By Michael E. Russell

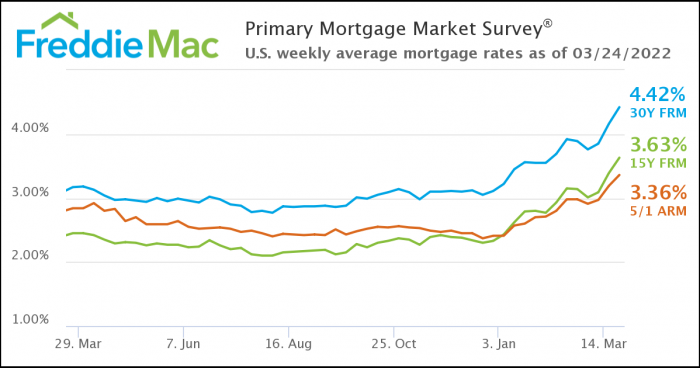

Sometimes it makes my head hurt trying to understand how Washington works. The Federal Reserve raises interest rates in order to curb inflation. Immediately following these actions, Senate Democrats passes the Inflation Reduction Act with the blessing of the White House.

This bill goes counter to what Jerome Powell and the Federal Reserve are trying to accomplish. Jim Kramer on CNBC calls this bill the “Spend Our Way To Oblivion Act or SOWOA.”

If you own stocks, this could be a problem. For many U.S. companies the bill includes a tax on stock buybacks. This will impact the way companies address their capital. A 15% book tax which hurts companies with net operating losses will force them to issue debt in order to raise capital.

Senator Chuck Schumer proudly states that this bill will allow Medicare to negotiate prices with drug companies. Really? This is not quite correct. Beginning 4 years from now, Medicare will only be negotiating on lowering prices on 10 drugs. Schumer also states that the bill will create higher paying Environmental Engineering jobs. This potentially will lead to hyper wage inflation. Just look at last Friday’s employment figures.

Environmental groups are euphoric over the bill, providing the potential for an additional 500,000 high paying jobs. That’s awesome, but where are the applicants to fill these positions? This is the type of wage inflation that the Federal Reserve is trying to rein in.

It appears that commodity inflation has peaked, but now we will have to contend with labor inflation by creating jobs we have no ability to fill, other than to take from the private sector. I don’t want to beat a dead horse, but every time Fed Chairman Jerome Powell tries to get a handle on inflation, the Federal government throws him a curveball.

The people of this country for the most part are hard-working and good-hearted. The stock market has politics, of course. We all want to slow global warming or better yet, STOP IT. However, what is occurring in Washington has the potential to destroy our free enterprise system. The government is printing money and spending it like sailors on shore leave. A final thought on this, TERM LIMITS.

On a positive note: We have had a nice bounce during the month of July. The jobs number this past Friday appears to show that we may not be on the verge of a recession, but it sure puts pressure on the Fed to increase rates.

Stock news. GE is splitting into 3 different companies. Those individual stocks could perform very well. Think back to the split up of AT&T into 7 different entities. I am still a big fan of ExxonMobil, even though it is already up 50% this year. JPMorgan has come down from $165 in January to $114. The potential for a higher price is very possible, while being paid with a nice dividend. Last, but not least, Proctor and Gamble. Most of us use their products on a daily basis, like toothpaste and laundry detergent, don’t we?

Until next month, try to stay cool.

Michael E. Russell retired after 40 years working for various Wall Street firms. All recommendations being made here are not guaranteed and may incur a loss of principal. The opinions and investment recommendations expressed in the column are the author’s own. TBR News Media does not endorse any specific investment advice and urges investors to consult with their financial advisor.