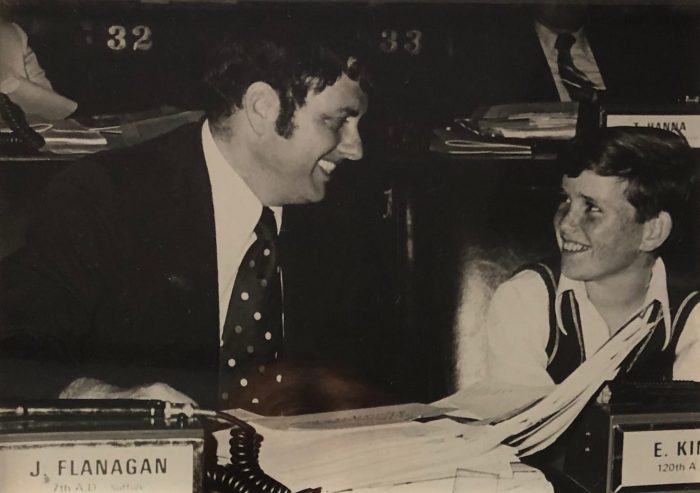

New York recently ended its 48-year streak of having a John Flanagan representative in the State Assembly or Senate.

“I thought about him when I was fighting for school aid for the entire state.”

John Flanagan Jr. retired from public service June 28, after spending 16 years in the Assembly and 18 years in the Senate, which included three years as Senate majority leader. When his political career began, Flanagan Jr. succeeded his father, John Flanagan, who served for 14 years in the state Assembly until 1986.

The younger Flanagan was 25 years old when his father died. Within a week of his father’s death, Flanagan, who, like his father is a Republican, was campaigning for his seat in the Assembly.

“It was a whirlwind of a time,” Flanagan said. “If my father had died a week later, based on what the law was, he would have been on the ballot as someone who was deceased.”

When he started campaigning, he was attending law school at night. When he won the election, he was sworn in in January and got married 10 days later.

Flanagan attributes his ability to stay grounded and deal with all the changes in his life at the beginning of his political career to a collection of people who loved his father and supported and guided him.

Throughout his over three decades in public service, Flanagan often thought of his father, who he describes as his “hero. If I’m going to be like anyone, I wanted to be like him.”

Flanagan sees similarities in their approach to public service, which is something his father and mother emphasized when he was young.

Both Flanagans were passionate believers in education. The senior Flanagan was a teacher for 10 years, while his son chaired an education committee.

“I thought about him when I was fighting for school aid for the entire state,” Flanagan said.

They also shared a commitment to swift and consistent justice for criminals and advocating for victims’ rights.

The younger Flanagan, who is 59 and is a divorced father of three, said he still has energy left in the tank and is eager to embrace his new role as vice president for government affairs at Northwell Health.

“I didn’t leave after 33½ years so I could go back,” Flanagan said.

He is, however, allowed to interact with state agencies and to work locally to help build the brand name in Suffolk County.

As for his work in the Legislature, Flanagan is proud of his efforts on behalf of people who live in group homes, which are, as he put it, “public policy issues that won’t always be on the front page” but are important.

Flanagan felt that taking care of children with special needs was the “ultimate reflection of who we were as a state.”

As a public servant, he felt it was his responsibility to help people feel that the government is there for them and is operating on their behalf.

He is “extraordinarily proud” of the work he did in education, where he felt the need to advocate for children across the state. He said he was “not afraid to mix it up” on anything, in rural, upstate, downstate, urban, suburban or other areas.

Flanagan is also pleased with the work he did to encourage organ donations through Lauren’s Law, which required the New York State Department of Motor Vehicles to ask anyone applying for a license to answer the question of whether they would like to be an organ donor.

“There’s not enough legitimate discourse on things the way they should be.”

“We have a lot more work to do and a lot further to go,” Flanagan said. “That’s something I’m going to continue to work on in my new endeavor.”

The greatest part of his political career, he said, was the people. He appreciated meeting the direct care workers, the hospice care workers and the staff with whom he felt privileged to work.

The part he misses the least is the backbiting and not having people always be honest and forthright with him.

While he has seen a collection of people who have left political office in the last few years, he said he can only speak for his retirement.

“Social media and changes in technology have made the economy better, [but] it’s a sound bite world of the highest order,” he said. “There’s not enough legitimate discourse on things the way they should be.”

He also said he doesn’t miss the drives to Albany, which he did for so many years that he’s convinced he went at least a million miles.

Before he left office, he walked around the state capitol, where he took in the architecture and made videos of pictures and paintings and narrated a description he “wanted to share with my family.”

While he said he’s going to miss 90 percent of his working life, he appreciated the joy of being “in the game. Doing the stuff I did, I felt like I was playing for the Yankees and I was in the playoffs. I got to be the majority leader.”

To those who believe he left because the Republicans lost the majority, he says that isn’t the case. He felt like he had a “very good run” and wanted to do other things. He considers himself a part of a select and small group of people who served in the Legislature, in both houses, and who became the majority leader.

He prides himself on his ability to work with so many people and on his consistency.

“I didn’t change my stripes,” he said.

He said he went public with his battle with sobriety. He appreciates the support of people who stood with and by him through those challenges. The low point of checking into rehab also helped bring him to a higher point in his life and career, he said.

Flanagan wanted to ensure that every child, no matter what their community, demographic, background and history had the same opportunities his children had.

Children with special needs have an Individual Education Program, which provides a personalized plan for their specific strengths.

“If education is being done properly, every child should have an IEP,” Flanagan said.

He is pleased with the work he did with Sen. Ken LaValle (R-Port Jefferson), who is also retiring this December, to secure millions of dollars for programs at Stony Brook University.

As for modern politics, Flanagan has mixed feelings about President Donald Trump (R).

“I wish he weren’t on Twitter,” Flanagan said. “He’s done strong things for the economy all across the country. The dialog on both sides should be at a better level.”

Flanagan, who earned his bachelor’s degree from the College of William & Mary and his law degree from Touro Law School, tried never to engage in insults.

“People have a right to expect from elected officials, whether trustees or school board members, to act a certain way,” he said.

“People have a right to expect from elected officials, whether trustees or school board members, to act a certain way.”

When he texts, Flanagan uses full sentences, correct grammar and punctuation and doesn’t use emojis. He believes politicians should use the English language to the greatest effect and to serve as educational role models for their constituents.

Flanagan is a fan of Chairman of the Suffolk County GOP Jesse Garcia, who has “done a great job of being a standard bearer for the party.”

Flanagan mentioned the Town of Babylon supervisor and chair of the county Democratic committee Rich Schaffer as one of his favorite Democrats.

“He and I don’t have to agree,” Flanagan said. “I respect who he is, his work ethic and his experience.”

In his office, Flanagan kept a a 2×7-inch placard that was in his house and also in his father’s office. It read: “God so loved the world that he didn’t send the committee.”

Flanagan said he believes that the saying suggests that “we have a tendency to overcomplicate things.”

For the current public servants just starting their political careers, Flanagan urged them to “be who you are. Do not forget the people you represent. They are the ones who are your bosses. Never lose sight of who you should be representing.”

![5 IMG_7930[1]](https://tbrnewsmedia.com/wp-content/uploads/2019/02/5-IMG_79301-700x357.jpg)