A change of leadership at Smithtown Town Hall has resulted in a proposed 2019 budget that could increase homeowners town taxes for the first time in three years.

Supervisor Ed Wehrheim (R) presented his $109 million tentative budget for 2019 to the town council in a short meeting Oct. 5, on deadline under New York State Law. The proposed budget represents an increase of $4 million more than this year’s budget, with $1.5 million additional in the taxes levied among Smithtown’s homeowners. The supervisor promised it will be used to the benefit of its residents.

“We’ve committed in this administration to invest in Smithtown,” Wehrheim said. “We are going to do just that. I looked at the operating budget and we’ve stayed within the 2 percent mandated state tax cap.”

If approved, the 2019 tentative operating budget will be a total $66.60 annual increase for the average Smithtown homeowner, according to Wehrheim, with $28 of that increase attributable to a rise in solid waste district fees.

The town’s singular largest driving cost behind the proposed budget was a $1.1 million increase to health care insurance contributions for its full-time union employees, according to the supervisor. He also expects operational expenses such as fuel and utility costs to continue to grow over the year ahead.

The tentative budget sets aside $5.5 million for road, curb and sidewalk improvements, which Wehrheim said he decided in conjunction with Superintendent of Highways Robert Murphy (R).

The town supervisor has also proposed an approximately 40 percent increase to the Community Development Fund, which he said is used to help fund a list of neighborhood projects to improve local look and character of the neighborhoods. Most of the town’s funds will be used to kick-start projects, according to the supervisor, before hopefully being reimbursed through a combination of state aid or other grants.

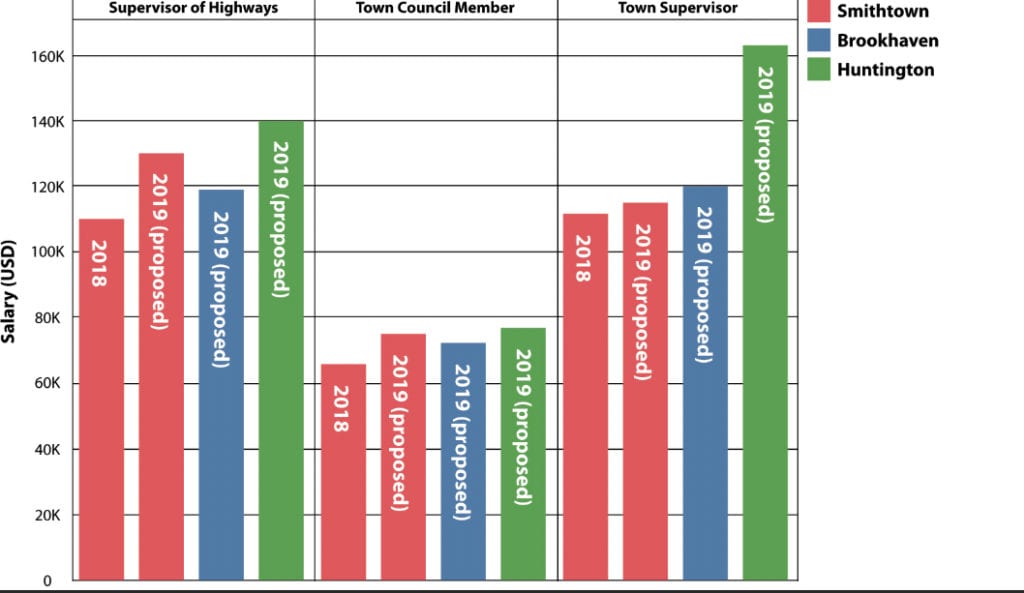

Wehrheim is looking to increase the salary of each town council member by more than $9,000; from $65,818 up to $75,000. This represents a year-to-year increase of about 14 percent.

“I feel that it is in line with surrounding neighboring municipalities,” he said. “I feel the council position deserves that salary. It’s a different administration and they have far more responsibilities than they did previously.”

By comparison, each Town of Brookhaven council member is poised to make $72,316 in 2019 while to the west, the proposed annual salary for Huntington town council members is $76,841 next year.

In Smithtown, Wehrheim has proposed $30,000 for a new government liaison position, which if approved, will become an additional title and responsibilities for one of the town board members. The supervisor said the individual appointed will take on responsibilities similar to a deputy supervisor or chief of staff.

“It’s a more economical way as opposed to additional full-time staff in the supervisor’s office,” he said.

Murphy also stands to get an additional $20,000 a year, increasing the highway supervisor’s salary from $110,000 up to $130,000 per year, if the proposed budget is approved. Wehrheim said the 18 percent hike is warranted and has been talked about for several years.

“[Highway] is the town’s largest department,” Wehrheim said.

In perspective, Murphy’s new salary would be more than Brookhaven’s highway superintendent, poised to earn $119,132 in 2019 but less than Huntington’s $140,000 salary per year.

Wehrheim said that while he has added a few new positions to his administration in 2018, including a public information officer, he is hoping to hire two additional laborers each for the Highway Department and Parks, Buildings & Grounds Department next year. The exact salary for these positions has yet to be determined, according to the supervisor, as the town is in the midst of negotiating new contracts with both the Civil Service Employees Union, representing the municipality’s employees, and the Smithtown Administrators Guild, which represents its departmental directors. The previous contracts expired Dec. 31, 2017.

“Any increase would be result of union negotiations,” Wehrheim said.

The supervisor has also put forth a proposed $10 million capital budget for 2019, presented at the same time as the operating budget. He said $8 million of that budget will be borrowed by the town, and allocated toward large projects such as $2.3 million for new water mains along St. James Lake Avenue business district and $2 million in 2019 toward renovation of Flynn Memorial Park.