By A. Craig Purcell, Esq.

For many people, a first arrest feels like the end of the world. Fear, embarrassment, and uncertainty can overwhelm someone who has never been on the wrong side of the law. But thanks to New York’s new Clean Slate Act, there is now a path for eligible individuals to move beyond their mistakes and work toward a brighter future.

The Clean Slate Act, which took effect on November 16, 2024, automatically seals eligible convictions—misdemeanors after three years and felonies after eight years—if certain conditions are met. This means those convictions will no longer be visible to the general public, including landlords, employers, and educational institutions. However, not all crimes are eligible. Serious offenses, like sex crimes and certain Class A felonies, are excluded. Additionally, sealing does not erase the record entirely; some agencies, such as law enforcement or employers in sensitive industries, will still have access.

While the Act offers a lifeline, it also requires patience. To qualify, a person must stay out of trouble—no new arrests or convictions—and meet other requirements during the waiting period. It could take until 2027 for the state to process all eligible cases, but for those who qualify, the potential benefits are life-changing.

Turning fear Into action

The first question many people ask after an arrest is, “Will this follow me forever?” The Clean Slate Act allows individuals to hope for a fresh start. It is an opportunity to reduce barriers to jobs, housing, and education, but it does not wipe the slate entirely clean. For example, the Act does not restore gun rights or erase the record entirely for government purposes.

The key is to take charge of the situation now. Yes, this moment may feel overwhelming, but it does not have to define your future. The Clean Slate Act is not automatic for everyone, and eligibility depends on what you do from this point forward.

From mistake to opportunity

Many first-time offenders feel stuck in shame and regret. While these emotions are natural, dwelling on them will not help you move forward. Instead, focus on the future. What can you do now to improve your situation?

The Clean Slate Act rewards those who stay on the right track. During the waiting period, you must avoid legal trouble, maintain employment, and contribute positively to your community. While it may take time, the effort is worth it. A sealed record can open doors to better job opportunities, housing, and education.

Other challenges to consider

Even with a sealed record, some barriers remain. For instance, getting licensed in certain professions—like nursing, real estate, or teaching—can still be challenging. The New York State License Guides can help explain what to expect when applying for licenses in various industries. Understanding these challenges now can help you better prepare for the future.

A second chance is within reach

Everyone makes mistakes, but those mistakes do not have to define the rest of your life. The Clean Slate Act is proof that people deserve second chances. It gives hope and opportunity to those willing to take the necessary steps to rebuild their lives.

By focusing on the future, making good choices, and staying committed to personal growth, you can take control of your story. The past may leave its mark, but it does not have to limit your future. With the Clean Slate Act, a fresh start is possible—and within reach.

A. Craig Purcell, Esq. is a partner at the law firm of Glynn Mercep Purcell and Morrison LLP in Setauket and is a former President of the Suffolk County Bar Association and Vice President of the New York State Bar Association.

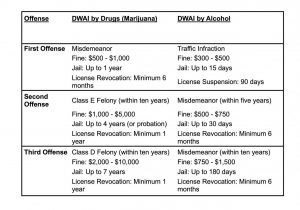

It should be noted that a significant difference between these two offenses is the severity of the above consequences. A DWAI by marijuana conviction results in a criminal record from the first offense, whereas a first-time DWAI by alcohol does not. However, proving impairment due to marijuana can be more complex. Unlike alcohol, where Blood Alcohol Content (BAC) levels provide a straightforward measure of impairment, the presence of drugs like marijuana does not necessarily indicate impairment. The prosecution must demonstrate that the driver’s ability to operate the vehicle was actually impaired. However, there is a movement underfoot to lower the legal BAC limit, which would seriously affect the enforcement, prosecution, and defense of Driving While Intoxicated (DWI) cases. More will be written about this in future articles.

It should be noted that a significant difference between these two offenses is the severity of the above consequences. A DWAI by marijuana conviction results in a criminal record from the first offense, whereas a first-time DWAI by alcohol does not. However, proving impairment due to marijuana can be more complex. Unlike alcohol, where Blood Alcohol Content (BAC) levels provide a straightforward measure of impairment, the presence of drugs like marijuana does not necessarily indicate impairment. The prosecution must demonstrate that the driver’s ability to operate the vehicle was actually impaired. However, there is a movement underfoot to lower the legal BAC limit, which would seriously affect the enforcement, prosecution, and defense of Driving While Intoxicated (DWI) cases. More will be written about this in future articles.

In the ongoing battle against impaired driving, the stakes couldn’t be higher. With potent synthetic drugs flooding into our communities, state legislators are feeling the pressure to modernize existing laws and ensure that those who choose to drive under the influence face appropriate consequences.

In the ongoing battle against impaired driving, the stakes couldn’t be higher. With potent synthetic drugs flooding into our communities, state legislators are feeling the pressure to modernize existing laws and ensure that those who choose to drive under the influence face appropriate consequences.