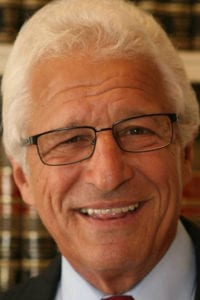

Smithtown residents crowded the town board meeting room to standing room only, trailing down the staircase, waiting patiently in line for one last chance to speak. The three-minute limit for public speakers forgotten, as they came to say farewell and thank you to Supervisor Patrick Vecchio (R).

Vecchio led his last town board meeting Dec. 12 marking the end of his 40 years in office.

“Supervisor Vecchio, today is certainly a historic occasion,” said Brad Harris, town historian and former councilman for 12 years. “You’ve been my supervisor for 40 years. That fact in itself is remarkable and historic as it makes you the longest serving supervisor in our town’s history, probably in the state, and probably in the nation … you’ve made Smithtown a model for others to follow.”

Many former town employees, former council members, politicians and residents could recall distinctly the first time they met Vecchio, some dating back to when he first took office in 1978.

“I met him 40 years ago when he was first running for election, I did not vote for him,” admitted Councilwoman Lynne Nowick (R-St. James). “I’m sorry I did not because the supervisor, along with the help of the town boards along the way, made this the best town in the United States.”

Suffolk County legislators Leslie Kennedy (R-Nesconset) and Rob Trotta (R-Fort Salonga) presented Vecchio with a county proclamation for his work.

“You have always done what you thought was right for the people,” Kennedy said. “I am proud you have been my supervisor. I know you will stay involved. I know you will put your two cents in at every opportunity you get and I am glad.”

“The best measure is: Did you leave the town better than those before you? The answer is absolutely yes.”

— Mike Fitzpatrick

Trotta noted that as the supervisor leaves office the Town of Smithtown is not in debt, but rather has a budgetary surplus.

“This town is in such good financial shape, it is all because of you,” he said. “You should be a model for every other town in the country, the nation, the state and certainly in this county.”

More than a few suggested to Vecchio if he was not interested in retiring, he could offer his services as a budgetary consultant to Suffolk County Executive Steve Bellone (D).

“Your service to Smithtown has been honorable and you are notoriously thrifty,” said Amy Fortunato, a Smithtown resident who campaigned unsuccessfully for a seat on town board this November.

Others lauded his focus on residents and tenacity in solving issues affecting Smithtown.

“Seniors are important and are often the forgotten ones,” said Rose Palazzolo, a St. James resident and president of the town’s Senior Center. “You have never forgotten the seniors.”

Even residents who found themselves at odds with Vecchio came forward to express their respect for his years of service.

“We didn’t always agree on things, in fact we disagreed a heck of a lot more than we agreed on things,” said Tony Tanzi, president of Kings Park Chamber of Commerce. “I always respected his opinion, and I know in my heart he always truly believed in what he was doing and put the town first.”

Tanzi noted that Vecchio would always be remembered as Mr. Supervisor.

Those who served on Smithtown town board over the years remembered Vecchio as a mentor with conviction.

“There are two figures in my life who have had the most influence in my political career, one of course is my father, and the other is you,” said state Assemblyman Mike Fitzpatrick (R-St. James).

“I want you to know that I have big shoes to fill, and I’m fully aware of that.”

— Ed Wehrheim

During his time in town office, Fitzpatrick said he recalls that the only victory he ever had against Vecchio on policies was the installation of a water slide at the pools in Smithtown Landing Country Club.

“The best measure is: Did you leave the town better than those before you?,” he said. “The answer is absolutely yes.”

Former town Councilwoman Pat Biancaniello laughed slightly, saying she never got a victory against Vecchio while in office but sometimes managed to get him to shift, or slide, opinions.

“Even though we’ve had differences and you didn’t take me from crayons to perfume, you took me from budgets to environment …” Biancaniello said, tearfully referencing the movie “To Sir, with Love.” “I want to thank you for how much you meant to me.”

Councilman Tom McCarthy (R-St. James) who served alongside Vecchio as deputy town supervisor, recalled making a $25 donation to his campaign for supervisor when he was only a town park employee.

“Thank you for allowing me to serve with you as a councilman for 20 years,” McCarthy said. “Thank you. I love you.”

Supervisor-elect and current Councilman Ed Wehrheim (R-Kings Park) beat Vecchio in the Republican primary in September, ending his 40-year reign, did wish him a fond retirement.

“I want you to know that I have big shoes to fill, and I’m fully aware of that,” Wehrheim said. “I intend to do my best to do that. It’s my hope you frequent town hall any time you want. Hopefully, you are a frequent visitor and take my calls when I need your guidance.”