By Victoria Espinoza

Huntington residents rallied behind the Grateful Paw Cat Shelter, of East Northport, this week after the Huntington Town Board announced it was evicting the shelter for failing to notify the board it had lost its 501(c)(3) not-for-profit in 2015.

Town Attorney Cindy Mangano addressed the public before the speakers began at the board meeting Tuesday, June 13, summarizing how the shelter, run by the League for Animal Protection and served exclusively by volunteers had taken this turn. She said the shelter was notified April 20 by the town to evacuate their Deposit Road establishment within 90 days due to losing their nonprofit status and violating federal and state law.

“In April, everybody here knows it’s time to file your tax returns or seek an extension,” Mangano said. “Charitable not-for-profit organizations must do the same thing. Earlier this year my office sat with Debbie Larkin, the president of LAP, and we were in the process of drafting a new agreement when we learned that a resident had incurred a penalty from the IRS for claiming a tax deduction for a donation to LAP.”

“I’m a cat lover, but five years without a filing, and it was known and the town was not told. I personally don’t have confidence in the league anymore to go forward when they knew the situation existed.”

— Frank Petrone

Mangano said the shelter had actually lost its not-for-profit status in 2015, but never advised the town, which was a breach in their original contractual agreement with the town. According to the town attorney, the LAP lost its charitable status because they did not file paperwork in time with the IRS and the New York State Attorney General’s Charities Bureau office.

“When this came to my attention I scheduled a meeting with Ms. Larkin,” Mangano said. “She told us she knew but she failed to advise us of this fact. So I cannot in counsel to this board advise the board to enter into a new agreement with an organization that as we speak has violated its agreement with the town and is in violation of federal and state laws.”

Residents flocked to the podium to defend the shelter and its contribution to the Huntington community.

“I’m here today to appeal to the town’s decision,” Sharlene Turner, who has adopted many cats from the shelter, said. “Please give the league a renewed opportunity to prove itself.”

Turner suggested setting up strict guidelines and rules moving forward. She commended the dedication of the volunteer staff for providing a safe and warm environment for the animals.

“All volunteers know each cat by name,” she said. “They know their personalities and the relationship a cat has with every other friend in the shelter.

Donna Fitzhugh has been a volunteer at the shelter since 1989.

“I have volunteered over 3,000 hours,” she said. “As you can tell I love working with LAP and volunteering my time and energy to this very worthy organization that has been serving this community for over 43 years. Yes we screwed up, something happened, and we want to rectify this — we do not want to leave. We want to stay and serve the residents of the Town of Huntington.”

Haley Shore, an 11-year-old who donned cat ears at the meeting, said she’s been volunteering at the shelter for about seven years.

“When I heard the news Huntington was going to possibly close the shelter, I was devastated,” she said. “The shelter has become my second home. But this is not about me, it’s about the shelter and all the innocent cats. What are they supposed to do without all of their dedicated and loyal volunteers? For some of these cats this has been the only home they’ve ever known. The cats can’t talk, so we have to be their voices.”

Haley also brought a petition signed by many friends and neighbors.

Several of the volunteers asked the board what would happen to the cats if the shelter closed its doors. According to the town, two other shelters have offered to take over including The Little Shelter in Elwood. However volunteers argued they don’t offer the same amount of health services for animals as the Grateful Paw staff does.

“Yes we screwed up, something happened, and we want to rectify this — we do not want to leave.”

—Donna Fitzhugh

Supervisor Frank Petrone (D) assured the audience that all of the cats living at the shelter now would continue to be cared for, and the shelter would continue with its no-kill policy. However despite the pleas of many residents, he said he had great concerns moving forward with LAP.

“Animals will not be harmed,” Petrone said at the meeting. “I’m a cat lover, but five years without a filing, and it was known and the town was not told. I personally don’t have confidence in the league anymore to go forward when they knew the situation existed.”

Petrone said it’s not as easy as the shelter just refiling for not-for-profit status.

“These laws were broken,” he said. “So you’re telling us just go forward and let’s make it nice. Well it’s not that simple.”

No further decision was reached by the board at the meeting.

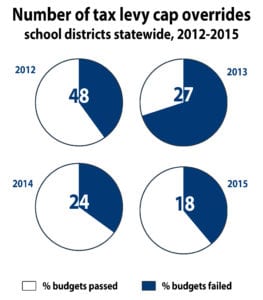

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.

The state cap limits the amount a school district or municipality can increase its tax levy, which is the total amount collected in taxes, from budget to budget. While commonly referred to as a “2 percent tax cap,” it actually limits levy increases to 2 percent or the rate of inflation — whichever is lower — before certain excluded spending, like on capital projects and pension payments.