Understanding sources and concerns

By Peggy Olness

The Suffolk County Legislature is the elected body responsible for public health and public safety, to maintain the county’s infrastructure (mostly roads and sewers) and provide assistance to those in need, for a population of 1.5 million people. The Legislature sets county policies, appropriates funding, levies taxes, reviews and adopts the annual budget and gives the comptroller authority to issue debt to finance capital projects and cash flow needs and issue bonds (incur indebtedness) for specific purposes.

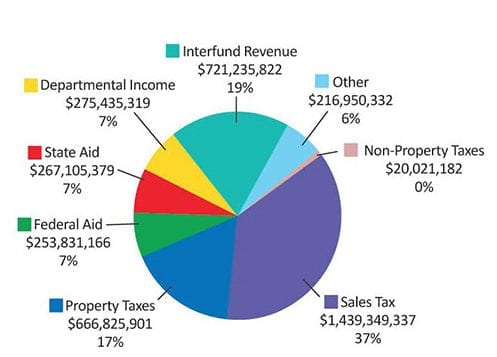

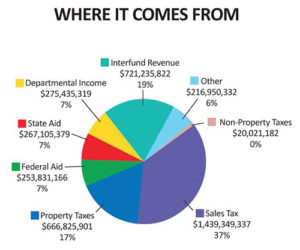

By law the county must have a balanced budget: Revenue must equal expenditures. Also by law, it cannot tax income. Therefore, the county depends on other types of tax revenues, and in some cases borrowing, to meet the cost of the annual budget. The largest revenue sources (as you can see in the pie chart) are the sales tax, state and federal aid, real property taxes and various fees and grants.

It is important to remember that the annual operating budget is a plan for spending. Thus, during the year changes and adjustments must be made to the budget to accommodate what really happens to the tax revenue stream and necessary expenditures to meet the needs of the citizens (for example, a snowstorm).

While Suffolk County collects the taxes, not all of the tax monies collected go into the county’s general fund to pay Suffolk County expenses. The actual distribution of these revenues often involves other funds specific to programs or purposes.

An example of this is the distribution of the sales tax, which represents about 60 percent of the general fund revenue. Suffolk County collects 8.625 percent on most taxable items. The county gives New York State 4.375 percent and keeps the remaining 4.25 percent, which it may distribute in several ways including:

•By law, the Suffolk County Water Protection Fund receives a dedicated one-quarter cent (0.25 percent) of sales tax revenue, which goes to sewer rate relief, general tax relief, land acquisition (Suffolk County Environmental Trust Fund) and water quality protection.

•By need, the county may allocate up to 3/8ths of 1 percent (0.00375 percent) to the police district fund.

•New York State keeps 4 percent of its 4.375 percent sales tax from Suffolk County and gives the remaining 0.375 percent to the Metropolitan Transportation Authority. State and federal aid money is received from New York State and the federal government to fund various programs and varies depending upon the program. The total amount varies from year to year.

Real property taxes are imposed on property owners at a rate based on the value of their property. The New York State Property Tax Cap law limits the amount by which local governments and school districts can raise property taxes from one year to the next. Going over this limit (equal to the lesser of 2 percent or the allowable growth factor) requires a 60 percent vote by the government or district.

Another county constraint on the amount of real property taxes is that nearly a century ago the New York State Legislature enacted the Suffolk County Tax Act, which requires that the county general fund use the collected property tax revenue received to make all other taxing jurisdictions within the county (towns, schools, police and other county and noncounty taxing entities) whole even when property owners are delinquent in paying their taxes.

Certain aspects of this tax act create cash flow issues for the county and other local taxing jurisdictions. This problem is currently being reviewed by the Suffolk County Tax Act Study Committee to see what solutions may be possible.

In addition to the taxes on real property the county also collects revenue from real property tax items. These include the revenue on the sale of defaulted properties; interest and penalties on unpaid taxes; and payments in lieu of taxes (PILOTs), which are reimbursements for properties that are off the tax rolls because they are owned by the federal government or exempted for other reasons. These real property tax items sometimes contribute more revenue than real property taxes themselves.

Beyond the various legal constraints mentioned, sales tax and property tax revenues tend to rise and fall with the economy since people spend less in bad times; this can place more burden, relatively speaking, on people with lower incomes. Due to the 2008 Great Recession, sales tax revenues dropped and have not recovered enough to produce sufficient revenue as county expenditures have increased. In 2017 county sales tax receipts grew by 4.28 percent but still came in $2.4 million short of budget projections. Therefore, the county has had to find other ways to generate more revenues.

The county has tried to solve the problem by increasing old fees and imposing new ones. Unfortunately, these new fees have not been enough, and since 2014 the county has had to borrow a total of $166.3 million from the Assessment Stabilization Reserve Fund (ASRF) to make up the shortfall. In 2018, the county must begin paying back the ASRF.

The new federal tax law, which took effect in 2018, may have significant effects on the county economy, thus leading to more uncertainty about budget projections in the coming year.

(Based on information presented in the Review of the 2018 Recommended Operating Budget prepared by the Suffolk County Legislature Budget Review Office.)

Peggy Olness is a board member of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org, email [email protected] or call 631-862-6860.

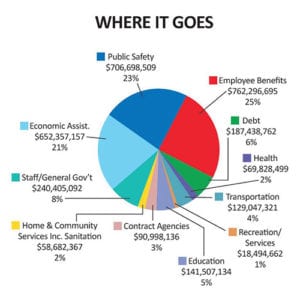

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.