By Michael Ardolino

So far, there is much less inventory on the market for the first quarter of the new year than originally predicted. What this means for sellers is less competition than previously anticipated and a higher chance of selling your home for top dollar. Inventory is not easily predicted accurately, so sellers should continuously watch inventory levels and make decisions based on current facts and statistics.

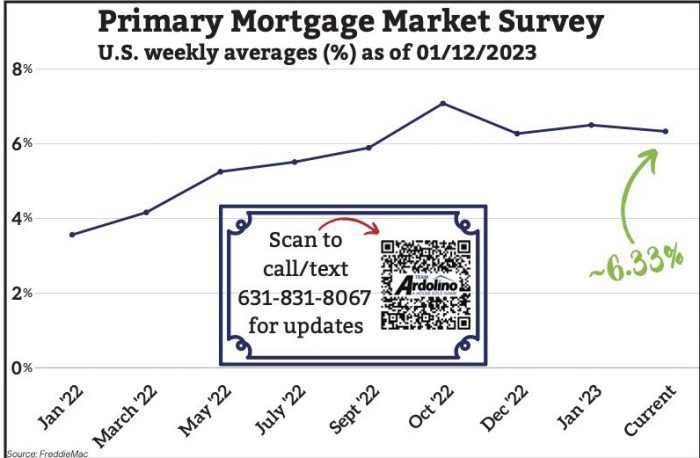

As for buyers, it’s also savvy to focus on mortgage rates. The year 2022 showed a clear positive correlation — meaning variables or values that travel in the same direction — between inventory and mortgage rates. When mortgage rates changed, so did inventory. Rates are nearly double what they were this time last year, and it’s clear that has affected inventory. (See graph above). The great news is these rates are still very low (especially compared to rates in the 7% range last October), competition is softer among buyers versus January 2022, and there are still options to buy.

According to Mike Simonsen at Altos Research, “the data doesn’t say ‘wait for an influx of homes.” He goes on to explain there is more inventory than this time last year, so buyers now have more options. There is no concrete evidence that supports the idea that a sudden wave of inventory is hitting the market. With fluctuating mortgage rates, taking advantage of the current market is strongly recommended.

Job market affects housing market

According to The New York Times’ December Job Report, several fields, such as medical, retail, construction, etc., generated job growth. “Employers added 223,000 jobs in December, the Labor Department reported.” Unemployment stands at 3.5%, proving stability and a healthy workforce.

Lydia DePillis at The New York Times states, “layoffs and initial claims for unemployment insurance have remained extremely low, while the gap between the number of available workers and listed jobs is far larger than its historical average,” meaning less available, or unemployed workers in a time of high employee demand. Jobs added to the market and current decrease in unemployment will lead to more potential homebuyers, especially with many looking to buy instead of rent.

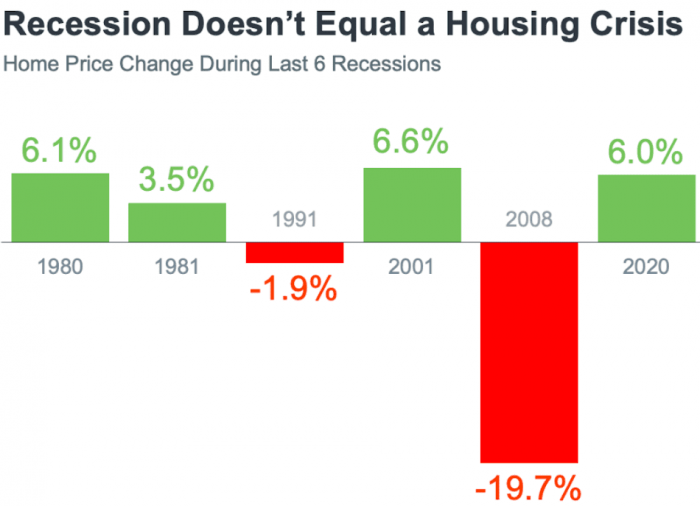

I’ve mentioned in previous articles the “shining star” of real estate is equity. Property ownership is one of the greatest hedges against inflation and can be tapped into in cases of emergencies. Since data of our local real estate market does not show price depreciation in the near future, purchasing a home now will build your equity and will provide a sizable return on investment (ROI) when you resell.

Takeaway

Right now is still an excellent opportunity to put your home on the market, and things are looking up for buyers as well. Sellers should take advantage of the current low inventory levels, and both sellers and buyers should take advantage of historically low mortgage rates and a strong job market. Equity in real estate is an excellent financial hedge, and locally appreciating homes will increase your ROI in a future resale. So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA