By Linda Toga

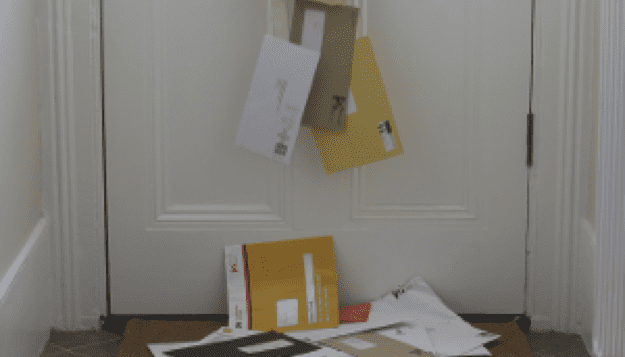

THE FACTS: My elderly aunt never married and is living alone. During my recent visits with her, it has become evident that she cannot continue to live independently. She is not bathing regularly, there does not appear to be much food in the house, some of the food is past its prime and the mail is piling up. The last time I was there, my aunt told me that she “helped” out one of my cousins who had called saying he was in jail and needed money to make bail. Apparently my aunt was the target of a scam. Clearly she needs someone to handle her finances. Unfortunately, there are no family members in a position to take care of my aunt and she never signed a power of attorney or health care proxy.

THE QUESTIONS: Is commencing a guardianship proceeding a good idea? What happens if there are no family members or friends who can serve as guardian?

THE ANSWER: Although every situation is different, from what you have told me, commencing a guardianship proceeding is not only a good idea but the best way to proceed. Generally the appointment of a guardian is appropriate when it appears that a person is likely to suffer harm because she cannot provide for her personal and property needs and cannot understand and appreciate the nature of her functional limitations. Your aunt will likely suffer harm if she continues to ignore her personal needs. The fact that she was an easy target for a scam artist and that she is not dealing with her mail suggest strongly that she does not understand her own limitations.

HOW IT WORKS: Although not all people who need a guardian need assistance with personal care and property management, it appears that your aunt does need a guardian of her person and her property. A guardian of her person may have the authority to make decisions about your aunt’s living arrangements, medical treatment and procedures and day-to-day decisions about her care. A guardian of her property may make decisions about her assets, may handle her finances and may, with court approval, apply for government benefits or engage in estate planning on your aunt’s behalf.

A guardianship proceeding is commenced by filing a petition with the court seeking the appointment of the guardian. The petition is filed along with an Order to Show Cause (OSC) that essentially advises your aunt, as well as other interested parties, that a hearing will take place before a judge to determine if your aunt lacks the capacity such that the appointment of a guardian is appropriate.

In the petition you will need to provide evidence of your aunt’s limitations and examples of things she has done or things she fails to do that could result in harm. The court needs to know about your aunt’s living situation, her medical conditions and medications she may be taking, her assets and income, among other things.

If there is someone who is willing to serve as guardian, the court should be provided with that person’s contact information and an explanation as to why he/she may be the right person to care for your aunt. If the petition does not identify a potential guardian, and the court determines that a guardian is needed, one will be appointed from a list of trained individuals.

Once the proper paperwork has been filed with the court and served upon all interested parties, the court will set the date for the hearing and will appoint a court evaluator who acts as the eyes and ears of the court. The court may also appoint an attorney to represent your aunt in the proceeding.

The court evaluator will meet with your aunt to evaluate her ability to make decisions about her personal care and financial affairs. The evaluator may also speak to you and other family members, health care providers and others in an effort to learn more about your aunt’s situation. The evaluator will then prepare a report for the court that includes the evaluator’s recommendation with respect to the appointment of a guardian and his/her opinion as to whether your aunt should be present for the hearing to be conducted by the court.

After hearing testimony from you, the court evaluator, your aunt and other interested parties with personal knowledge of your aunt’s situation, the court will decide if the appointment of a guardian is appropriate. If your aunt is found to be incapacitated and a guardian is appointed, the court will explicitly state what types of decisions can be made by the guardian. The guardian will be required to complete a guardian training course and, depending on the value of your aunt’s assets, may be required to post a bond. In addition to visiting your aunt at least four times a year and making decisions on your aunt’s behalf, the guardian will be required to file annual reports detailing all financial activity and updating the court on your aunt’s condition.

Although the time between filing the petition and the hearing is supposed to be about one month, delays are common and, even after the hearing is completed, there is considerable time and effort required before the appointed guardian is actually in place and authorized to serve.

In addition to the time and effort associated with a guardianship proceeding, there are significant costs involved in having a guardian appointed, including payment to the court evaluator and any court-appointed attorney. In your aunt’s case, these costs may have been avoided if your aunt had engaged in estate planning and had a properly drafted power of attorney and health care proxy and/or trust in place. If you decide to pursue the appointment of a guardian for your aunt, be sure to retain an attorney with experience in the guardianship part so that the process will be handled properly and expeditiously.

Linda M. Toga, Esq. provides legal services in the areas of estate planning, probate, estate administration, litigation, wills, trusts, small business services and real estate from her East Setauket office.

Another way the paternity of a child born out of wedlock can be established is through an Order of Filiation. A proceeding to establish paternity may be brought in Family Court by the mother of the child, a person claiming to be the father, the child or the child’s guardian. Assuming adequate proof is submitted to the court, an order will be issued setting forth the relationship between the father and the child. Just as there is a 60-day period during which the paternity acknowledgment can be rescinded, the court has 60 days in which to vacate an Order of Filiation before it is deemed conclusive evidence of paternity.

Another way the paternity of a child born out of wedlock can be established is through an Order of Filiation. A proceeding to establish paternity may be brought in Family Court by the mother of the child, a person claiming to be the father, the child or the child’s guardian. Assuming adequate proof is submitted to the court, an order will be issued setting forth the relationship between the father and the child. Just as there is a 60-day period during which the paternity acknowledgment can be rescinded, the court has 60 days in which to vacate an Order of Filiation before it is deemed conclusive evidence of paternity.