Join Burner Prudenti Law, P.C. for an Estate Planning seminar titled Protecting Assets: Should I Put My Home in a Trust? at Sachem Public Library, 150 Holbrook Road, Holbrook on Tuesday, July 23 at 6:30 p.m. The program will cover how to protect assets, including property and second homes, the ways to reduce and eliminate taxes, and the importance of having a sound estate plan in place. To register visit burnerlaw.com/seminars-webinars/ or call 631-646-2733.

Teachers Federal Credit Union to open new branch in Holbrook

Teachers Federal Credit Union, has announced the upcoming opening of its newest branch in The Shops at SunVet in Holbrook. Set to open in 2025 as part of the highly anticipated redevelopment of the existing SunVet Mall shopping center, this will be the newest branch Teachers Federal Credit Union will open since expanding its branch presence to Florida last year.

The SunVet Mall, once a landmark in the Holbrook community, is being transformed into a vibrant 168,000-square-foot open-air shopping center, The Shops at SunVet. This major revitalization project will feature an array of retail and dining options anchored by a new Whole Foods Market. The modernized center aims to provide a dynamic and enjoyable shopping experience for the local community and visitors alike.

“We are thrilled to expand our presence on Long Island and be a part of this exciting new development aimed at revitalizing the Holbrook area,” said Brad Calhoun, President and CEO of Teachers Federal Credit Union. “Selecting The Shops at SunVet for our next branch location underscores our commitment to strategic growth and providing our members with increased convenience and flexibility as they partner with Teachers Federal Credit Union on their financialjourneys.”

The new Teachers branch will feature a welcoming and innovative design and provide a full suite of financial services, including personal and business banking, mortgages, auto loans, and financial planning. Members will continue to benefit from the credit union’s commitment to exceptional service, competitive rates, as well as tools and resources needed to make informed financial decisions.

“Opening our next branch at The Shops at SunVet aligns with our commitment to enhancing the financial well-being of our members and supporting the communities we serve,” added Calhoun. “We are excited to continue to share the value of a Teachers Federal Credit Union membership with more people in New York and across the country.”

ABOUT TEACHERS FEDERAL CREDIT UNION

Teachers Federal Credit Union (Teachers) is one of the country’s largest credit unions, with more than $9.8 billion in assets and more than 460,000 members across all 50 states. Founded in New York in 1952, Teachers is a full-service, not-for-profit financial institution with an open charter offering membership to anyone in the U.S. through its 30 full-service branches and best-in-class digital solutions. Teachers is a key supporter of the communities it serves and is proud to offer a range of member-focused products with competitive rates and low fees. What started as a smart solution for teachers is now smart for all. For more information, visit www.teachersfcu.org.

Money Matters: How is your retirement income taxed?

By Michael Christodoulou

Once you’re retired, you will likely need to draw on several types of income for your living expenses. You’ll need to know where these funds are coming from and how much you can count on, but you should also be aware of how this money is taxed — because this knowledge can help you plan and budget for your retirement years.

Here’s the basic tax information on some key sources of retirement income:

Social Security: Many people don’t realize they may have to pay taxes on their Social Security benefits. Whether your benefits will be taxed depends on how much other taxable income you receive from various sources, such as self-employment, stock dividends and interest payments. You’ll want to check with your tax advisor to determine whether your income reaches the threshold where your Social Security benefits will be taxed. The lower your total taxable income, the lower the taxes will be on your benefits. The Social Security Administration will not automatically take out taxes from your monthly checks — to have taxes withheld, you will need to fill out Form W-4V (Voluntary Withholding Request). Again, your tax advisor can help you determine the percentage of your benefits you should withhold.

Retirement accounts: During your working years, you may have contributed to two basic retirement accounts: an IRA and a 401(k) or similar plan (such as a 457(b) plan for state and local government employees or a 403(b) plan for educators and employees of some nonprofits). If you invested in a “traditional” IRA or 401(k) or similar plan, your contributions may have been partially or completely deductible and your earnings grew on a tax-deferred basis. But when you start taking withdrawals from your traditional IRA or 401(k), the money is considered taxable at your normal income tax rate. However, if you chose the “Roth” option (when available), your contributions were not deductible, but your earnings and withdrawals are tax-free, provided you meet certain conditions.

Annuities: Many investors use annuities to supplement their retirement income. An annuity is essentially a contract between you and an insurance company in which the insurer pays you an income stream for a given number of years, or for life, in exchange for the premiums you paid. You typically purchase a “qualified” annuity with pre-tax dollars, possibly within a traditional IRA or 401(k), so your premiums may be deductible, and your earnings can grow tax deferred. Once you start taking payouts, the entire amount — your contributions and earnings — are taxable at your individual tax rate.

On the other hand, you purchase “non-qualified” annuities with after-tax dollars, so your premiums aren’t deductible, but just like qualified annuities, your earnings grow on a tax-deferred basis. When you take payments, you won’t pay taxes on the principal amounts you invested but the earnings will be taxed as ordinary income.

We’ve looked at some general rules governing different sources of income, but you should consult your tax professional about your specific situation.

Ultimately, factors such as your goals, lifestyle and time horizon should drive the decisions you make for your retirement income. Nonetheless, you may want to look for ways to control the taxes that result from your various income pools. And the more you know about how your income is taxed, the fewer unpleasant surprises you may experience.

Michael Christodoulou, ChFC®, AAMS®, CRPC®, CRPS® is a Financial Advisor for Edward Jones in Stony Brook, Member SIP

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor.

Attorney At Law: Protecting our children — Estate planning for beneficiaries

By Brit Burner, Esq.

Estate planning is often a family affair. While clients may come to us worried about their future, they are also worried about the future of those they will leave behind when they die. It may be a child, niece, or nephew who has had a run of bad luck, a string of bad relationships, or one that makes bad business decisions.

Even clients who are leaving assets to children with good marriages and seemingly no debt have concerns that one of these negative situations may arise in the future for one of their beneficiaries, and then what?

When concern about a beneficiary is top of mind, clients are often interested in hearing about the options available for leaving assets behind in a Trust for the benefit of one or multiple beneficiaries. These can be called by several names but we regularly use the term “descendants trust.” This type of trust gives creditor protection to beneficiaries, protecting their inheritance from dissipation in the event of a divorce, bad business decisions, general creditors, or any other creditors. A descendants trust can be drafted to avoid additional estate taxes at the beneficiary’s subsequent death, thereby preserving wealth for another generation.

A descendants trust can be created for each beneficiary to protect their inheritance. These trusts are created by the client’s last will and testament or living trust, and the creating document lists the specific rules of each trust.

One of the first decisions to make is who should serve as trustee. The trustee is responsible for investing and reinvesting assets held by the trust. This can include assets invested in the market, cash, or real estate. To assist clients in making the decision of who should serve as trustee, we ask if we are trying to protect the beneficiary from themself or from others. If the beneficiary is the problem, we will recommend a family member, friend, or corporate entity serve as trustee. For concerns about creditors, divorcing spouses or other outside entities, we may recommend that the beneficiary can serve as their own trustee.

The particular circumstances of the situation will help dictate this choice. If a close family member or the beneficiary serve as trustee, they are deemed to be “interested” rather than “independent.

In determining allocations of principal from the trust, an interested trustee is restricted to distribution only for health, education, maintenance, and support. If there is an independent trustee, then assets can be paid for any reason at the discretion of the trustee.

For distributions of income, a descendants trust can provide that any income generated from an asset in the trust shall be paid out to the beneficiary, although the income can also be directed to remain in the trust and distributions can be made upon the discretion of the trustee. However, the trustee must keep in mind that income that remains in the descendants trust will be taxed to the trust at its own tax rate, usually higher than that of the individual beneficiary.

Beyond the known concerns for a beneficiary, there may be a concern for future need for Medicaid or other government benefits. The descendants trust is a good solution because it can have supplemental needs language that allows a beneficiary to maintain or apply for government benefits while maintaining trust assets to be preserved, should this become necessary.

While some clients may feel that their assets are such that their children will not need government benefits, there are many wonderful programs for the disabled that can only be accessed by government benefit programs. This provision may or may not be applicable to future heirs and is prudent to include. The future is unknown and with the proper planning, you be sure your beneficiaries and the money you leave for them is well protected.

Britt Burner, Esq. is a Partner at Burner Prudenti Law, P.C. focusing her practice areas on Estate Planning and Elder Law. Burner Prudenti Law, P.C. serves clients from New York City to the east end of Long Island with offices located in East Setauket, Westhampton Beach, Manhattan and East Hampton.

Money Matters: What to know before ‘reversing’ your retirement

By Michael Christodoulou

If you’ve retired, you may have thought you closed the book on one chapter of your life. But what happens if you need to “reverse” your retirement?

Due to higher inflation and rising interest rates, many retirees are taking out more money from their retirement accounts than they had originally anticipated. As a result, some are headed back to the workforce. If you’re thinking of joining them, you’ll need to consider some factors that may affect your finances.

First, if you’ve been taking Social Security, be aware that you could lose some of your benefits if you earn over a certain level, at least until you reach your full retirement age, which is likely between 66 and 67. Specifically, if you are under your full retirement age for the entire year, Social Security will deduct $1 from your benefit payments for every $2 you earn above the annual limit, which, in 2024, is $22,320. In the year you reach your full retirement age, Social Security will deduct $1 in benefits for every $3 you earn above a different limit, which, in 2024, is $59,520.

Social Security will only count your earnings up to the month before you reach your full retirement age, at which point your earnings will no longer reduce your benefits, regardless of how much you earn. Also, Social Security will recalculate your benefit amounts to credit you for the months your payments were reduced due to your excess earnings. Social Security also allows you to pay back early benefits received if you withdraw your application within 12 months of starting benefits. This move could help you receive substantially higher benefits at full retirement age.

Your Social Security isn’t the only benefit that could be affected by your earnings. Your Medicare Part B and Part D premiums are based on your income, so they could rise if you start earning more money. Also, your extra income could push you into a higher tax bracket.

Nonetheless, you can certainly gain some benefits by returning to the working world. Obviously, you’ll be making money that can help you boost your daily cash flow and possibly reduce some debts. But depending on where you work, you might also be able to contribute to a 401(k) or other employer-sponsored retirement plan. And regardless of where you work, you’ll be eligible to contribute to an IRA. By putting more money into these accounts, you may well be able to strengthen your financial position during your retirement years. You might also be able to receive some employee benefits, such as group health insurance — which could be particularly valuable if you haven’t yet started receiving Medicare.

In addition to the potential financial advantages of going back to work, you might get some social benefits, too. Many people enjoy the interactions with fellow workers and miss these exchanges when they retire, so a return to the workforce, even if it’s on a part-time basis, may give you an emotional boost.

In the final analysis, you’ll want to weigh the potential costs of going back to work against the possible benefits. There’s no one right answer for everyone, but by looking at all the variables, you should be able to reach a decision that works for you.

Michael Christodoulou, ChFC®, AAMS®, CRPC®, CRPS® is a Financial Advisor for Edward Jones in Stony Brook, Member SIP

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor.

Daniel R. Liff named to Forbes Magazine’s List of Best-in-State Wealth Advisors

Morgan Stanley (NYSE: MS )has announced that Daniel R. Liff, a Managing Director, Financial Advisor in the Firm’s Hauppauge Wealth Management office, has been named to Forbes Magazine’s 2024 list of Best-in-State Wealth Advisors.

Forbes’ Best-in-State Wealth Advisors list comprises a select group of individuals who have a minimum of seven years of industry experience. The ranking, developed by Forbes’ partner SHOOK Research, is based on an algorithm of qualitative and quatitative data, rating thousands of wealth advisors and weighing factors like revenue trends, AUM, compliance records, industry experience and best practices learned through telephone and in-person interviews.

“I am pleased that Dan is representing Morgan Stanley,” commented Robert Forte, Market Manager of Morgan Stanley’s Hauppauge office. “To be named to this list recognizes Dan’s professionalism and dedication to the needs of his valued clients.”

Morgan Stanley Wealth Management, a global leader, provides access to a wide range of products and services to individuals, businesses and institutions, including brokerage and investment advisory services, financial and wealth planning, cash management and lending products and services, annuities and insurance, retirement and trust services.

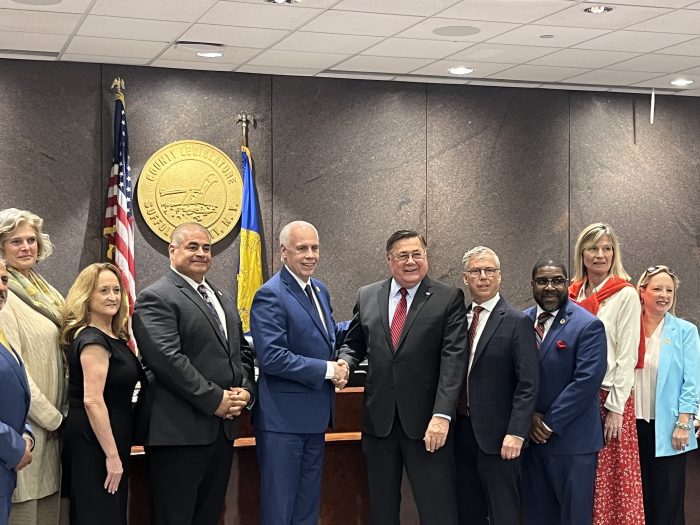

Romaine unveils vision for a safer, stronger Suffolk in State of the County address

By Samantha Rutt

In his inaugural State of the County Address, Suffolk County Executive Ed Romaine (R) outlined a comprehensive four-year plan to revitalize and fortify Suffolk County, emphasizing key priorities such as fiscal responsibility, public safety, infrastructure enhancement and social services reform.

“I am extremely hopeful about the future of this county and there are 18 reasons for that and they all sit around me,” the executive said of his Legislature. “I have watched this Legislature for many years. I was part of this Legislature for many years and I am so impressed with the dedication and commitment of these people,” Romaine said as he stood before the podium.

Addressing an audience May 7 at the William H. Rogers Building in Hauppauge, Romaine outlined his administration’s achievements within its first 100 days while charting a course for the county’s future.

“Let me start off by saying that the state of the county is good — but it can be improved,” Romaine said. “I am going to be working with the 18 people behind me, men and women of goodwill. Men and women of intellect. Men and women to lead this county forward, because I believe our best days are ahead.”

Fiscal strength and accountability

Romaine heralded significant strides in Suffolk County’s financial standing, citing a notable upgrade in the county’s credit rating by S&P Global Ratings.

“One thing I’ve learned over a long life is all issues of government are issues of money,” he emphasized. “Right now our general obligation bonds are rated ‘AA-’. I am happy to say that we got our first upgrade this quarter and we are now ‘A+’.”

With an upgraded rating and a stable outlook, the county seeks fiscal stability and enhanced access to capital markets.

Additionally, Romaine announced initiatives to ensure budgeting practices, including a commitment to adhere to the state-mandated 2% property tax cap and the establishment of a centralized grants office to maximize state and federal funding opportunities.

“New York State has a 2% tax cap, inflation is running a lot higher than 2%,” Romaine explained. “I will submit a budget this September for next year that will not exceed the 2% property tax cap. We cannot afford to do that.”

Investment in public safety

Recognizing the importance of public safety, Romaine announced key appointments within the Suffolk County Police Department and outlined plans to expand law enforcement capabilities.

“Public safety is a concern — we have new leadership in our department,” Romaine said. “As I promised, I’ve hired more detectives, and we have more cops on the street. It’s important because two things that I’ve heard from the voters and residents of Suffolk County is we need the county to be safe and we need it to be affordable.”

Investments in new personnel, equipment and technologies aim to uplift public safety efforts and address emerging challenges. Notably, Romaine emphasized the significance of fair and efficient operations within the Traffic and Parking Violations Agency, a growing concern among residents across the county.

Infrastructure revitalization

Romaine touched on the imperative to modernize and maintain county facilities, highlighting initiatives to renovate and upgrade critical infrastructure. With a focus on improving constituent affairs and enhancing employee morale, the administration plans to address long-standing deficiencies in county facilities, including the Suffolk County Police headquarters and the Medical Examiner’s Office building.

Additionally, plans to reacquire the former John J. Foley nursing home property in Yaphank signals a strategic approach to meet evolving community needs while realizing significant cost savings.

Cybersecurity preparedness

Reflecting on the cyberattack of 2022 and acknowledging the enduring threat posed by cyberattacks, Romaine outlined measures to reinforce the county’s cybersecurity infrastructure. Through comprehensive audits, strategic hiring and resource allocation, the administration shifts its aim to mitigate vulnerabilities and safeguard sensitive data.

Social services reform and environmental preservation

“Now I come to the Department of Social Services, a department that needs a little bit of attention,” Romaine shared. “When I came into office and I read the Newsday article that Suffolk County was one of the worst in the state at processing SNAP [Supplemental Nutrition Assistance Program] applications and that we were way behind in processing social service applications … that is going to change. We are going to put staffing in, we are going to be on top of things.”

Additionally, Romaine reaffirmed the county’s commitment to environmental preservation — just like preservation was a staple of Romaine’s time as Brookhaven Town supervisor — citing investments in farmland preservation and open-space conservation as critical components of sustainable development. The county executive recently appropriated $15 million to preserve farmland across the county. Since taking office, nearly 100 acres of farmland and open space throughout the county has been preserved with additional acquisitions planned later in the year.

Looking ahead

“I believe working together, investing in our infrastructure and rebuilding what is needed in this county as our best days are ahead,” the county executive remarked.

In concluding his address, Romaine articulated a vision of optimism and collaboration, emphasizing the collective efforts needed to propel Suffolk County forward. With a dedicated team and a commitment to transparency and accountability, he expressed confidence in the county’s ability to overcome challenges and realize its full potential.

“Let’s step up to the plate, we have a lot of challenges ahead,” Romaine concluded.

Money Matters: New choices for business owners to consider

By Michael Christodoulou

If you own a business and you offer a 401(k) or similar retirement plan to your employees, you’ll want to stay current on the various changes affecting these types of accounts. And in 2024, you may find some interesting new developments to consider.

These changes are part of the SECURE 2.0 Act, enacted at the end of 2022. And while some parts of the law went into effect in 2023 — such as the new tax credit for employer contributions to start-up retirement plans with 100 or fewer employees — others were only enacted this year.

Here are some of these changes that may interest you:

New “starter” 401(k)/403(b): If you haven’t already established a retirement plan, you can now offer a “starter” 401(k) or “safe harbor” 403(b) plan to employees who meet age and service requirements. These plans have lower contribution limits ($6,000 per year, or $7,000 for those 50 or older) than a typical 401(k) or 403(b) and employers can’t make matching or nonelective contributions. These plans are low-cost and easy to administer but the credit for employer contributions doesn’t apply, as these contributions aren’t allowed, and since start-up costs are low, the tax credit for these costs will be correspondingly lower than they’d be for a full-scale 401(k) plan.

Matches for student loan payments: It’s not easy for young employees to save for retirement and pay back student loans. To help address this problem, Congress included a provision in Secure 2.0 that allows employers the option to provide matching contributions to employees’ retirement plans (401(k), 403(b), 457(b) and SIMPLE IRAs) when these employees make qualified student loan payments. Of course, if you offer this match for student loan payments, your costs will likely increase, although these matching contributions are tax deductible. In any case, you may want to balance any additional expense with the potential benefit of attracting and retaining employees, particularly those who have recently graduated from college.

401(k) eligibility for part-time employees: Part-time employees who are at least 21 years old and have at least 500 hours of service in three consecutive years must now be eligible to contribute to an existing 401(k) plan. The inclusion of part-time employees could lead to higher business expenses for you, depending on the amount of contributions you may make to employees’ plans. Again, though, you’d be offering a benefit that could be attractive to quality part-time employees.

Emergency savings account: Many people, especially those who don’t earn high incomes, have trouble building up emergency funds they can tap for unexpected costs, such as a major home or car repair or large medical expenses. Now, if you offer a 401(k), 403(b) or 457(b) plan, you can include a pension-linked emergency savings account (PLESA) that allows non-highly compensated employees to save up to $2,500, a figure that will be indexed for inflation in the future. PLESA allows for tax-free monthly withdrawals without incurring a 10% tax penalty. PLESA contributions are made on an after-tax (Roth) basis and must be matched at the same rate as other employee contributions.

You may want to consult with your tax and financial professionals to determine how these changes may affect what you want to do with your retirement plan. The more you know, the better your decisions likely will be.

Michael Christodoulou, ChFC®, AAMS®, CRPC®, CRPS® is a Financial Advisor for Edward Jones in Stony Brook. This article was written by Edward Jones for use by your local Edward Jones Financial Advisor.

Money Matters: What should you know about long-term care?

By Michael Christodoulou

We all hope to remain healthy and independent throughout our lives — but life can be unpredictable. If you were ever to need some type of long-term care, would you be financially prepared?

Long-term care encompasses everything from the services of a home health aide to a stay in an assisted living facility to a long residence in a nursing home. You may never need any of these kinds of care, but the odds aren’t necessarily in your favor: Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and support in their remaining years, according to the U.S. Department of Health and Human Services.

And all types of long-term care can involve considerable financial expense. The median annual cost for a home health aide’s services is more than $60,000 per year, and it’s more than $100,000 per year for a private room in a nursing home, according to Genworth, an insurance company. Furthermore, contrary to many people’s expectations, Medicare usually pays very little of these costs.

Of course, some people expect their family will be able to take care of their long-term care needs. But this may not be a viable strategy. For one thing, your family members simply may not have the skills needed to give you the type of care you may require. Also, by the time you might need help, your grown children or other family members might not live in your area.

So, you may need to protect yourself and your loved ones from the potential costs of long-term care. Basically, you’ve got two main choices: You could self-insure or you could transfer the risk by purchasing some type of long-term care insurance.

If you have considerable financial resources, you might find self-insuring to be attractive, rather than choosing insurance and paying policy premiums. You may wish to keep an emergency savings or investment account that’s earmarked exclusively for long-term care to help avoid relying on your other retirement accounts. But self-insuring has two main drawbacks. First, because long-term care can be costly, you might need to plan for a significant amount. And second, it will be quite hard to predict exactly how much money you’ll need, because so many variables are involved — your age when you start needing care, interest rates or inflation, the cost of care in your area, the type of care you’ll require, the length of time you’ll need care, and so on.

As an alternative to self-insuring, you could purchase long-term care insurance, which can provide benefits for home health care, adult day care and assisted living and nursing home facilities. However, you will need to consider the issues attached to long-term care insurance. For one thing, it can be expensive, though the younger you are when you buy your policy, the more affordable it may be.

Also, long-term care policies typically require you to wait a certain amount of time before benefits are paid. But policies vary greatly in what they offer, so, if you are thinking of buying this insurance, you’ll want to review options and compare benefits and costs.

In any case, by being aware of the potential need for long-term care, its cost and the ways of paying for it, you’ll be able to make the appropriate decisions for your financial situation, your needs and your loved ones.

Michael Christodoulou, ChFC®, AAMS®, CRPC®, CRPS® is a Financial Advisor for Edward Jones in Stony Brook

This article was written by Edward Jones for use by your local Edward Jones Financial Advisor.

Money Matters: When should you take Social Security?

By Michael Christodoulou

One of your important sources of retirement income will likely be Social Security — but when should you start taking it?

One of your important sources of retirement income will likely be Social Security — but when should you start taking it?

You can start collecting Social Security benefits at 62, but your checks will be considerably bigger if you wait until your full retirement age, which is likely between 66 and 67. You could even wait until you’re 70, at which point the payments will max out, except for yearly cost-of-living adjustments. But if you need the money, you need the money, even if you’re just 62 or any age before full retirement age.

However, if you have adequate financial resources to meet your monthly needs, whether through earned income, your investment portfolio or a combination of the two, you could have some flexibility in choosing when to take Social Security. In this case, you may want to weigh these considerations:

Life expectancy: For all of us, it’s one of life’s great mysteries: How long will we live? Of course, we can’t see into the future, so the question can’t be answered with total confidence. But to make an informed decision on when to take Social Security, you don’t need to know your exact lifespan — you just need to make a reasonably good estimate.

So, for example, if you’re approaching 62, you’re enjoying excellent health and you have a family history of longevity, you might conclude it’s worth waiting a few years to collect Social Security, so you can receive the bigger payments. Conversely, if your health is questionable and your family has not been fortunate in terms of longevity, you might want to start taking your benefits earlier.

Employment: You can certainly continue working and still receive Social Security benefits. However, if you’re under your full retirement age for the entire year, Social Security will deduct $1 from your benefits for every $2 you earn above the annual limit of $22,320. In the year you reach your full retirement age, Social Security will deduct $1 in benefits for every $3 you earn above $59,520. So, you may want to keep these reductions in mind when deciding when to begin accepting benefits. Once you reach your full retirement age, you can earn any amount without losing benefits. (Also, at your full retirement age, Social Security will recalculate your benefit amount to credit you for the months you received reduced benefits because of your excess earnings.)

Spouse: Spouses can receive two types of Social Security benefits: spousal and survivor. With a spousal benefit, your spouse can receive up to 50% of your full retirement benefits, regardless of when you start taking them. (Your spouse’s benefit can be reduced by the amount of their own retirement benefit and whether they took Social Security before their full retirement age.) But with a survivor benefit, your decision about when to take Social Security can make a big difference.

A surviving spouse can receive the larger of their own benefit or 100% of a deceased spouse’s benefit, so if you take benefits early and receive a permanent reduction, your spouse’s survivor benefit may also be reduced for their lifetime.

When to take Social Security is an important — and irrevocable — decision. So, consider all the factors before making your choice.

Michael Christodoulou, ChFC®, AAMS®, CRPC®, CRPS® is a Financial Advisor for Edward Jones in Stony Brook. Edward Jones, Member SIPC