By Lynn Hallarman

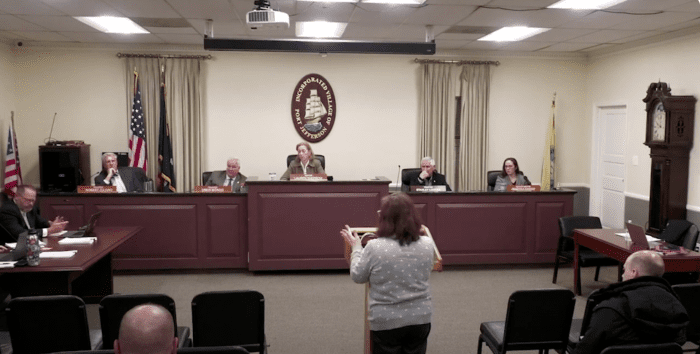

During the Feb. 28 Village of Port Jefferson Board of Trustees meeting, officials sought public input while deliberating the implementation of a tax cap override law allowing the village, if necessary, to increase property taxes above the New York State 2% tax cap.

The 4-1 vote grants trustees the option to levy additional property taxes past the 2% limit during the fiscal year 2024-25.

Village treasurer, Stephen Gaffga, explained that based on the state 2% tax cap law, allowable tax growth for the village can be up to, but not beyond, approximately $7.4 million this budget cycle. The tax cap override option would allow the board to levy taxes above the $7.4 million for unexpected village costs.

“Based on my analysis of current village funds, I do not foresee the village needing to exceed the tax cap,” he said.

“The village has exceeded the 2% tax cap in eight of the last nine years,” Gaffga told TBR News Media. “The approximate range of the piercing is between $8,000 and $380,000, depending upon the year.”

New York State property tax cap New Yorkers pay among the highest property taxes nationwide. In 2011, the state Legislature enacted the tax levy limit to check spiraling property taxes. The law was made permanent in 2019 and limits the increase in the property taxes for a given budget cycle to 2% or the rate of inflation, whichever is lower. This law impacts all local governments and school districts outside New York City.

However, state law allows local governments to circumvent the tax levy limit by enacting a local law granting them the option to pierce the cap and increase property taxes above the 2% limit. A 60% majority, or three out of five votes from the village Board of Trustees, is needed to put in place an override option of the tax cap.

Public comment

Village resident Barbara Sabatino sought reassurances from the board. “We’ve had this type of public hearing for multiple years, and it was always with the assurance that should the village have to exceed 2% the increase would be small,” she said.

“We don’t have those figures yet,” Gaffga said. “But that’s certainly something that we can come up with during the tentative budget hearing for everybody.”

Vote breakdown

Trustees Biondo, Juliano, Kassay and Loucks voted to adopt the resolution establishing a tax cap override option for this fiscal year.

Mayor Lauren Sheprow opposed the measure. “I feel strongly committed that my fiduciary responsibility as mayor, and working with the treasurer, that I’m strongly committed to not piercing the tax gap,” she said.

The next Board of Trustees work session will be held March 13 at Village Hall.