By Peggy Olness

In 1968, the citizens of Suffolk County voted to adopt an amendment to the Suffolk County Charter that replaced the Suffolk County board of 10 town supervisors with elected legislators from the 18 legislative districts designated in the amendment. Among the major duties given to the Suffolk County Legislature was the duty of reviewing, amending and approving the annual budgets needed to allow Suffolk County to function.

A budget is a plan that looks at the revenue expected for the fiscal year and the best way to spend to provide the needed services during that fiscal year. The Suffolk County fiscal year runs from Jan. 1 to Dec. 31 of each calendar year. During each year the legislature must review, amend and adopt three budgets to allow the county to function during the next fiscal year. These budgets are:

•The capital budget covers major construction expenditures such as road and bridge repair and construction, most of which extend for periods of more than one year. The capital budget is reviewed during the spring and usually approved by May.

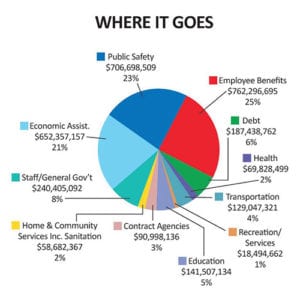

•The operating budget funds the day-to-day operations of the county departments and agencies and is reviewed in the fall and usually approved in November so that spending can begin Jan. 1 of the next fiscal year.

•The community college budget funds the county’s community college system and is reviewed during the summer and usually approved before the start of the community college fall semester. The college budget covers a period coinciding with the school year.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The county executive’s budget staff reviews the requests and works with the departments/agencies to produce a budget with which the county executive’s office is comfortable. This budget request is then sent to the county legislature. Each legislator receives a copy, and the legislature’s Budget Review Office begins work on the review and evaluation of the facts and figures in the county executive’s budget request so that it can advise the legislators on any concerns or problems that may occur.

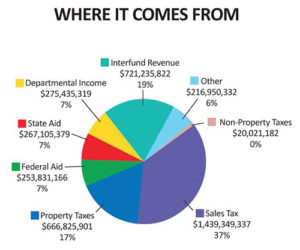

Suffolk County relies on sources of revenue to fund the county budget that are problematic. While the federal government and the states can tax incomes, the county is limited to sales taxes, property taxes and various fees such as the motor vehicle surcharge and the tax map certification. Unfortunately, both sales and property taxes are considered “regressive taxes.” When the economy is good, these taxes produce a sufficient amount of revenue. However, when the economy is bad such as during the recent Great Recession, the revenue from these tax sources is reduced and has not covered all the county’s expenses.

There are limitations on the amount of revenue the county can draw from these sources. New York State caps the property tax increase each year (2 percent at present). To exceed this amount would require a 60 percent vote by the county legislature.

Currently, the sales tax provides about 60 percent of the general fund revenue. As a result of the sluggish economy, the county has been forced to borrow from several sources to balance the budget since 2008. These loans must now be paid back. Moreover, the sales tax revenue has not rebounded sufficiently to cover the budget. An underlying problem with the sales tax is the increase in internet sales at the expense of “brick and mortar” local store sales. These online sales do not return sales tax to Suffolk County.

In future columns, the League of Women Voters will review some of the problems Suffolk County faces in the future as a result of the changes in the local economy.

Peggy Olness is a board member of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org, email [email protected] or call 631-862-6860.