By Talia Amorosano

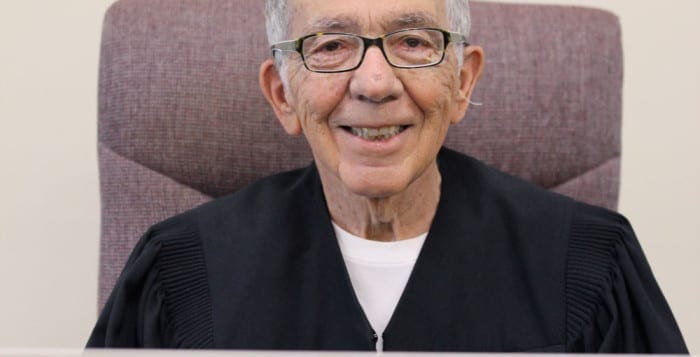

When he entered a seminary at age 14, Port Jefferson Village Justice Peter Graham had no idea he would eventually study law, let alone hold a gavel or ever be referred to as “your honor.”

But after four years of training to become a priest, instead of the voice of God it was the voice of singer Hoagy Carmichael through his bedroom window, delivering a message about “a gal who’s mighty sweet, with big blue eyes and tiny feet,” that resonated with him. It was then that Graham decided to abandon this path in favor of one that did not necessarily encompass what he referred to as “the two Cs”: chastity and celibacy.

He traded in his cassock for textbooks, studying biology and chemistry in college and completing law school.

But instead of heading straight for the courtroom, Graham enlisted in the U.S. Army.

“When I finished law school, I felt that I owed my country two years of my life,” Graham said.

He enlisted as a private and refused to receive a commission.

“For 16 weeks they gave me infantry basic training,” he said. “I ran all day. … On the last day [of basic training], I walked 26 miles alone. I was frustrated.”

Just when things seemed low, an unexpected opportunity arrived in the form of a long plane ride to Germany and a short conversation.

“You went to law school, right?” asked a colonel, according to Graham. Before he knew it, he was declared the district attorney of his battalion. Riding on the reassuring words of the colonel — “Don’t make a mistake” — Graham worked on murder, assault and rape cases and gained real experience in the field he had previously only studied.

A particularly interesting case, the justice said, involved a woman who Graham believes murdered her husband, an Army major. Graham had jurisdiction over the case and tried to get her convicted. However, the Supreme Court eventually ruled it could not convict because the defendant was not enlisted. To this day, Graham does not know what became of her.

Despite that situation, “I learned so much [about law] from being in the Army.”

All these years later, and after spending more than 25 years on Port Jefferson Village’s bench, Graham still practices law and specializes in criminal and civil law. As a village justice, a role to which he was recently re-elected for another term of service, he remains diligent about informing himself of the latest policies and practices.

He also keeps an eye on changes in his community — he emphasized the importance of maintaining an awareness of what’s going on in the area and said doing his job helps to keep him alert to the needs of the people. But he stayed away from patting himself on the back.

“All I do is try to be fair to the people,” he said. “I want to make sure they understand what the charge is and what their alternative is.”

Graham’s ability to make people feel comfortable in the courtroom may have something to do with the friendly treatment he gets in out-of-work environments. He said what is most rewarding about being a village justice is “the respect you see on the street. … I’ve been around so long that people are saying hello to me and I don’t even know who they are.”

In addition to praising his community, Graham spoke highly of his colleagues.

About fellow Justice Jack Riley, Graham said he is on the same page about how to handle people in the courtroom. Of Village Court Clerk Christine Wood, with whom he has worked for almost 11 years, he said,

“She does phenomenal work. … I don’t think she’s ever made a mistake.”

Wood was just as complimentary in return.

“He’s awesome. I’ve actually worked for eight judges and he is one of my top,” she said. “He’s the most caring gentleman, and I don’t say that about many people. He’s got a heart of gold.”

Wood said Graham “goes above and beyond” for his village justice role.

When Graham isn’t working, he enjoys being active around Port Jefferson. Although he won’t play golf “because golf is for old men,” he defined himself as a once-avid tennis player.

“They used to call me the deli man because my shots were always slices.”

He plans to start playing more again in the future, when his elbow feels better.

In addition to the “beautiful tennis courts,” Graham appreciates Port Jefferson’s proximity to the water and its abundance of outdoor activities.

He described his experience living in Port Jefferson and serving as a village justice as “a pleasure.”

“I never ask for an increase [in pay]. Whatever it is, it is, and it’s great.”