When the initial impact of the coronavirus pandemic truly hit home back in March, after businesses were forced closed from state mandates, many turned to their insurance providers and filed for business interruption insurance, which they expected would be used for just this sort of occasion.

Only many received notifications back that their claims were denied. The reason: Insurance companies put in provisions within their policies that excluded coverage due to damages “caused by or resulting from any virus, bacterium or other microorganism that induced or is capable of including physical distress, illness or disease,” according to the Insurance Services Office, an insurance advisory organization.

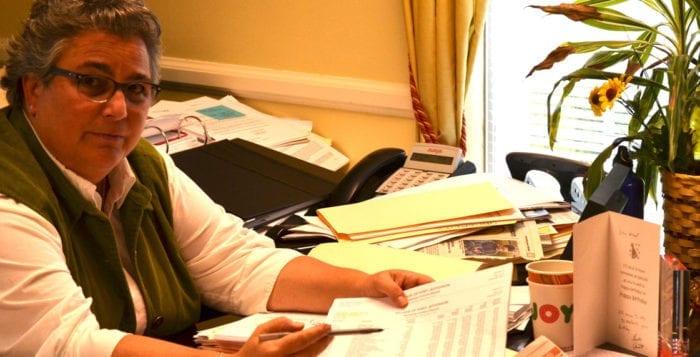

Though business owners and small business advocates such as The Ward Melville Heritage Organization President Gloria Rocchio pay the premiums year after year, she said they and so many others were denied coverage despite the fact that small businesses didn’t close because they or their shops were confirmed with the virus, but government orders forced them to close.

“Very simplistically, [business owners] buy themselves a job for the community, and now they’re made to lay off people, keep their business closed, pay all fixed overheads and maybe they don’t have a reserve at home,” Rocchio said. “Everything the government is putting forth is not helping the small businessman — the one who doesn’t have a million in the bank and is paying fixed expenses.”

Efforts on Local and State Levels

The provision in many insurance policies was instituted little less than two decades ago after the severe acute respiratory syndrome, or SARS, epidemic of the early 2000s. It is only now, almost 20 years later, that owners filing claims learn of the provision despite them having paid premiums for years.

There is a combined bill in the New York State Assembly and Senate to require companies to accept current interruption claims.

WMHO submitted a public letter to Gov. Andrew Cuomo (D) April 22 requesting he supports the Assembly and Senate bill.

“What we’re saying is to do business in our state, we in the state government do have the power to make sure contracts are fair and equitable.”

— Steve Englebright

“An insurance policy is a contract between the insured and the insurer that clearly spells out those conditions covered and excluded,” the letter reads. “In recent years, because of severe losses, insurers have added exclusions to their policies, slowly diminishing the very purpose of insurance.”

The state Assembly bill is being sponsored in part by Assemblyman Steve Englebright (D-Setauket) and Fred Thiele (I-Sag Harbor), and there is a concurrent bill in the state Senate. It would require insurance agencies to cover businesses during the COVID-19 pandemic, and would renew any policy that would have covered businesses during shutdown if they expired in the meantime. New York is just one state of seven which is proposing bills to mandate coverage.

“Insurance is controlling risk, that’s what insurance companies do,” Englebright said. “What we’re saying is risk transfer needs to occur with this type of policy in a more predictable manner and a more eligible manner than the fine print currently allows.”

The bill is still in the Assembly Insurance Committee, but Englebright, a ranking assemblyman, said it is picking up widespread support in the Democratic-controlled state Legislature.

He added he does not believe what insurance companies say when they argue accepting businesses claims would bankrupt their agencies.

“What we’re saying is to do business in our state, we in the state government do have the power to make sure contracts are fair and equitable,” Englebright said.

Multiple local government and industry groups have come out in support of such a bill. The Long Island Builders Institute released a letter supporting the legislation, saying that if a business has been paying for its insurance, it should honor the claims.

Mitch Pally, CEO of LIBI, said the insurance companies denying these claims will only create a deeper hole in the economy, which will be an even greater burden to the insurance companies if they go under and no longer can pay their premiums. He also predicted dire consequences to many businesses if claims continue to be denied by June 30 “because the people who bought them didn’t assume their business can be interrupted by something that doesn’t apply [to the insurance].”

The Brookhaven Town Board and Supervisor Ed Romaine (R) also signed a letter asking Cuomo to throw his support behind the bills.

Federal Efforts

There is a bill currently lingering in the U.S. House of Representatives Committee on Financial Services, co-sponsored by Rep. Tom Suozzi (D-NY3) that would require insurance companies in the future from denying company’s claims based on a pandemic, but even that has seen “tremendous pushback from the insurance industry,” he said during a Zoom call hosted by Discover Long Island May 19. “It’s very controversial — I’m getting the crap kicked out of me by certain people.”

Suozzi, who was appointed by President Donald Trump (R) to the economic reopening task force, said he did not believe anything regarding interruption insurance will see the light of day in some of the large stimulus bills Congress is currently working on.

Some policyholders nationwide have sued their insurance companies for denying their claims. A barbershop owner in San Diego has created a class action lawsuit against his policyholder, Farmers Insurance Group, for denying his claim under such virus damages provisions. Several other class-action lawsuits have been filed in the past month and a half against several other insurance companies.

Though such lawsuits take months if not years to get going, and especially with many court systems largely shut down from the pandemic, it will be a while before any cases see a judge.

“By the time those lawsuits get done, those businesses will be out of business,” Pally said.

Insurance Providers Respond

The American Property Casualty Insurance Association has said if governments required the companies process these claims, it would mean companies would have to process over 30 million businesses suffering from COVID-19-related losses. APCIA President David Sampson was quoted on Twitter saying requiring so would “significantly undermine” their abilities to cover such things as wind damage, fire or other losses.

The industry as a whole currently sits on an $800 billion surplus, according to the National Association of Insurance Commissioners. That business group released a report May 15 with statements from 50 experts from the Wisconsin School of Business insurance panel that if local governments force insurance companies to accept the claims, it will “threaten the solvency of the insurance industry.” Though the report is sponsored by the association through its independent research division, most experts on the panel largely agreed the private marketplace could not handle all the losses with the current surplus in the industry.

“By the time those lawsuits get done, those businesses will be out of business.”

— Mitch Pally

Though in that same study, some experts, 13 percent of the 50, argued the industry could be able to handle the claims, depending on how federal legislation was enacted.

Industry lobbyists have said the federal government should be providing help, but one example of small business aid, the Paycheck Protection Program, which was supposed to help keep many small shops in business, has been mired in problems since its inception, and many owners are simply refusing to use the funds fearing they will have to pay back the money long term as a loan.

The Washington Post reported last month that insurance associations and business groups are hiring lobbyists specifically to play out this fight in Washington, D.C.

What some are hoping for is some kind of middle ground, a place where insurers and the federal government’s interests meet. One suggested draft bill, the Pandemic Risk Insurance Act of 2020, would pay agencies losses when those exceed $250 million and capped at $500 billion over the calendar year, though that bill would only cover future pandemics, and more insurance companies have come out saying it should be the federal government which needs to handle such calls for aid, according to The Wall Street Journal.

Suozzi said he agreed most insurance companies would be “wiped out” trying to cover interruption claims during the pandemic, but also put stock in a public-private partnership, including the possibility of using the infrastructure of the insurance industries to funnel money back into these businesses.

“The bottom line is there’s no relief right now — it’s not going to solve anybody’s problems right now — and I don’t want anybody to get their hopes up,” the congressman said. “But it’s something I’m conscious of and other people are working on it — we just don’t know what the right answer is yet to get it done, because there is so much incredible pushback from the other side.”

In the meantime, Pally said it’s best for businesses to continue writing their state and federal officials. Rocchio suggested that owners, despite the fact some agencies are advising not to bother to file a claim, should apply anyway should anything change in the near future.