By Michael Ardolino

Another year is coming to an end, and a new one is about to begin. It’s time to look back at the real estate trends of 2023 and what experts are predicting for 2024.

2023 in review

The real estate market in 2023 displayed some interesting dynamics, with fluctuations in mortgage rates and a continued appreciation of home values. Buyers are looking, and there aren’t enough homes on the market.

As I mentioned in last month’s column, people are still moving to the suburbs, and there is solid evidence of that trend here on the North Shore of Suffolk County. What we’re seeing is more demand for homes than there are currently up for sale. It may not be the same as the previous couple of years; however, the demand is still there.

— From October to December, we experienced a 3% decrease of homes on the market in Suffolk County.

— Nearly 60% of homes in the county sold above the asking price.

— Suffolk County homes sold for over 3% higher than a year ago.

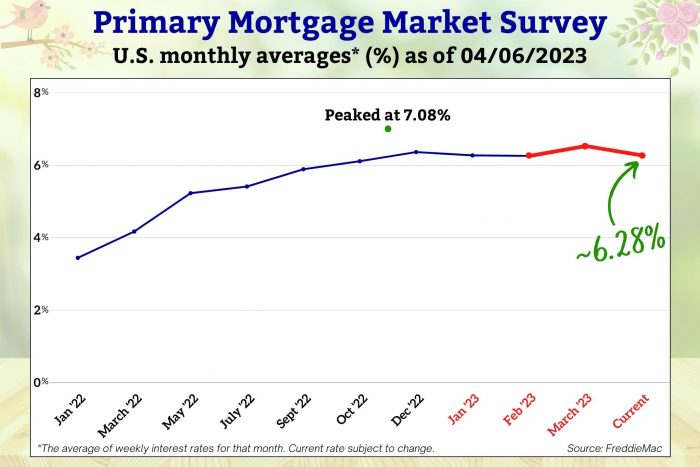

— Rates climbed to nearly 8% this year but dipped toward 7.5% recently for a 30-year mortgage.

Looking forward to 2024

Predictions indicate a positive trajectory for home prices, a decrease in mortgage rates and potential interest rate cuts by the Federal Reserve in 2024. The Feds cutting interest rates, possibly multiple times in the coming year, would end 20 months of rate hikes.

In an article posted to the HousingWire website, Lawrence Yun, National Association of Realtors’ chief economist, said data shows inflation is easing, which could lead the Federal Reserve to cut rates.

“I think that the Federal Reserve will cut interest rates four times in 2024,” Yun said. “Inflation will be much calmer, [and] the abnormal spread between mortgage rates and the 10-year treasury [yield] will begin to normalize or narrow.”

Some real estate experts have gone as far as predicting that home prices will continue to rise over the next five years. It’s difficult to predict that far out as real estate is inherently uncertain as it’s influenced by local economic and global factors.

The one thing we know is that homes are appreciating right now and mortgage rates are currently decreasing. We don’t have a crystal ball to know what will happen over the next few years. We do know what’s going on now.

Advice to sell before more houses are listed in the spring aligns with the current market conditions and trends.

Spring ahead

If you’re thinking of selling, don’t make the mistake of waiting until the weather gets warmer. Now is the time to sit with a real estate professional and to prepare your home. Go through your house and donate the furnishings and items you don’t need and finally make those small repairs on your to-do list.

Takeaway

Potential sellers should stay informed about the latest market developments and consider consulting with real estate professionals for personalized advice.

So … let’s talk.

Michael Ardolino is the Founder/Owner Broker of Realty Connect USA