By Peggy Olness and Nancy Marr

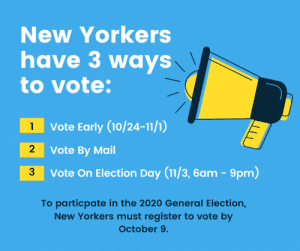

It is said that 90% of Americans have already decided on their choice for President this year. In fact, early voting has already begun in some states (NYS starts on Oct. 24) and absentee ballots have been mailed by county Boards of Elections to those who’ve requested them. The Presidential campaigns have dominated the media for (it seems) a year, while voters barely register their interest on concerns about lower-ballot races and propositions.

All seats in the U.S. House of Representatives are voted on every two years, and Suffolk County voters are either in the 1st, 2nd or 3rd CD. Currently the Democrats have a majority of the 435 voting seats in the House. US Senators are elected for 6-year terms; in 2020 neither of our two senators is facing election. Currently the 100-member Senate has a Republican majority.

New York State’s Senators and Assembly members are all up for election in 2020; the Governor is not. We experienced the use of executive orders for the Governor during the pandemic, but it’s up to the Legislature to codify the laws.

Both the NYS Senate and the NYS Assembly currently have Democratic majorities (historically the NYS Senate had a Republican majority) and have been able to pass a number of laws including voting reform in the past 2 years. Check your NYS Senate and Assembly races and candidates on Vote411.org.

Additionally, there are candidates for NYS Supreme Court, County Court Judges and Family Court Judges on your ballot. Most are cross-endorsed by all major parties; thus they have no opponents. Refer to Vote411.org to find the Judicial candidates on your ballot.

In addition to the races, party lines and candidates, every Suffolk County voter will have 2 resolutions on the reverse/back of your ballot. (Town of Riverhead voters will have a third resolution relating to their Town government). Each resolution statement is written as a question, and you have a choice to vote YES or NO.

The League of Women Voters of Suffolk County is not supporting or opposing any resolution, but will clarify the pros and cons or issues relating to each proposition.

PROP 1: for all Suffolk County voters

Shall Resolution No. 442-2020, adopting a charter law to change the legislative term of office for County legislators from two (2) years to four (4) years be approved?

Details:

The twelve-year term limit for legislators would remain in effect notwithstanding any change in the legislative term of office. If approved by voters, the four-year term of office would begin Jan. 1, 2022 (affecting all 18 Legislators elected on the November 2021 ballot.)

Pros:

■ All other Suffolk County elected officials serve four-year terms.

■ Allows more time for legislators to see projects come to fruition.

■ Frequent periods of campaigning for office and fundraising take time away from legislative issues.

Cons:

■ Frequent elections help to keep legislators accountable.

■ Frequent elections require candidates to hear from citizens more often.

PROP 2: for all Suffolk County voters

Shall Resolution No. 547-2020, adopting a charter law to transfer excess funds in the Sewer Assessment Stabilization Reserve Fund to the Suffolk County Taxpayer Trust Fund and to eliminate the requirement that interfund transfers be made from the General Fund to the Sewer Assessment Stabilization Fund be approved?

Purpose of Resolution 547-2020:

This resolution proposes that funds from the Sewer Assessment Stabilization Reserve Fund (ASRF) be made available to pay county operating expenses. In 1987, county voters passed a quarter cent sales tax to fund the Drinking Water Protection Program (DWPP). The funds have been used for land acquisition, maintenance of water quality and the sewer districts, including current efforts to fund septic systems that can remove nitrogen from waste water. The ASRF Fund 404, which receives 25% of the DWPP tax revenue, was created within the Suffolk County Drinking Water Protection Program to protect taxpayers in sewer districts where there is an increase in costs of more than 3%.

The ASRF ended 2019 with a balance of 35 million dollars. The resolution proposes a Suffolk County Taxpayers Trust Fund be created to receive 15 million dollars of the unspent balance, as well as any other sum that may be transferred to the Trust Fund to balance the county’s operating budget.

The resolution also proposes that a debt of $144,719 million, borrowed from the DWPP since 2011, be canceled so that the funds that are released can be placed in the Trust Fund for use by the county for its operating budget, if so passed by the legislature.

Background:

In September 2020, the New York State Comptroller listed Suffolk County as one of the eight NYS municipalities in significant fiscal stress, stating “since the pandemic hit, local governments have seen a massive drop in sales tax collections. This is hurting their bottom lines and many have few options to plug the hole.” Rather than borrow from other sources that impose interest charges, the county borrowed from the DWPP with the requirement that it pay the amount borrowed back once revenue sources rebounded.

In 2018, 2019, and 2020 the county paid back a total of $26,581 million, leaving $144,719 million outstanding. The County Executive points out that Suffolk has satisfied some of its obligations by already spending $29.4 million for water quality and land acquisition projects, as agreed to in a 2014 settlement, in which he agreed to repayment by 2029.

There is concern that the intent and result of the resolution becoming law, although it deals with a complex issue, is not clearly phrased to the voter. The resolution is contrary to two court decisions. In the Levy lawsuit in 2011 and the settlement by the County Executive in 2014, the county has been ordered to repay the monies borrowed from a fund dedicated to drinking water protection.

Visit the LWVSC website resources page at https://my.lwv.org/new-york/suffolk-county/resources to learn more about Suffolk County finances, the actual legislation behind the propositions and more details on Proposition 2.

Peggy Olness is a board member and Nancy Marr is first vice president of the League of Women Voters of Suffolk County, a nonprofit, nonpartisan organization that encourages the informed and active participation of citizens in government and influences public policy through education and advocacy. For more information, visit www.lwv-suffolkcounty.org or call 631-862-6860.

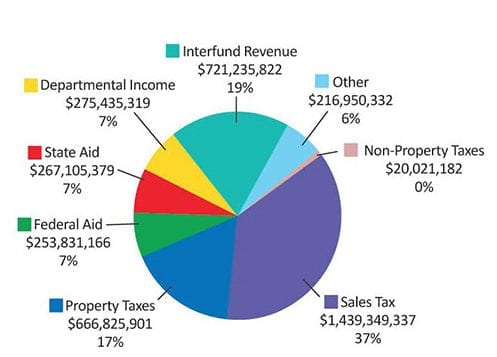

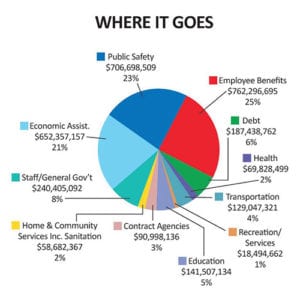

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.

The operating budget generally receives most of the attention because it has the largest impact on our day-to-day lives and the services citizens receive. The operating budget process begins in the spring when the county executive tells the county departments and agencies what he expects the county financial situation will be in the next fiscal year and requests each department/agency head to submit a budget request for the coming fiscal year based on those expectations.