The federal Small Business Administration announced the government’s Payment Protection Program, which initially put up $349 billion in funds for small businesses across the country, has run out of funding in just eight days since it came online.

Thousands of loans are still being processed, and both government and small business owners are calling for more funds to be added to the bill, which was meant to stimulate small businesses and help keep more from filing for unemployment.

Around 41,000 loans have been approved for New York State out of 1.7 million. However, many businesses were left short of approval or didn’t manage to file in time. Others, who filed early as possible, found their early attempts confused with both misinformation and lack of clarity from banks and federal agencies.

Bernie Ryba, the regional director of the Stony Brook Small Business Development Center , said during a live stream with the Rocky Point Sound Beach Chamber of Commerce April 16 there are growing signs of the economy deteriorating “faster than anticipated,” and the $2.2 trillion CARES Act, passed at the end of March, may not be enough.

He added banks have already been ordered to not accept any more applications.

“It demonstrates the extent of the damage small businesses have experienced over the past three weeks,” he said.

Ryba said the SBA was not staffed to handle the number of applications. From acceptance of application to approval was going to be 30 days, but he said that number has gone out the window due to the incredible number of applications.

Some have also criticized who have been able to apply for loans, and how quickly they received it. Politico reported that a number of large chain restaurants ate up millions of dollars in loans meant for small businesses. Such chains as the companies behind Potbelly Sandwich Shop and Ruth’s Chris Steak House, each received $20 million and $10 million in loans respectively. While the loans were meant for companies with 500 or less employees, this rule was expanded to allow companies to apply as long as they didn’t have more than 500 employees in a single location.

While both Republicans and Democrats agree more funds need to be added, the parties are bickering back and forth about how much. The GOP has proposed an additional $250 billion to the PPP program, but Dems stymied that, arguing the bill, which U.S. Sen. Chuck Schumer (D) called CARE 3.5, should also include $100 billion for hospitals, $150 billion for state and local governments and a boost to food assistance. Republicans have blocked that effort in return.

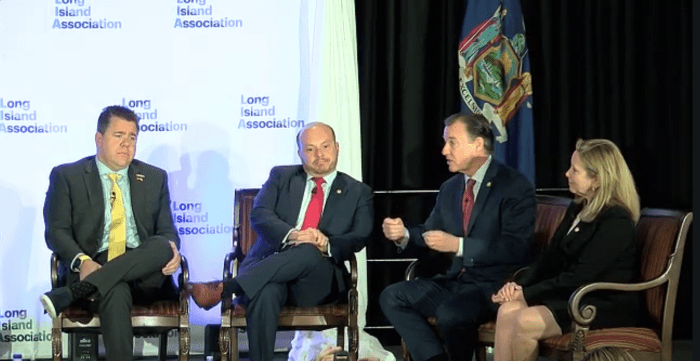

Schumer, the senate minority leader, said in a live streamed conference with Long Island Association President and CEO Kevin Law April 17 that there could be two additional COVID-related bills in the near future.

Meanwhile, Ryba said his small business center, which also has offices in SUNY Farmingdale, will be receiving around $1.1 million in federal assistance so they can hire additional staff in order to handle a larger number of business owners looking for advice.

Law said the thing of biggest importance isn’t the long term of the whole U.S. economy, but making sure that these small businesses and average people have money in their pockets to deal with the short term. He also questioned whether the government may allow some different types of nonprofits to apply for aid through PPP, as currently only 501c3’s are applicable. Schumer said they would look into allowing 501c6’s and others to also apply for any further aid in the future.

Schumer agreed, saying the government’s focus should be twofold, adding the government needs to approve the PPP extension “so their money gets out there faster, it is job number one. Testing — if we don’t get it done we’re not going to recover. Those are the two biggest things.”

More from Schumer and Law’s Conversation

People are facing multiple hurdles during the ongoing coronavirus crisis, but Law said those people need help from the federal government.

With people’s $1,200 checks for people making under $75,000 a year finally going out, Schumer said that should not be the end of such funds to everyday Americans. He added he thought the wage limit should be raised to people making around $99,000 a year.

“If you have a wife who is a hospital worker, you’re making more than [the $75K] but you still need help,” he said.

In terms of mortgages, Law said while there was something being done for those with federally backed mortgages, he asked if there was anything being done for those with more locally or commercially backed mortgages.

“We need some kind of commercial forbearance for both commercial and tenants,” Schumer said. “I pushed for this in CARE 3.” (The bill called the CARES Act passed March 30.)

The LIRR is currently asking for an additional bailout, with ridership now down by 97 percent, but services are continuing for essential workers, especially those working in health care. Schumer said he wants to provide more assistance to both the LIRR and to the Suffolk and Nassau bus systems.

For other municipalities, he said bills he called CARE 4 and 5, the first of which he expected to come up in the first few weeks of May, will also include more money for townships who have also experienced revenue shortfalls from the coronavirus.

Law also suggested the federal government look into creating some kind of public works program in the vein of President Franklin Roosevelt’s post-Great Depression programs in the 1930s and 40s, specifically for public and infrastructure works such as roads, bridges and sewers. Schumer agreed with the idea for when things finally start to open up.

“We’re going to have to stimulate the economy, and the best way to do that is through infrastructure,” the senator said.