A proposal to rezone part of Route 347 near the Smith Haven Mall has the town Planning Department mulling over its roster of retail.

In November, the town board considered at public hearings proposals to construct a 30,500-square-foot building on Route 347 near Alexander Avenue in Nesconset along with another 3,100-square-foot building on Middle Country Road, making way for a potential shopping center to house restaurants and small office space, attorney David N. Altman said. But Smithtown’s Assistant Planning Director Dave Flynn approached the town board at a work session Tuesday morning to ask members to consider the application’s potential impacts, given an already robust level of business zoning in town.

Flynn said he and the Planning Department staff delved into the potential shopping center when its applicant, Sun Enterprises, Inc., asked for a rezoning for the area from residential, single-family to neighborhood business. The department then drafted a memo to the town board recommending the property be developed into garden apartments instead of retail because of what Flynn cited as a possible overabundance of business zoning in the town.

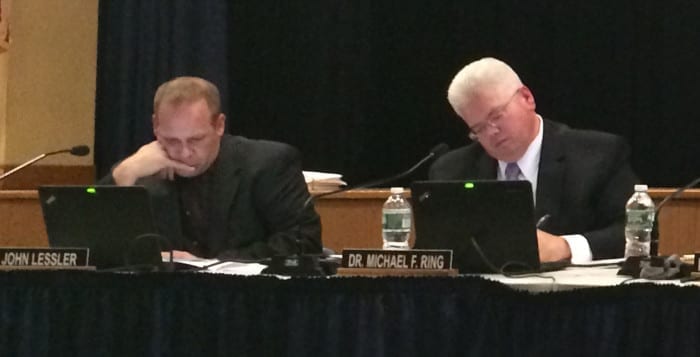

“I felt it was my obligation to speak with you,” Flynn said to Smithtown Supervisor Pat Vecchio (R), Councilman Tom McCarthy (R) and Councilman Ed Wehrheim (R) at the work session. “If the town board felt this should be explored, I would contact the property owner. It’s hard to measure the damage it would do.”

Vecchio, McCarthy and Wehrheim heard Flynn’s considerations for the future zoning of the area, but leaned more on the side of following through with what the board and the applicants had already started.

“The applicant did his due diligence, and I think we should do ours,” McCarthy said.

Wehrheim also said he had similar sentiments.

“The applicant went through a lot to get to this point,” he said. “And now we are going to change our minds?”

The town board heard public hearings at its Nov. 20 meeting to consider the shopping center, which Altman said would create anywhere from 20 to 50 construction jobs and 20 to 50 permanent full-time jobs. The applicant was asking for the rezoning of three separate lots into one business lot, which Altman said could increase the overall real property taxes generated for the site from $25,000 a year to anywhere from $180,000 to $225,000.

Frank Filiciotto, a hired civil engineer and traffic planner, also spoke to the board at the November meeting and said the potential development would draw from existing traffic in the area and wouldn’t significantly impact the number of cars traveling along Route 347.

“It’s important to note that all three driveways will be right in, right out driveways,” he said. “There’s no conflicting left turning maneuvers in and out of these sites. So what it does is, it draws from the traffic that’s already on the streets.”