Let’s Talk … Real Estate: Is it best to wait … or sell or buy now?

By Michael Ardolino

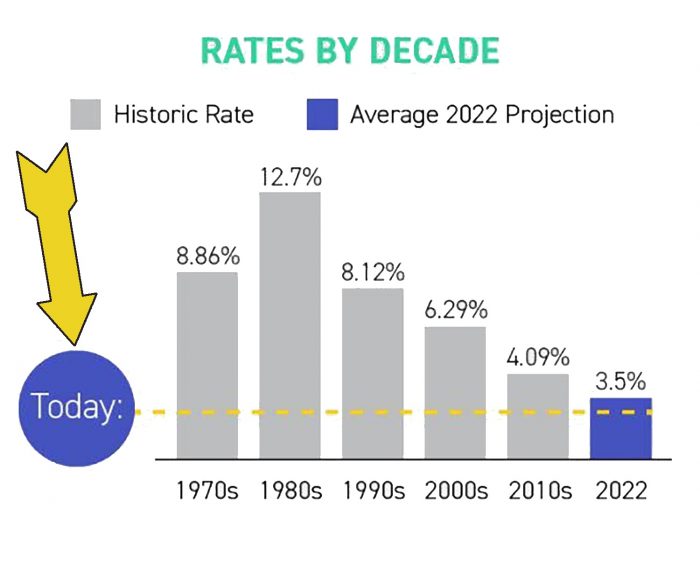

Great news is trending for 2022. The real estate market is still favoring sellers, and buyers can take advantage of mortgage rates that remain historically low.

Timing is everything. The best tip anyone can give a homebuyer is: Take advantage of rates on the low side now.

Let’s look at the data. According to Keeping Current Matters, mortgage rates are still below the average for each of the last five decades. Back in the 1980s, some people were paying rates as high as 12.7%! (See graph above)

For each single percentage point a mortgage rate is raised, it may only translate into a small increase in your monthly payment; however, over a few decades that will add up to a significant amount. Even half a point can make a difference.

The first few weeks of 2022 have been a prime example of how quickly mortgage rates can change. Freddie Mac reported 3.55% for a 30-year fixed-rate mortgage on Jan. 27. Just three weeks before the company was reporting the same rate at 3.22%. Fortunately, the week before the 27th stayed flat despite the month-long rise, but these numbers are the highest in nearly two years.

Experts, such as Freddie Mac’s Chief Economist Sam Khater, expect the increase to be gradual, with rates possibly reaching 3.7% by the fourth quarter. We’ll stay on top of this closely.

Lock it in. People starting the home buying process will benefit from visiting various banks to find the best rate and locking it in. Rates fluctuate daily, sometimes even hourly.

How does a rate lock work? The lock will protect you against rate increases while in the home buying process. Of course, there is always a chance rates can go down, and that’s when it’s wise to ask your lending institution if they offer a “float down” option. Considering how things are trending, it’s most likely not needed now.

Make sure to ask about fees before locking in a mortgage rate. Depending on the lender, locks tend to last 30 to 60 days. Also, ask about extension costs past 60 days.

Make the move. The housing demand will continue to be high due to more buyers than sellers. Fannie Mae and Freddie Mac predict trends that will see a strong increase in home prices in 2022.

Many homeowners wait until later in the year to put their homes on the market as many people in the past searched for homes in the warmer weather to prepare to move after the school year ended. Buyers will look earlier now that they see mortgage rates increasing. Get their attention by putting your house on market earlier than the rest.

Takeaway. Be the first to secure the best price for your home, and if you need to take out a mortgage on your new place, enjoy 16-year low rates. So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA.