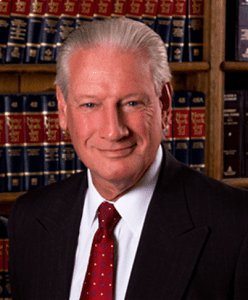

By A. Craig Purcell, Esq.

In the ongoing battle against impaired driving, the stakes couldn’t be higher. With potent synthetic drugs flooding into our communities, state legislators are feeling the pressure to modernize existing laws and ensure that those who choose to drive under the influence face appropriate consequences.

In the ongoing battle against impaired driving, the stakes couldn’t be higher. With potent synthetic drugs flooding into our communities, state legislators are feeling the pressure to modernize existing laws and ensure that those who choose to drive under the influence face appropriate consequences.

One of the primary concerns among lawmakers is the outdated nature of the current list of illegal drugs outlined in public health law. Democratic Assemblyman Bill Magnarelli pointed out the glaring flaw, stating that the list can’t keep pace with the rapid influx of new drugs hitting the streets. And he’s not alone in his sentiment; Onondaga County District Attorney William Fitzpatrick echoed Magnarelli’s concerns, emphasizing the ease with which drug manufacturers can skirt legislation by altering chemical compositions overnight.

This legislative lag poses a significant challenge for law enforcement, making it increasingly difficult to prosecute impaired drivers effectively. As Magnarelli aptly said, “You can’t keep up with it.” This sentiment underscores what our legislature sees as an urgent need for updated legislation that can adapt to the ever-evolving landscape of drug abuse and impairment.

Thus, Assemblymen Magnarelli’s proposed bill seeks to overhaul New York State’s vehicle and traffic law. At its core lies a crucial revision: broadening the definition of “drug” to encompass any substance or combination thereof that impairs physical or mental abilities. This change is essential in recognizing the diverse array of substances capable of impairing drivers, ensuring that the law remains relevant and effective in safeguarding public safety.

However, not everyone is on board with Magnarelli’s proposal. Critics argue that the bill’s reliance on subjective judgment in diagnosing impairment may pose challenges. Yet, Magnarelli remains resolute in his conviction: “Don’t get behind the wheel.” For him, the message is crystal clear — driving while impaired is not worth the risk.

As the bill navigates through the legislative process, its fate hangs in the balance. With a version also under consideration in the Senate, the stage is set for a pivotal debate on how New York State can best address the issue of impaired driving. Be assured, however, that there has never been a time when it was more advisable for anyone charged with a drug and/or drinking-related offense to obtain experienced counsel to represent them in the courts of New York State.

A. Craig Purcell, Esq. is a partner at the law firm of Glynn Mercep Purcell and Morrison LLP in Setauket and is a former President of the Suffolk County Bar Association and Vice President of the New York State Bar Association.