By Michael Ardolino

The experts were right. U.S. Federal Reserve System Chair Jerome Powell recently said that raising interest rates 50-basis-points, which converts to .5%, is on the table for the central bank’s May meeting.

The May rate increase will follow the Fed’s decision to raise rates in March. It would be the first time since 2006 that rates were raised in back-to-back meetings. And, the half-point increase would be the first in 22 years.

Mortgage rates

Since January, mortgage rates for a 30-year fixed mortgage have climbed from an average of 3.11% to a current 5.35%. It’s the first time that the rate has gone above 5% in a decade. We’ve mentioned in several past articles that experts have always projected rising interest rates spread across 2022, even though they are still on the low side.

Mortgage rates on the rise and inflation fluctuating may prompt people to question where the housing market is leading. People may also wonder how home prices and home unit sales will be affected.

According to Sam Khater, Freddie Mac’s chief economist, mortgage rates increased for seven consecutive weeks. “While springtime is typically the busiest homebuying season, the upswing in rates has caused some volatility in demand,” Khater said. “It continues to be a seller’s market, but buyers who remain interested in purchasing a home may find that competition has moderately softened.”

This softening makes sense as many potential buyers may start looking for houses in a lower price range or take a break from looking at homes.

Debunking some myths

Some buyers may want to wait until home prices and mortgage rates decrease, which isn’t a financially-savvy move. It’s imperative to keep in mind that rates and prices will continue to rise, so the longer you wait, the more it will cost you.

Homeowners, don’t think you can set the asking price at whatever amount you want because of a seller’s market. Your house still needs to be priced appropriately. Real estate professionals have seen homes that have remained on the market for months, even though most properties have sold in days around them. It’s all about pricing.

Despite memories from the early 2000s, the housing market is not in a bubble ready to pop. The 2006-08 bust happened because of the foreclosures that flooded the market due to purchasers who weren’t qualified for the mortgage they had and homeowners using the equity in their homes as if it was an ATM.

What has happened in the real estate market the last few years has happened naturally and hasn’t been generated by financial institutions easing lending requirements. Today’s market is continuing as a seller’s market with homes continuing to appreciate due supply and demand, because the pandemic increased the number of people who realized the importance of having their own home, especially in the suburbs.

Takeaway

A recent article in The New York Times, “The Sky-High Pandemic Housing Market Finds Gravity Does Exist,” summed up the current real estate market best.

“By any standard that prevailed before 2020, this would be a hot real estate market.” While demand is subsiding slightly, home prices remain high, with economists predicting a continued rise in the near future.

So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA.

With now being a good time to sell, some homeowners may be asking, “Where do I go?” Moving off of Long Island is a big decision even for potential sellers looking to downsize and retire to a warmer state or one with lower taxes. If you’re not ready just yet, take a look at a condo. This option can satisfy the goal of less upkeep of your property as you won’t be shoveling snow or weeding your garden.

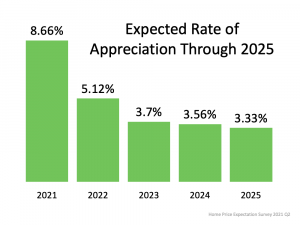

With now being a good time to sell, some homeowners may be asking, “Where do I go?” Moving off of Long Island is a big decision even for potential sellers looking to downsize and retire to a warmer state or one with lower taxes. If you’re not ready just yet, take a look at a condo. This option can satisfy the goal of less upkeep of your property as you won’t be shoveling snow or weeding your garden. The amount of household wealth a homeowner stands to earn going forward is substantial. As the graph on the right illustrates, a homeowner could increase their net worth by a significant amount — over $93,000 by 2026.

The amount of household wealth a homeowner stands to earn going forward is substantial. As the graph on the right illustrates, a homeowner could increase their net worth by a significant amount — over $93,000 by 2026.