By Michael Ardolino

The market is shifting; sellers and buyers will still see home price appreciation and gains in their equity.

How does the shift affect home prices?

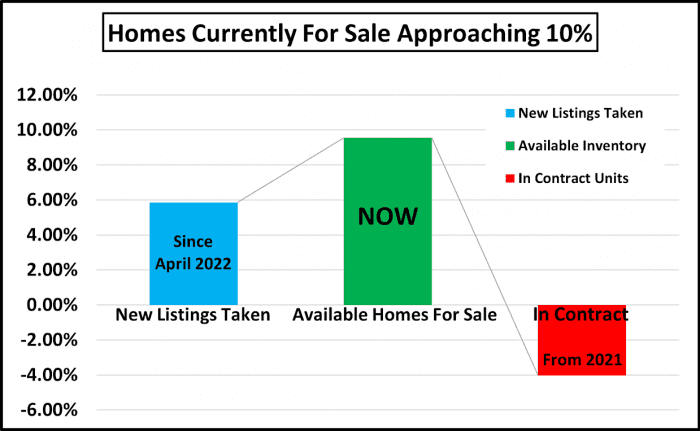

Demand remains higher than supply, so home prices are appreciating, and sellers will still get a good amount of offers even if it takes a bit longer. In Suffolk County, houses appreciated nearly 10% and higher since last year and more than 50% got over the asking price. Sellers are still making a significant profit.

The steep incline of market values and buyer rush is now pacing itself and most experts predict the appreciation will continue. David Ramsey, a personal finance personality, says, “The root issue of what drives house prices almost always is supply and demand…” and we couldn’t agree more. When priced correctly, houses are still selling at record-high prices and low days on the market.

Certainty of equity

One certainty in a time of uncertainty, mixed news, and mixed predictions, is the value of equity in real estate. According to CoreLogic’s 2022 Q2 Home Equity Report, “the total average equity per borrower has now reached almost $300,000, the highest in the data series.”

The year-over-year equity percentage for U.S. homeowners with a mortgage has increased 27.8%; this is a $60.2K average equity gain.

Selma Hepp, interim lead of the Office of the Chief Economist, CoreLogic, stated “For many households, home equity is the only source of wealth creation. As a result, recent record gains in equity and record declines in loan-to-value ratios will provide many owners with a financial buffer in case economic conditions worsen. In addition, record equity continues to provide fuel for housing demand, particularly if households are relocating to more affordable areas.”

Equity builds long-term wealth gain for homeowners, and should you want access to additional funds, you can always rely on the equity you’ve grown. In times of financial uncertainty, follow the certain.

The shining star

Sellers, as your home value has appreciated considerably, tap into the profit from your equity and take advantage of the current market conditions. Timing is everything and ask your local real estate professional to help you research the area you’re looking to move. Your real estate agent can also help you connect with a professional in that location with expertise in their market conditions.

Homebuyers are future sellers, and they can feel confident to invest in a home now and build their own equity knowing price appreciation is forecasted. When a homebuyer becomes a seller, they’ve already paid off some of their mortgage and can take advantage of the real estate market at the time and come out with a significant profit themselves.

Takeaway

So, the shining star of the market is demand still predominates supply. Home price appreciation is still forecasted, and equity gains are at record-highs. A market shift can be easily navigable with the help of a real estate professional. So … let’s talk.

Michael Ardolino is the Founder/Owner-Broker of Realty Connect USA.