By Linda M. Toga, Esq.

THE FACTS: After my mother’s death I was approached by a man I will refer to as Joe who claims that my mother was his biological mother as well. According to Joe, before she and my father married, my mother gave birth to Joe and immediately put him up for adoption. Although Joe admits that my mother rejected his attempts to develop a relationship with her during her lifetime, Joe now claims that since my mother died without a will, he is entitled to a share of my mother’s estate.

THE QUESTION: Is Joe correct? Will my siblings and I have to share our inheritance with him?

THE ANSWER: Fortunately for you, Joe is wrong.

HOW IT WORKS: Generally a child who is adopted out does not have the right to an inheritance from the estate of his birth mother. The order of adoption generally relieves the birth parents of all parental duties and of all responsibilities for the adopted child. At the same time, the order extinguishes all parental rights of the birth parent to the estate of a child who has been adopted, including the right to serve as administrator of that child’s estate and the right to inherit under the intestacy statutes.

Although Joe seems to be relying upon the fact that your mother died without a will and, therefore, did not explicitly disinherit him, his reliance is unwarranted. That is because the New York State intestacy statute and the domestic relations law govern how your mother’s estate should be distributed.

While the child of a decedent is generally entitled to a share of his parent’s estate if the parent dies without a will [Estates, Powers and Trusts Law §4-1.1 (a)(1) and (3)], the rights of an adopted child in the estate of a birth parent are governed by subsection (d) of the statute. It provides that the Domestic Relations Law, specifically Domestic Relations Law §117, controls.

Domestic Relations Law §117 (1)(a) and (b) provide that an order of adoption relieves the birth parent of all parental duties and responsibilities and extinguishes any rights the parent would otherwise have over the adoptive child’s property or estate. At the same time, the order terminates any rights of the adoptive child to an inheritance from the birth parent.

Although there are some exceptions to these laws, the logic behind terminating inheritance rights is to prevent people in Joe’s position from enjoying a windfall by inheriting from both his birth and adoptive parents and to prevent a birth mother from receiving an inheritance from a child that she did not support during her lifetime.

Under the circumstances, the only way Joe could inherit from your mother’s estate would be if she chose to name him as a beneficiary in a will or a trust or on a beneficiary designation form. If Joe decides to pursue a claim against your mother’s estate, you should be able to defeat the claim by providing the court with evidence that Joe was legally adopted as a child.

It would be wise to retain an attorney experienced in estate administration to assist you with this matter.

Linda M. Toga provides personalized service and peace of mind to her clients in the areas of elder law, estate administration and estate planning, real estate, marital agreements and litigation. Visit her website at www.lmtogalaw.com or call 631-444-5605 to schedule a free consultation.

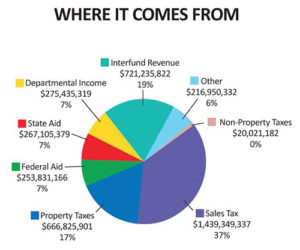

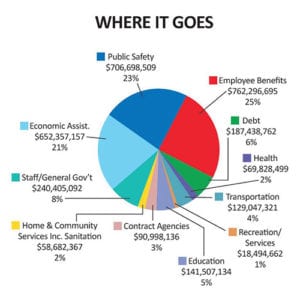

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.