By Michael Ardolino

Many real estate experts will tell you when selling a house, no matter what the market is like, the seller can get a great return on their investment if they understand market trends. This particular piece of advice is always worth repeating.

Right now

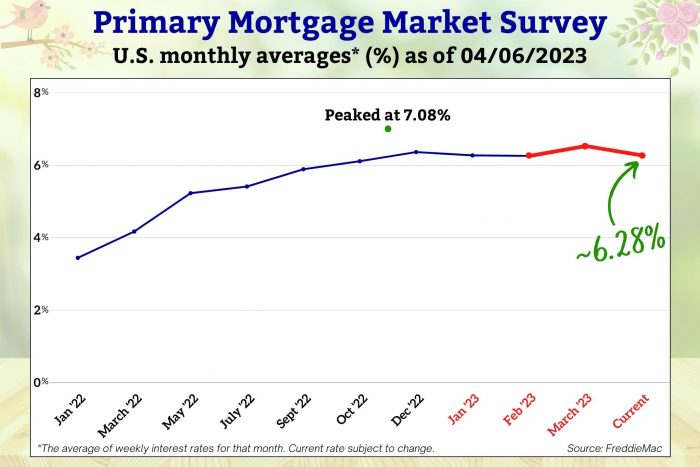

Many buyers were starting to acclimate to raising mortgage rates, which doubled within months in 2022. Lately, things have been improving. As of April 6, Freddie Mac reported an average 30-year fixed-rate mortgage of 6.28%, which was down from 6.32% the week before, making it the fourth seven-day period in a row where rates decreased.

A dip in mortgage rates leads to more buyers returning to the market.

For countless potential homeowners, the obstacle will not be the mortgage rates; it will be the low inventory.

“Mortgage rates continue to trend down entering the traditional spring homebuying season,” said Sam Khater, Freddie Mac’s chief economist, in a press release. “Unfortunately, those in the market to buy are facing a number of challenges, not the least of which is the low inventory of homes for sale, especially for aspiring first-time homebuyers.”

Low inventory combined with higher rates than last year means prices are remaining steady across Long Island.

In a recent article on the Keeping Current Matters website, Lawrence Yun, chief economist at the National Association of Realtors, projected home prices will remain steady. “We simply don’t have enough inventory,” Yun said. “Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30% price decline is highly, highly unlikely.”

In other words, most real estate experts are not predicting another housing crash.

Be a savvy seller

While home prices remain steady, buyers are not offering more than the asking price for houses that need work. How do you get your house to sell quickly? Make any necessary repairs. As I have mentioned in past columns, this doesn’t mean elaborate renovations. It means you must fix that leaky faucet, running toilet or damaged flooring.

Sellers also need to be flexible with showings. Keep your home clean and organized so that when an agent calls to say a buyer wants to look at your home, it can be viewed at a moment’s notice.

Most important of all, now more than ever, you want to work with a real estate agent who prices your home realistically. Look at what similar homes sold for in the past couple of weeks, not the last few years.

Take away

Sellers who are practical regarding pricing — looking at today’s prices and not yesterday’s — and choose to work with a real estate professional can garner a great return on their investment.

So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA