Let’s Talk … Real Estate: The truth about the market

By Michael Ardolino

The beginning of this year has proved to look at more than one factor when predicting the future of real estate. Sellers and buyers have been on the edge of their seats.

National headlines, including “foreclosures” and “recession,” haven’t helped matters. To avoid misconceptions, those wanting to sell or buy a home need to read past headlines for context.

Let’s discuss foreclosures

Earlier in the pandemic, people were eligible for a forbearance program for coronavirus-related financial hardships. The federal program allowed property owners going through a difficult time to request a pause or reduction of their mortgage payments from their lenders. It provided an opportunity for many to get back on their feet.

Experts are finding that many who took advantage of this plan could catch up on their payments or restructure their loans, making it easier for them to make payments again.

Mortgage Bankers Association findings show that 36% of loans upon exiting the forbearance program were paid in full, 44.6% were repayment plans and 18.4% of mortgage holders still had problems.

For the homeowners who had enough equity to sell their homes, the real estate market has quickly absorbed the new listings because inventory is low and demand still remains high.

Recession doesn’t equal housing crisis

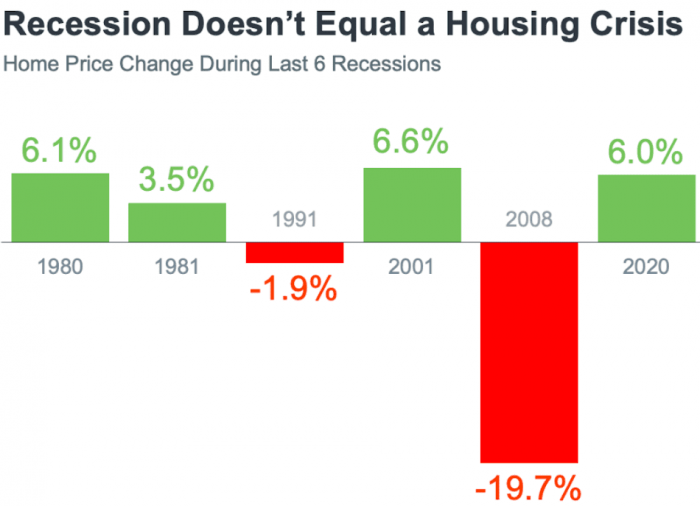

When some people hear “recession,” they think if there’s a housing bubble it will be ready to pop. Looking back at 2008, I can understand the concerns. Interestingly, there have been half a dozen recessions since 1980, and homes have appreciated four times and only twice depreciated. (See the chart in my ad in Arts & Lifestyles)

The data proves that a slow economy doesn’t necessarily mean home values fall.

I mentioned in past columns that this time around, as homes appreciated and the trend continued, we were in better condition than 2008 when a high percentage of borrowers were defaulting on their subprime mortgages.

Those mortgages were easier to get than they are today, and the banking industry learned from its mistake. Banks are looking for buyers with credit scores on the high side who can afford a solid down payment. Also, homeowners who refinance must maintain 20% equity, which wasn’t the case in 2008 and led to property values falling to a point where the owner had a higher principal than what their house was worth.

Takeaway

Timing is everything. There’s no need to panic even if the economy isn’t ideal. With a little research, you can find the best time for you to sell or buy a home.

So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA.