The New York State Education Department is cracking down on Native American mascots in schools, and Comsewogue School District is now in its sights.

In a Nov. 17 letter sent out to districts across the state, NYSED senior deputy commissioner James Baldwin alerted school administrators that using Native American mascots, team names or imagery is prohibited “without current approval from a recognized tribe.”

Districts failing to meet these standards, Baldwin wrote, “may be in willful violation of the Dignity [for All Students] Act.” The penalty for violators could “include the removal of school officers and the withdrawal of state aid.”

Facing the threat of losing state aid, CSD officials will have to work against the clock. NYSED is placing a deadline on school districts, ordering them to retire these mascots before the end of the 2022-23 school year.

The Education Department is developing new regulations to clarify its policy, with a release date anticipated sometime in April. Until then, New York school districts remain in limbo.

Jennifer Quinn, superintendent of schools at Comsewogue School District, said the district would not make any policy determinations until NYSED releases its detailed guidelines.

“There are so many question marks,” she said. “Until we see the actual regulations, we’re kind of playing a guessing game.”

While school districts statewide undergo significant changes in the coming months, certain characteristics may set Comsewogue apart from the pack.

Historical background

Before Europeans had ever stepped foot on Long Island, from present day St. James to Wading River and as far south as Gordon Heights, the Setalcott Nation once inhabited the lands. Within that territory lies Port Jefferson Station/Terryville, an area known to the Setalcotts as Comsewogue, meaning “place where paths come together.”

The Terryville-Comsewogue School District was formed in 1874, and the senior high school opened nearly a century later in 1971. The school district has prominently showcased its precolonial heritage along with its name.

One district emblem contains the initials “CSD” with a feather draped over its side. Another logo displays a visually striking profile depicting a Setalcott. This logo is etched ubiquitously throughout the district’s website, school walls and at the center of the high school’s turf athletic field. Sports teams are called “the Warriors.”

Setalcott reaction

Helen Sells is president of the Setalcott Native American Council. In an interview, she said she is personally not offended by the use of Setalcott images and references in Comsewogue schools. Sells referred to the term “warrior” as a distinction among her ancestors.

“It was an honor for our men, and some of the women, to serve for our country and for the freedoms of all,” she said. “The men were considered warriors because they had to go out and hunt for food and hold the community together.”

Asked whether Comsewogue School District should continue using Setalcott mascots, team names and imagery, Sells responded affirmatively. “To me, it’s important as a family to try to keep that history going,” she said.

Whether this response constitutes “current approval from a recognized tribe” is still to be determined. NYSED declined to comment for this story.

Debating mascots, logos and team names

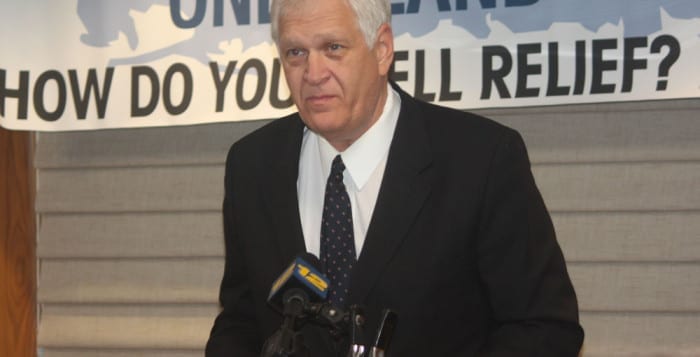

New York State Assemblyman Ed Flood (R-Port Jefferson), whose 4th Assembly District encompasses CSD, said the state has more pressing educational concerns than deciding mascots and team names.‘The state takes the approach that one size fits all. They’re not looking into every local district.’

— Ed Flood

“There’s so much wrong in education right now,” he said. “I think our kids — I see it in my own children being out of the classroom for so long — are kind of behind,” adding, “We have bigger problems to fix.”

A Comsewogue alum, Flood held that the logos and team name were not intended to deride Native Americans. “It’s not used in any way to be offensive,” he said. “Comsewogue is a pretty diverse district with people of all races and ethnicities. We were all proud to put on that jersey, and we understood what it represented.”

Flood’s predecessor in the state Assembly, Steve Englebright (D-Setauket), offered that ethical dilemmas often require moderation and restraint by decision-makers. He cited the example of the U.S. Army renaming bases that had honored former Confederates.

“I believe the model for what should be done is probably the way that the U.S. Army has approached the question of renaming military bases,” Englebright said. “The approach was to set up — two, I believe — study commissions and to give thoughtful consideration if there is a controversy.” He added, “I’m not sure there is a controversy here.”

State aid conundrum

Debates surrounding state contributions to public education have been ongoing for over a century and a half, said Campbell Scribner, assistant professor of education at the University of Maryland College of Education in College Park.

In an interview, he traced the historical trends of public education in the United States, highlighting the complexities surrounding state aid.

“One of the ambiguities or tensions in American education is that, constitutionally, there has never been a federal right to education, but there is a state right,” he said. “Since at least the Civil War, all state constitutions make provisions for public education.”

However, until the early to mid-20th century, state funding lagged behind local contributions. “Although states have a constitutional obligation to provide education, they didn’t fund it very well,” Scribner said.

Without organized state bureaucracies or state income tax, school districts generated revenue primarily through local property taxes. This model offered considerable local autonomy in setting curricula and other districtwide standards.

Invoking social reforms‘States have taken a much more robust posture. They’ve taken more interest in what’s happening locally.’

— Campbell Scribner

The dynamic between states and school boards changed as state aid began to comprise a heftier chunk of school districts’ overall budgets. With the injection of state funds, Scribner suggests power has shifted away from local school officials and into the hands of state bureaucrats.

“States have taken a much more robust posture,” Scribner said, adding, “They’ve taken more interest in what’s happening locally.”

With more say over budgeting, states have found leverage in setting curricula and social standards within school districts. Moreover, the threat of revoking state aid can be an effective instrument.

Despite the state’s newfound power, this approach has limits: “The state certainly does not want to come across as coercive,” Scribner said. “I don’t think it’s going to help state legislators to look like they’re bullying local school boards or denying children education.”

“But on the other hand,” he added, “I don’t think, legally, the school boards have the sort of rights they might assume they do or the same prerogative against the states.”

Native American imagery

Within the scope of national and statewide politics, CSD is caught in a much broader web over the role of Native American imagery.‘There’s a long history of European settlers appropriating Native American imagery.’

— Andrew Newman

Andrew Newman is a professor and chair in the English Department at Stony Brook University whose research focuses on the intersection of early American, indigenous and media studies.

Newman shared that Native American imagery within popular culture is a centuries-old practice dating back to the 18th century.

“There’s a long history of European settlers appropriating Native American imagery,” he said. “There was an idea of Native Americans as being sort of tied to the land, athletic, representing this kind of uncivilized masculinity that was very attractive to the mainstream white culture.”

He added, “This phenomenon was referred to by the scholar Philip Deloria, in a book [of the same title] from 1998, as ‘Playing Indian.’”

Newman maintained that these portrayals often negatively affect self-perceptions within Native American communities, adding that such caricatures can minimize historical injustices.

The movement away from Native American mascots and team names has gradually developed within public education and professional sports. After years of resistance, the former Washington Redskins football and Cleveland Indians baseball franchises have finally changed their team names to more neutral identifiers, respectively the Commanders and Guardians.

Newman said mascots, team names and imagery can be hard to do away with because of the strong emotional ties these symbols can produce. This effect is especially prevalent within schools.

“The students and families and communities that are associated with these schools are kind of attached to the school’s traditions,” the SBU professor said. “They’re hard to give up.”

Veneration vs. denigration

The debate over the use of Native American mascots surrounds two main arguments, according to Newman. On the one hand, proponents say these images glorify indigenous heritage and tradition. On the other, detractors view them as derogatory and offensive to Native Americans.

Reflecting upon the function of public education, Newman noted the apparent contradiction between the mission to educate about local history while potentially alienating a segment of the local population.

“Especially in educational institutions, where presumably part of the mission is to educate the students about the local history, I don’t think that educational mission is compatible with the use of a Native American-themed mascot,” the SBU professor said.

An opportunity for dialogue‘When we do make our plan, we are very mindful of including every stakeholder.’

— Jennifer Quinn

Assessing NYSED’s approach, Flood suggested Albany is applying a blanket policy to a multifaceted issue. He contended the state government is neither informed of Comsewogue’s historical circumstances nor sensitive to the variations between tribes across Long Island.

“The state takes the approach that one size fits all,” the assemblyman said. “They’re not looking into every local district.”

While pressure comes down from Albany, Scribner said schools are uniquely suited to answer these moral questions through their abundant channels for local input.

“School politics remain one of the strongest and most accessible democratic spaces we have in this country,” the UM professor said. “They are, of course, hemmed in certain ways by state regulations. But again, I still think that if local voters really want something, they do have levers to pull.”

Quinn affirmed CSD’s commitment to working as a community through this sensitive local matter. “Nobody wants to do anything to make a child feel uncomfortable,” she said. “Ultimately, we have to see what [NYSED is] going to tell us we have to do, and then we can make a plan.”

The district superintendent concluded, “When we do make our plan, we are very mindful of including every stakeholder. Our community is going to be very involved.”

Englebright noted that CSD likely did not intend to disparage Native Americans when it created its logo and team name.

Nonetheless, the former assemblyman reiterated that study commissions and community forums could be fruitful in working out competing ethical considerations.

“History is complicated,” Englebright said. “That’s why I think this deserves some introspection.”