By Samantha Rutt

The real estate landscape in Suffolk County is experiencing a significant shift, with the scales tipping decidedly in favor of sellers. As demand continues to outpace supply, prospective homebuyers face fierce competition and rising prices. This phenomenon, commonly known as a seller’s market, has implications for both buyers and sellers in the region.

Suffolk County, nestled on Long Island’s eastern end, boasts a unique blend of scenic landscapes, vibrant communities, and proximity to New York City. This desirability has driven a surge in demand for residential properties across the county. However, this increased demand is not matched by a proportional rise in housing inventory, creating a supply-demand imbalance.

The limited availability of homes for sale has sparked intense competition among buyers vying for desirable properties. Multiple offers, bidding wars, and quick sales have become commonplace, placing sellers in the advantageous position of fielding competitive offers and securing favorable terms.

“There’s no inventory, that’s the bottom line,” Jolie Powell, of Jolie Powell Realty said. “We have a very strong buyer demand and we have virtually nothing to sell them.”

According to Redfin, a real estate brokerage corporation, the median sale price in Suffolk County in December of 2023 surged 9.4% compared to the previous year, hovering around $596,000. Homes spend an average of just 28 days on the market, compared to 36 last year, indicating a market hungry for listings. The sale-to-list price ratio often exceeding 100% showcases just how fiercely buyers compete for available properties.

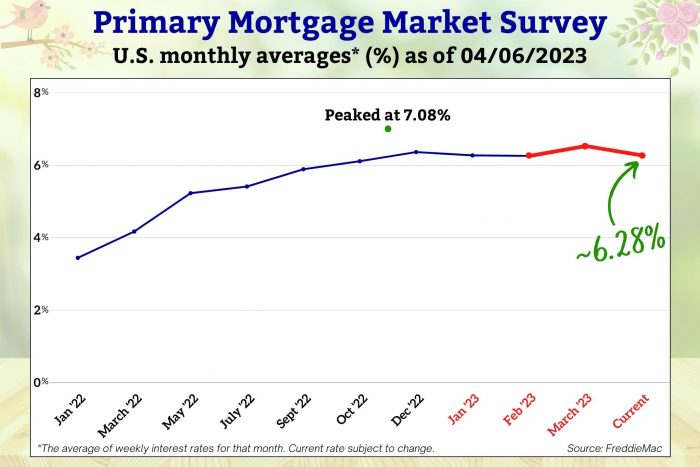

“There’s several reasons,” the broker/owner Powell when asked about the potential causes for the lack of inventory said. “The rates have been high, people got spoiled. Post pandemic, the rates were 3%, and now the rates have doubled. People that locked into that rate have a good situation, and they’re not selling.”

With demand driving prices upward, Suffolk County has witnessed a steady appreciation in property values. Homes are fetching premium prices, often exceeding their listing prices as eager buyers seek to secure their slice of Suffolk County’s real estate market.

“I don’t forsee the inventory level rising at all, which means the prices will probably appreciate, and we’ll probably go back to bidding wars again this spring,” Powell said.

Sellers in Suffolk County are positioned to capitalize on the favorable market conditions. With high demand and low inventory, sellers can command top dollar for their properties and negotiate favorable terms. This upward trend in property values is a treat for sellers, who stand to benefit from lucrative returns on their investments.

Prospective homebuyers navigating Suffolk County’s seller’s market face formidable challenges. Buyers must act swiftly, be prepared to make compelling offers, and potentially adjust their expectations to align with market realities.

“I’m hoping the rates will come down a little bit, this spring, and all indications are pointing to lower interest rates than they are right now. So that will hopefully encourage people sell because those that sell need to buy as well,” Powell said.

As the county’s real estate market remains predominantly in favor of sellers, both buyers and sellers are pushed to adapt to the evolving landscape. With demand outstripping supply, buyers face challenges in securing properties, while sellers stand to benefit from rising property values and heightened competition.