Local elected officials are joining forces to tell Albany that their towns and villages will not lose zoning control.

During her State of the State address, Gov. Kathy Hochul (D) spoke of creating more affordable housing options. When the 2022 State of the State book was released, the proposed plan, found on pages 130 through 131, stated that it would require all towns and villages in New York state to allow accessory apartments, which in turn would effectively eliminate single-family zoning laws.

The proposed plan spurred Town of Brookhaven officials to call a press conference Feb. 3, while others have spoken out via statements. The proposed legislation would require municipalities to allow one accessory dwelling unit using backyard cottages, attics, garages and basements. The plan is one that the State of the State describes as providing “an affordable multigenerational housing option that helps families live closer together.”

While local municipalities would still have a say in minimum and maximum size requirements, local zoning authorities would not be able to prevent reasonable new construction, the governor said.

Huntington

In the Town of Huntington, accessory apartments may be allowed when someone listed on the deed resides at the dwelling. The living space cannot be less than 300 square feet or more than 650 square feet and must have two bedrooms or less. The accessory apartment must be attached to the home.

Supervisor Ed Smyth (R) is against Hochul’s plan.

“This is an election year overreach by the governor that no one in their right mind should support,” Smyth said. “It has bipartisan opposition at all levels of government for good reason: It would eliminate local control of development and hand it off to extremists in Albany.”

At press time, Huntington announced they would be part of a county press conference on Feb. 10 to comment further on the issue.

Smithtown

In the Town of Smithtown legal accessory apartments with a valid mother/daughter permit from the Building Department are the only ones permitted with limited exceptions including older two-family homes that were grandfathered in. Rules differ in the town’s villages.

Town of Smithtown Supervisor Ed Wehrheim (R) said in a statement he fears stripping local zoning control “would only result in a mass exodus.”

“The harsh reality is that Long Island, especially Suffolk County, lacks the modern infrastructure to handle the population increase which this proposal would create,” the supervisor said. “The environmental impacts alone should terrify every Long Islander. We have outdated wastewater systems underground, roads in major need of repair, archaic stormwater infrastructure and in the near future will have nowhere to put our trash. These are the issues that require resolution from the state, not removing local zoning control. This proposal will create a strain on the school system, increased property taxes, amplify traffic and burden local resources which are already stressed. Furthermore, people move out to the suburbs because the perception of the American Dream is still that quaint neighborhood home, picket fence and all, where they can raise a family. As public servants, it’s our duty to preserve and protect that dream.”

In Head of the Harbor, Mayor Doug Dahlgard echoed the sentiments.

“Taking away local zoning control with a broad brush is not acceptable and will be met by opposition claiming the character of our communities will change for the worse,” the mayor said. “Starting a conversation about how to allow generations of a family to stay together on Long Island, on the other hand, makes sense.”

Wehrheim agreed that the issue of affordable housing needs to be discussed and would welcome a task force consisting of local, county and state officials using proven studies and incorporating successful methods that could create affordable housing options in appropriate areas such as a downtown business neighborhood near a train station.

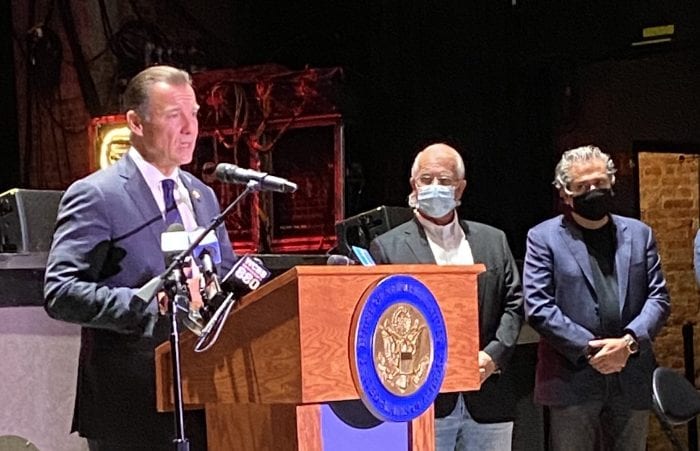

Congressmen support local officials

Town officials have received moral support from their congressmen. U.S. Rep. Tom Suozzi (D-NY3) in a press release criticized Hochul. Suozzi will run in the Democratic primary for governor in June against Hochul

“Governor Hochul’s radical proposal would take away zoning control from municipal governments, erode local government authority and end single-family housing across New York,” Suozzi said. “Hochul’s plan to eliminate home rule is not what we need. I support affordable housing, building up around downtown train stations and helping the homeless. I oppose eliminating home rule and ending single-family housing.”

The presumptive Republican nominee for New York State governor, U.S. Rep. Lee Zeldin (R-NY1) said in a joint statement with Brookhaven officials that Hochul “isn’t focused on real solutions.”

“This blatant attack on suburban communities will end single-family housing as we know it, strip local control away from the New Yorkers who live there, tank the value of their homes, overcrowd their previously quiet streets, and on top of it all, not do anything to solve our affordable housing problem,” Zeldin said.