The committee’s title sounds like something out of a science fiction movie, but Brookhaven Town’s plan to streamline government services is nonfiction and slated for the nearer future than a galaxy far, far away.

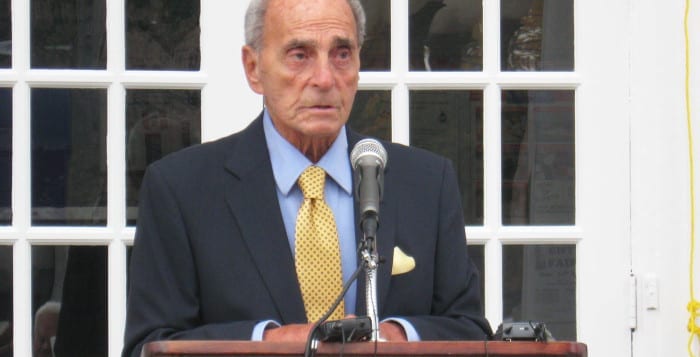

Brookhaven Town hall was the setting for the inaugural Council of Governments Committee meeting, a congregation of representatives from across the town’s villages, ambulance and fire, school and library districts Oct. 10. The leaders came together to begin brainstorming strategies to make government more efficient by sharing services with the goal of reducing costs for their mutual taxpayers. The meeting was hosted by Brookhaven Supervisor Ed Romaine (R) and was attended by representatives from the Villages of Belle Terre, Shoreham and Port Jefferson; Setauket Fire District; Port Jefferson EMS; Comsewogue, Port Jefferson, Emma S. Clark, and Middle Country libraries; and Shoreham-Wading River, Comsewogue, Port Jefferson and Rocky Point school districts among many others.

Brookhaven was recently awarded a $20 million Municipal Consolidation and Efficiency Competition grant by New York State, which will go toward modernizing and reinventing the delivery of services while reducing the burden on taxpayers by reducing redundancy in local governments, pursuing opportunities for increasing shared services, and implementing modernizations and best practices, according to a town press release. The committee will be charged with implementing the changes and identifying additional areas for efficiency and fiscal savings, as well as providing oversight of the 16 MCEC projects.

“We’re interested today in talking about what we can do jointly for our mutual constituents to improve the delivery of services, to reduce costs, to share services whenever possible — to do the things that are going to move this town, your school district, your village, your taxing district forward so that our mutual constituents benefit from this,” Romaine said. “I think this is an opportunity for us to redesign how we do things. This is one opportunity where we can reach across jurisdictional lines and say we’re all in this together.”

Engineering firm Laberge Group has served as a consultant for the town’s municipal consolidation plans, and representatives Ben Syden and Nicole Allen were on hand at the committee meeting to update the attendees on the status of some of the projects already underway.

“A year and a half ago, we asked for your hope, we asked for you to say, ‘yup, I may be interested in doing this,’” Syden said during the meeting. “Now, we have pilots, we have examples and now we want to deploy this townwide.”

The projects will be implemented over a span of two to three years, according to Syden, and the full implementation of the projects is expected to save more than $60 million collectively amongst the taxing districts over five years.

The dissolution of the Village of Mastic Beach and reincorporation into the town, the consolidation of 24 of the town’s 112 special districts including four water districts into the Suffolk County Water Authority and six erosion control districts consolidated into one are among the already completed projects undertaken as part of the MCEC project. Upcoming projects include the consolidation of property tax collection and processing systems with several villages including Port Jefferson and Shoreham, construction of a regional salt storage facility, purchase of regional specialized fleet equipment, expansion of single-stream recycling waste management services to six special districts throughout the town and many more.