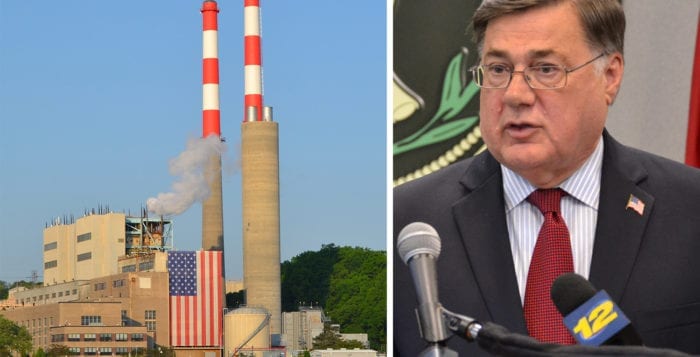

More than 500 residents joined forces in the Northport High School auditorium March 16 to challenge the Long Island Power Authority. The quasi-governmental agency is seeking through the courts a 90 percent reduction in the approximately $82 million in annual property taxes it pays to the Town of Huntington for the Northport power plant.

A number of Northport residents were galvanized to take action. Paul Darrigo, a local commercial banker with Capital One, launched a new Facebook page, Concerned Taxpayers Against LIPA.

“We now have 1,200 members and are still growing at a rate of 15 members per hour,” Darrigo said.

LIPA states in its report, “2019 Fair Property Taxes for Electric Customers,” that New York charges more of the cost of government on utilities than other states. As a result, the not-for-profit entity alleges that it’s overassessed for its aging assets.

“I am advocating for the governor to support my two initiatives to provide Long Island residents with $139 million in state aid to communities impacted by tax certiorari issues.”

— Jim Gaughran

“The plant’s units were built in 1967 and 1976 and its technology is outdated,” LIPA spokesman Sid Nathan said. The plant operates at 12 percent capacity today compared to 54 percent capacity in 1999, a 78 percent decline.

The tax reductions LIPA seeks will reportedly be used to reduce customers’ electric bills.

Gordian Raacke, executive director of nonprofit advocacy group Renewable Energy Long Island, stated by email that he agreed.

“All LIPA customers pay more than would be the case if the properties were assessed at fair value,” he said.

But many Town of Huntington residents aren’t buying into what they call more empty promises.

If LIPA’s case is successful, as the agency has been in previous cases, critics say it could inflict a major economic blow to the community. Northport schools would annually loose an estimated $49 million out of some $54 million it receives from LIPA, according to district’s attorney John Gross.

To compensate for the loss, the Town of Huntington states on its website that residents would be forced to pay higher property taxes.

New York State Sen. Jim Gaughran (D-Northport) organized the town hall meeting to answer questions and to let the community know that he aims to seek funding to soften the blow if LIPA’s case prevails. His legislative bills, however, would require the approval of state lawmakers and Gov. Andrew Cuomo (D). The state senator said he’s working to build consensus in Albany, but urges citizens to contact elected officials at all levels of government to encourage cooperation in the battle.

“I am advocating for the governor to support my two initiatives to provide Long Island residents with $139 million in state aid to communities impacted by tax certiorari issues,” he said. “I am fully supportive of the town and school district in continuing their fight against LIPA.”

The situation raises questions about how education is funded in New York state. However, many community members question why National Grid and PSEG aren’t bearing tax liabilities when shareholders are earning dividends. National Grid, a business based in the United Kingdom, owns the Northport plant and operates under contract to LIPA; PSEG Long Island manages transmission and distribution for LIPA.

Gaughran said that he’s looking into reforms that ensure the public’s interest is properly represented.

“Local communities should not be bankrupt by runaway authorities like LIPA,” he said.

“I love this place, but if I can’t afford to pay my bills what good is it.”

— Joseph Sabia

Northport resident Michael Marcantonio was among people who spoke during the meeting. Now a lawyer specializing in mergers and acquisitions, corporate governance and hostile takeovers, the Northport High School graduate blames the problem on the government’s practice of using public funds to bail out shareholder-owned businesses. LIPA, he explained to the crowd, was formed when officials used the public’s money to buy all the debt and some of the assets of the Long Island Lighting Company after it mismanaged the Shoreham nuclear project, which

ultimately failed.

“This is what corruption looks like,” Marcantonio said. “Do not trust LIPA, they are robbing us, and we need to fight this.” The Northport resident ran for the state’s 12th Assembly District in 2018, largely on the LIPA issue, but he was forced to drop out due to a court decision over him voting locally in 2012 and 2014 while a student at Duke University Law School in North Carolina.

Newspaper reports from 1998 show that the now defunct Bear Stearns, the investment firm involved in the subprime mortgage crisis, served as the state’s financial adviser for the LILCO bailout, before quitting to successfully bid and broker the deal’s bond offering. At $7 billion, it became the largest public offering for municipal bonds in U.S. history.

The LILCO deal was originally promoted publicly as a 20 percent rate reduction plan, as reported in the May 28, 1998 New York Times article titled “The End of LILCO, as Long Island has come to know it.” Long Island ratepayers reportedly paid the highest electricity bills in the nation at the time. As details began to surface, critics found the scheme entailed delaying interest payments on the debt and permanently saddled ratepayers with 33 years of liability.

Nicole Gelinas, a senior fellow at the think-tank Manhattan Institute wrote a 2013 op-ed piece in Newsday titled “Long Islanders are still paying for three bailouts.” The policy analyst explained that Long Islanders need to understand the past mistakes related to the bailouts to prevent similar situations in the future.

LIPA restructured part of its debt in 2013. That plan, as reported in Newsday, aimed to reduce the cost of debt, instead of paying it down.

LIPA reports today that customers pay 10 percent in debt reduction and another 10 percent goes in interest. An additional 15 percent of a LIPA bill pays taxes and other fees. LIPA’s report does not specify what those other fees are.

“Do not trust LIPA, they are robbing us, and we need to fight this.”

— Michael Marcantonio

Business leaders, who also spoke at the meeting, urged others to join the Northport Chamber of Commerce. School board members passed out red business cards instructing residents to visit STOP LIPA NOW on Facebook and get involved.

LIPA states in its report that it ensures it’s working on all customers behalf to lower tax bills on its power plants and other equipment to reflect their fair value. It estimates the plant tax valuation at $200 to $500 million. Huntington assessed the value on the tax code at $3.4 billion.

The plant sits on some 244 waterfront acres near Asharoken, which LIPA estimates is worth “roughly $50 million.”

“We are confident that the court will agree that the Northport power plant is accurately assessed,” said Nick Ciappetta, Town of Huntington attorney.

For people like Northport resident Joseph Sabia, the situation has become unbearable.

“I love this place, but if I can’t afford to pay my bills what good is it,” he said.

The original article had the wrong first name for Sen. James Gaughran. We regret the error.