Your neighbors as citizen educators and advocates

By Lisa Scott

The League of Women Voters of Suffolk County (LWVSC) has been writing a monthly column in this paper for the past 10 months. We thank Leah Dunaief for giving us this opportunity to share our insights and information with TBR readers (in print and online) and look forward to continuing this league “outreach” to our fellow Suffolk County residents each month. We chose the title “Making Democracy Work” very deliberately, since “Work” refers to both a functioning democracy as well as alluding to the “roll up your sleeve” efforts of the league and all of you as responsible citizens in Suffolk.

LWVSC has no actual members — our local leagues in Brookhaven, the Hamptons, Huntington, Shelter Island and Smithtown are the member organizations. The board meets monthly as we exchange best practices and insights, address challenges and plan joint league activities and visibility, as well as observe and study county government and issues and construct responses on a county level.

We share, we learn, we argue, we support and we inspire greater league visibility and effectiveness. The league is very much a grassroots organization in which our local community/town leagues are vibrant and active on local issues and study and share state and town issues and insights in order to reach consensus to further action.

The league’s passion and mission focus on voter education (in many forms) as well as advocacy on issues that we’ve studied on all government levels. Our overarching philosophy is being nonpartisan: We never support or oppose candidates or parties. We’re collaborative and have a strong commitment to civil discourse and civic engagement.

We recently held our 50th annual convention, which reflected the activities and events Suffolk local leagues held in the past 12 months. We’d like to share some of these with you in order to celebrate the scope and depth of what the league (your neighbors here in Suffolk County) is able to accomplish.

•We held over 100 voter registration drives and distributed voter registration forms at cooperating retail locations, events, fairs and naturalization ceremonies.

•We sponsored or moderated over 20 candidate debates for school boards and for town and county government offices.

•We work closely with the Suffolk County Board of Elections to better understand election processes and rules, advocate for increased voting accessibility (e.g., early voting, no excuse absentee ballots, etc.) and recently met for an overview of poll worker training.

•There are numerous strong league youth programs that include a selective Students Inside Albany three-day conference; an annual Student Day at the Suffolk County Legislature; a Running and Winning program for girls; working with Girl Scouts on government and woman suffrage badge requirements; presenting a Vote 18 program for high school seniors; and encouraging schools to contact the Board of Elections for education on the voting machine process (using a sample “ice cream ballot”). We developed and publicized public service audio spots for local colleges and communities to remind people about election day and hours and we worked with youth-led political action groups to create Youth Engaging Youth programs to promote civic engagement.

•We hold lots of public information meetings on a wide range of civic topics ranging from elected officials speaking on topics of concern (e.g., Assembly member/committee chair Steve Englebright on offshore drilling and water issues) to an informational meeting on end-of-life choices and decisions. We invite officials such as town justices or town trustees to explain and discuss their roles; host debates on the NYS constitutional convention referendum; presented a panel on immigration on the south fork of Long Island and hold annual town supervisor meetings to discuss challenges and plans.

•There are celebrations, outings and learning opportunities as well: celebrating the LWVUS’ 98th birthday (we were founded by leaders of the woman suffrage movement in 1920); commemorating NYS woman suffrage in 1918 with multiple events, programs and speakers; holding Community Conversation lunches to informally engage with local leaders; organizing tours of less-known communities and sites in our own areas and co-sponsoring films and reading books with panels and discussions.

The public knows the league for debates, voter registration drives and observing at and speaking before local and county government. We’re particularly proud of our annual Directory of Public Officials and the election/voter information available from our website and phones. Learn more about us, help us further achieve our mission to educate and advocate in Suffolk County, join us and support us. Make Democracy Work!

Lisa Scott is president of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org, email [email protected] or call 631-862-6860.

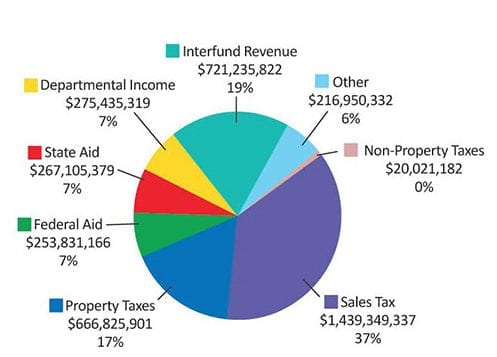

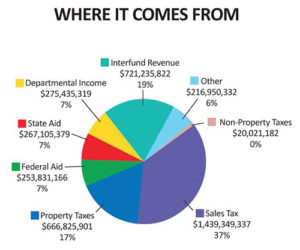

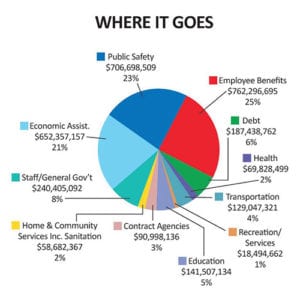

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

Lisa Scott is the president of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org, email

Lisa Scott is the president of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org, email