Cuomo lauds LIRR reform, hints at renewable energy initiatives

By Donna Deedy

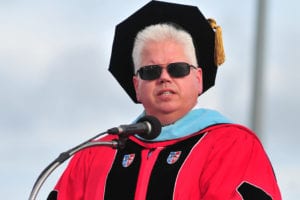

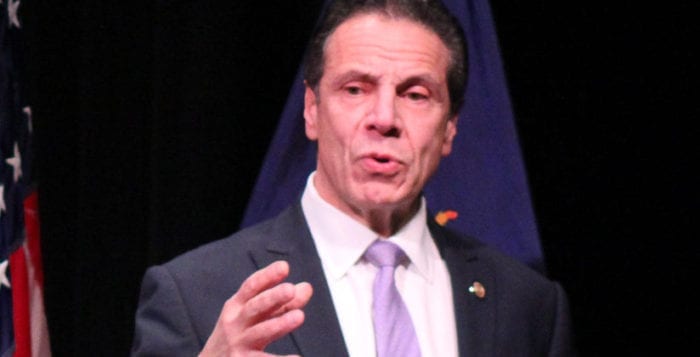

Gov. Andrew Cuomo (D) unveiled April 11 his Long Island agenda to a crowd of some 400 politicians, business leaders, local residents and students at Stony Brook University’s Student Activities Center. It was one of two stops statewide, where the governor personally highlighted regional spending for a local community.

Overall, the $175 billion fiscal year 2020 budget holds spending at 2 percent.

“This year’s budget builds on our progress and our momentum on Long Island, and it includes $18 billion for Long Island — the largest amount of money the state has ever brought back to the region, and we’re proud of it,” Cuomo said.

Nearly half of the revenue that Long Island receives goes toward school aid and Medicaid, $3.3 billion and $6.9 billion collectively, according to Freeman Klopott in New York State’s Division of the Budget. But the spending plan funds several bold initiatives, such as an overhaul of the MTA and Long Island Rail Road and the phase in of free public college tuition for qualified students.

Long Island Association president and CEO Kevin Law, who had introduced the governor, suggests looking at the enacted budget as five distinct categories: taxes, infrastructure, economic development, environmental protection and quality of life issues, such as gun safety reform.

On the tax front, Long Islanders, according to the governor’s report, pay some of the highest property tax bills in the United States. Over the last 20 years, Cuomo said, local property taxes rose twice as fast as the average income.

On the tax front, Long Islanders, according to the governor’s report, pay some of the highest property tax bills in the United States. Over the last 20 years, Cuomo said, local property taxes rose twice as fast as the average income.

“You can’t continue to raise taxes at an amount that is more than people are earning,” he said. His goal is to stabilize the tax base.

On the federal level, the governor will continue to fight with other states the federal tax code, which last year limited taxpayers’ ability to deduct state and local taxes over $10,000 from their federal income tax returns. Long Island reportedly lost $2.2 billion.

Otherwise, the governor considers his plan to be the most ambitious, aggressive and comprehensive agenda for Long Island ever.

The budget’s regional development goals emphasize a commitment to Long Island’s research triangle: Cold Spring Harbor Laboratory, Northwell Health, Stony Brook University and Brookhaven National Laboratory. The governor envisions the Island as New York’s potential economic equivalent to California’s Silicon Valley. The objective is to bridge academic research with commercial opportunities.

Some of the largest investments include $75 million for a medical engineering center at Stony Brook University, $25 million to Demerec Laboratory at Cold Spring Harbor, $12 million for a new college of veterinary medicine at Long Island University Post, $5 million in additional research investments at Stony Brook University and $200,000 cybersecurity center at Hofstra University.

“Governor Cuomo’s presentation was uplifting,” said state Assemblyman Steve Englebright (D-Setauket). “It was also a preview of the future of Long Island as an indelibly important part of the state the governor and Legislature appreciate and are continuing to invest into.”

Offshore wind initiatives will be announced in the spring, with a goal of providing 9,000 megawatts of wind power by 2035. As part of Cuomo’s New Green Deal, the state target is 100 percent clean energy by 2040.

Highlights of Gov. Cuomo’s 2019-20 budget for Long Islanders

Taxes: Permanently limits local tax spending to 2 percent annually. The 2 percent property tax cap, first implemented in 2012, has reportedly saved Long Island taxpayers $8.7 billion. Now that the property tax cap has become permanent, the governor reports that the average Suffolk taxpayer will save an estimated $58,000 over the next 10 years. The budget also supports the phase in of middle-class tax cuts. By 2025, under the reforms, middle-class filers will save up to 20 percent income tax rate and impact 6 million filers.

Internet taxation: Requires internet purchases to charge sales tax to fairly compete with brick-and-mortar retail establishments. This reform is expected to raise sales tax revenue by $33 million for Suffolk County in 2019.

LIRR reforms: Dedicates $2.5 billion to the Long Island Rail Road. $734 million will be used to purchase 202 new trains, $47 million will fund the Ronkonkoma train storage expansion project, which adds 11 tracks to the railyard. Another $264 million is allocated to reconfiguring and rebuilding the Jamaica station. An additional 17 stations will also be upgraded. A third track will be added between Hicksville and Floral Park to address bottlenecking. Many projects are already underway and expected to be completed

by 2022.

The new LIRR Moynihan Train Hall will become an alternative to Penn Station in New York City. It will be located in the old post office building. Construction is underway with completion targeted for the end of 2020. The cost is $2.5 billion with $600,000 million allocated for 2020. A new LIRR entrance at mid-block between 33rd Street and 7th Avenue will also be built at a price tag of $425 million.

School aid: Increases school aid to $3.3 billion, a nearly 4 percent uplift. The 2020 budget includes a $48 million increase of foundation aid.

College tuition: Funds tuition-free education in public colleges to qualified students, whose families earn less than $125,000 annually. The program annually benefits more than 26,100 full-time undergraduate residents on

Long Island.

The DREAM Act: Offers $27 million to fund higher education scholarships for undocumented children already living in New York state.

Higher education infrastructure: Spends $34.3 million for maintenance and upgrades at SUNY higher education facilities on Long Island.

Downtown revitalization: Awards Ronkonkoma Hub with $55 million for a downtown revitalization project. Nassau County will receive $40 million to transform a 70-acre parking lot surrounding Nassau Coliseum into a residential/commercial downtown area with parkland, shopping and entertainment, where people can live and work. Hicksville, Westbury and Central Islip will also receive $10 million each to revitalize its downtowns.

Roads and bridges: Among the initiatives, $33.6 million will be used toward the Robert Moses Causeway bridge. Safety will be enhanced with guardrails along Sunken Meadow Parkway for $4.7 million. The Van Wyck Expressway is also under expansion for improved access to JFK air terminals.

Health care: Adds key provisions of the Affordable Care Act to state law, so health insurance is protected if Washington repeals the law.

Plastic bag ban: Prohibits most single-use plastic bags provided by supermarkets and other retailers beginning in March 2020. Counties and cities can opt to charge 5 cents for paper bags. It is projected that 40 percent of revenue generated will fund local programs that purchase reusable bags for low- and fixed-income consumers. The other 60 percent will fund the state’s environmental protection projects.

Food waste recycling program: $1.5 million will be allocated to establish a clean energy, food waste recycling facility at Yaphank.

Clean water initiatives: Awards Smithtown and Kings Park $40 million for installing sewer infrastructure. A shellfish hatchery at Flax Pond in Setauket will get an additional $4 million. The new budget offers $2 million to the Long Island Pine Barrens Commission and $5 million in grants to improve Suffolk County water supply. The Long Island South Shore Estuary will get $900,000, while Cornell Cooperative Extension will receive $500,000. The state will also fund another $100 million to clean up superfund sites such as the Grumman Plume in Bethpage. The state has banned offshore drilling to protect natural resources.

Criminal justice reform: Ends cash bail for nonviolent felonies and misdemeanors. Mandates speedy trial to reduce pretrial detention. Requires that prosecutors and defendants share discoverable information in advance of trial.

Gun safety: Includes one of the nation’s first “red flag” laws. Passed in February 2019, the law enables the courts to seize firearms from people who show signs of violent behavior or pose a threat to themselves or others. The new law, which takes effect later this year, also authorizes teachers and school professionals to request through the courts mental health evaluations for people who exhibit disturbed behavior related to gun violence. Bans bump stocks. Extends background check waiting period for gun purchases.

Anti-gang projects: Invests more than $45 million to stop MS-13 gang recruitment and improve youth opportunities.

Opioid crisis: Allocates $25 million to fund 12 residential, 48 outpatient and five opioid treatment programs. The state also aims to remove insurance barriers for treatment.

Tourism: Promotes state agricultural products with $515,000 allocated to operate Taste NY Market at the Long Island Welcome Center with satellite locations at Penn Station and East Meadow Farm in Nassau County. The PGA Championship next month and Long Island Fair in September, both at Bethpage, will also feature New York agricultural products.

Agriculture: Continues support for the New York State Grown & Certified program to strengthen consumer confidence and assist farmers. Since 2016, the program has certified more than 2,386 farms.

Voting: Sets aside $10 million to help counties pay for early voting. Employers must offer workers three hours of paid time off to vote on election day.