‘The glory of gardening: hands in the dirt, head in the sun, heart with nature. To nurture a garden is to feed not just the body, but the soul.’ — Alfred Austin

By Elissa Gargone

Since it was founded in 2001, Jefferson’s Ferry residents have enthusiastically gardened, whether in their apartments, their patios, in the yards of their cottages or in a number of garden beds provided by Jefferson’s Ferry for resident use. Over the years, the demand for growing space has increased. Jefferson’s Ferry President and CEO Bob Caulfield has worked with the resident Garden Committee to help bring their wishes to fruition. Today, 36 elevated beds tended by Independent Living residents overflow with a variety of flowers, vegetables and herbs. Elevated beds are easier on the gardeners’ backs and knees, and are accessible to residents who use wheelchairs.

Additional gardens can be found within the interior gardens and greenspaces of Jefferson’s Ferry Health Center residences. Of the dozen boxes within the interior garden, roughly half are used by residents as part of the recreational therapy program.

Each year, the raised-bed gardeners have an opportunity to display the fruits of their labor at a community gathering, and this year was no exception. A special Garden Showcase and Happy Hour celebration was held during the height of the harvest on August 16. Display tables were loaded with bumper crops of summer flowers, tomatoes, cucumbers, eggplant, basil, lavender and other herbs, as well as samples of Essie Freilach’s homemade pickles and a Chinese-inspired eggplant dish prepared by Mark Saidens. House plants also got their moment in the sun. Blooming orchids and violets in a variety of colors were in abundance. Resident Laura Lesch displayed a 100-year-old Snake Plant that has been passed down through several generations of her family.

Anthropologist Margaret Mead famously said, “Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has.”

A cadre of Jefferson’s Ferry residents has taken that sentiment to heart, with a mission to give back to the environment what development has taken away. Since 2018, the Grounds Committee has spearheaded a project to protect the endangered Monarch Butterfly. When the project was proposed to the community, the response was overwhelmingly positive. Management has since expanded the Monarch project to restore native plants and trees to the 50 acre campus with pollinator, bird and aquifer-friendly native plants and trees, particularly in a meadow around its Melo Pond wetland.

Hoping to obtain outside funding for the expanded project, Grounds Committee member Dorothy Gilbert initiated a grant application to Suffolk County. She was able to involve a diverse group of resident educators, scientists, engineers, construction experts and grant writers to help shape the application. These included a geologist who provided valuable information about soil and the effects of fertilizing, an expert photographer who took pictures during the early work, a resident who was able to get an endorsement for the application from a local government official, and the support of the resident chairs of the Jefferson’s Ferry’s Grounds, Conservation, and Public Affairs committees and the Residents Council.

“We may be the old guard but we are setting an example by doing something that other Long Islanders can do as well — protecting the environment for future generations. We are not wasting our talents after retirement; we want to continue to make a contribution to our community and to society. The new meadowlands include plants vital to important pollinators, including the Monarch Butterfly and other insects and birds. We have planted a variety of native milkweed, which the Monarchs need to reproduce, creating a way station for the them as they migrate south. The meadow provides food and shelter to other native creatures and thrives without the fertilizers and heavy irrigation required for lawns, which is very environmentally friendly to Long Island’s water supply,” said Dorothy Gilbert.

“The Jefferson’s Ferry community, from our management team to our fellow residents, have been immensely supportive of our endeavors, encouraging us every step of the way. There are costs associated with our undertaking, so we have been building the garden beds and the meadows in steps as the budget allows,” added Mark Saidens.

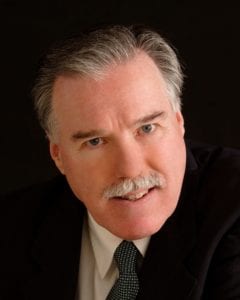

“One of the many things that has always made Jefferson’s Ferry stand out as an extraordinary community is the people who live here,” said Bob Caulfield. “They continue to be active and involved in important social activism. They are environmentally conscious and generous in their charitable donations and volunteerism. They embrace lifelong learning and new ideas and gladly share their talents and wisdom.”

Elissa Gargone is Vice President of Sales and Marketing at Jefferson’s Ferry Life Plan Community in South Setauket.