By Sabrina Artusa

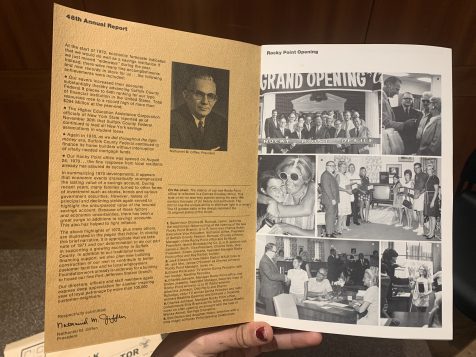

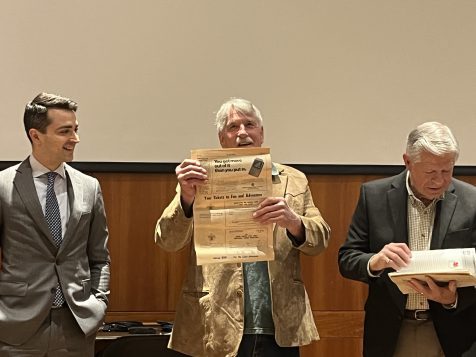

A time capsule from 1971 was unearthed after a Teacher’s Federal Credit Union in Port Jefferson Station off Route 112 was demolished.

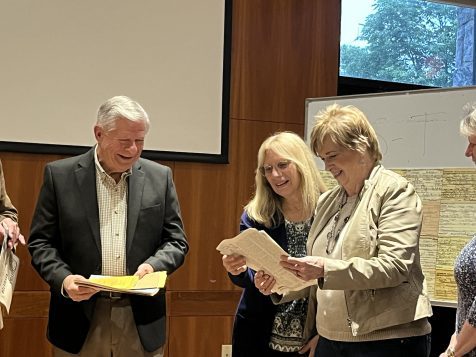

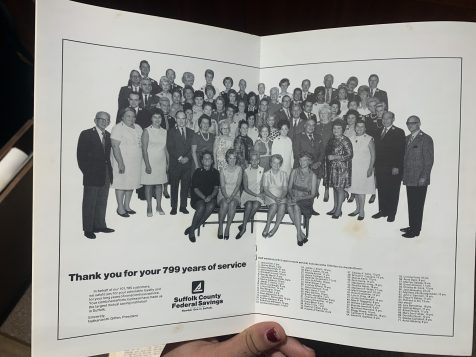

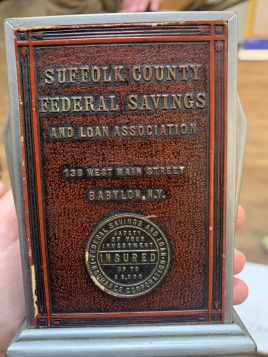

Members of the Suffolk County Federal Savings and Holdings company stood before the Port Jefferson Station Civic as they took a step back in time to 50 years ago. Yellowed newspapers, performance reports and pamphlets were tucked inside the capsule and passed around, reminding the former staff of the homey workplace that sparked lifelong careers in banking.

Assistant manager Robert Walther said he was present when it was put together. “This was kind of like us giving back to the community. Our manager always thought that banking was for the community,” he said.

The Suffolk County Federal Savings and Holdings company was the beginning of a long string of banks for most of these employees, many of whom stuck around for the several mergers that took place after it was acquired by Long Island Savings.

Will Stowell, who worked in maintenance, heard that Staller Associates was going to demolish the building, which was a vacant Teacher’s Federal Credit Union, and remembered the time capsule hidden in the side of the building. He recounted the mason enclosing it.

For staff members like Walther, Stowell, and Betsy Whitney, Suffolk County Federal Savings and Holdings was where they got their start in the industry. Whitney started working as a teller during summers off from college; when she graduated she enrolled in the management program. Stowell rose through the ranks of building maintenance.

“Things have changed in the banking business since then,” said Walther.

The staff would have Christmas parties and decoration contests with the other branches – which they often won. They would sit on floats and take part in parades. Pouring over old photos, Whitney remembered sitting in a float in New York City with her co-workers and seeing Luciano Pavarotti on a horse next to them.

“They treated us so well,” she said. “We were like movie stars.”

Stowell remembers the bank being like “a living room”; it was so comfortable. One civic member was a customer. “I can’t tell you how helpful they were when we first moved out here. I can’t talk highly enough about the employees that were there. [I was so upset] when they left us and turned us over to Astoria,” she said.

Unfortunately, the bank could not compete with higher interest rates. Managed by the Federal Savings and Loans Insurance Corporation, they couldn’t raise their mortgage rates due to state law.

“We couldn’t offer any higher than 8.5% anymore because of state law and that put the bank in a financial position where we couldn’t survive,” said Walther. In the 1980s, before the bank was acquired by Long Island Savings, the 30-year fixed mortgage rate reached 18%.

“We thought we were going to be there for years,” Walther said.

The bank closed and many of the staff retired, but some still keep in touch. The community-based approach to banking has stayed with the employees for decadesQ, shaping their careers and lives.

Greg Balling, who was a locksmith for the bank, had fond memories of his time there. “We were like family,” he said.