Rocky Point nixes green building tax exemption

Green buildings in Rocky Point are no longer eligible for a school tax exemption.

Just three months after the Rocky Point school board granted a Leadership in Energy and Environmental Design — commonly known as LEED — buildings tax exemption, the board voted to withdraw it.

Trustee Melissa Brown made the motion, which passed 4-1, shortly after 11 p.m. at the school board meeting on March 23. Trustee Scott Reh, who voted for the exemption in December, cast the single dissenting vote.

Brown said she made the motion in light of the “uncertainty of our financial future.”

It was the second time a motion was made to rescind the exemption.

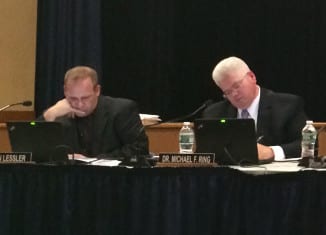

The first time was in January, when Trustee John Lessler wanted to further review the financial ramifications the exemption would have on other taxpayers.

Lessler’s motion failed, 3-2, with him and Trustee Sean Callahan voting in the minority. The two trustees had originally voted against the tax break.

At the time, Lessler said he believed it was a property owner’s private decision to build to LEED standards and not one that should be subsidized by the school district.

The exemption applies to residential and commercial buildings.

“It’s a heavy implication in the future if more and more of these homes do it,” he said.

Depending on the level of LEED certification, property owners could have avoided paying school taxes for a certain number of years. New buildings with the highest level of LEED certification would have been exempt for the first six years, then would have received reduced taxes in the following four years.

The state enacted the LEED exemption program in 2012, authorizing local municipalities and school districts to grant the exemption. In 2013, Brookhaven Town crafted its own tax break based on the state initiative. The town has yet to receive any applications for the exemption, according to Jim Ryan, Brookhaven’s tax assessor.

Rocky Point would have been the first area school district to offer the exemption. Neighboring districts such as Miller Place, Shoreham-Wading River, Mount Sinai, Comsewogue, Port Jefferson and Middle Country have not filed to offer the exemption, according to The New York State Department of Taxation and Finance.

Rocky Point resident Danny Andersen brought the program to the district’s attention last year and urged the board to adopt it. Andersen could not be reached for comment regarding the board’s decision.

Board President Susan Sullivan, who voted to adopt the exemption and to rescind it, said the board could revisit the matter in the future once it receives more information. The school district has granted tax exemptions in the past, including last year’s veterans tax exemption. Under that program, veterans get a certain reduction in their school taxes and other taxpayers make up the difference.