Let’s Talk … Real Estate: Market stays competitive while mortgage rate increases

By Michael Ardolino

As I mentioned in last month’s column, it’s essential to pay attention to current events. For those watching the news, you’ve probably noticed the various factors affecting today’s real estate market.

Federal Reserve

The U.S. Federal Reserve System met this month and raised interest rates for the first time since 2018. At a recent conference Jerome Powell, chair of the Federal Reserve, said, “There is an obvious need to move expeditiously to a more neutral level and more restrictive levels if needed to restore price stability.”

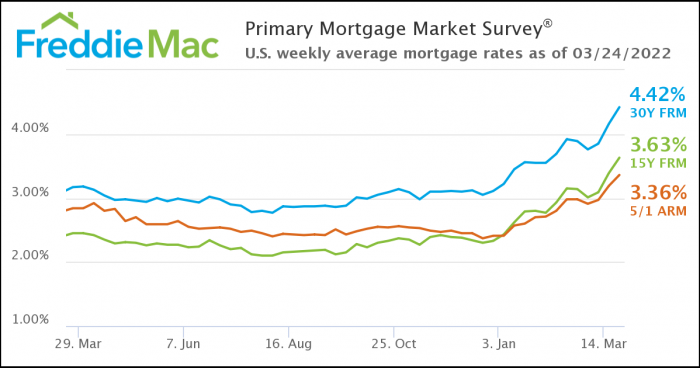

Due to anticipation of the meeting, the average 30-year fixed mortgage rate climbed to 4.16%, according to Freddie Mac. After the meeting, the rate climbed up slightly to 4.52%. Keep in mind at the end of 2021, rates were at 3.11%. Powell has hinted at a 50-basis-point rate hike, which converts to .5%, by the Federal Reserve’s meeting in May or even before; some experts believe the rate could possibly jump even higher.

Current trends

Mortgage rates are slightly up during a period when there are more buyers than sellers in the real estate market. That’s good for sellers as it keeps the market competitive.

According to the National Association of Realtors, pending home sales were down 5.4% in February compared to 2021 across the nation, however, in the Northeast, homes going into contract are up!

“Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale,’” said Lawrence Yun, NAR’s chief economist.

Also, due to inventory not meeting demand, we’re still seeing homes appreciate. Keeping Current Matters, a real estate resource, reported home values appreciated an average of 15% across the country last year. Experts predict that home prices will remain steady.

World events are indeed causing supply chain issues. We have been hit hardest in our pockets when paying for oil deliveries or gasoline, which will continue to affect us. When consumers spend more to drive their car or heat a home, they may have less money to save for a new house. Going back to low home inventory, this slight dip in homebuyers hasn’t affected real estate yet.

Takeaway

The beginning of this year has proved to look at more than one factor when predicting the future of real estate. Mortgage rates may be slowly rising, and then low inventory also comes into play to balance things out. Remember, rates are still historically low, as the graph above shows.

For potential sellers, it’s still a favorable time to put your house on the market while prices are on the high side. A home sale now could mean getting a bigger home or downsizing. Or, if you’re moving out of state, you’ll have the competitive edge with more money in your pocket because house prices are rising all over the country, even in areas once known as more affordable. So … let’s talk

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA.