By Victoria Espinoza

President Donald Trump (R) presented his blueprint for the 2017-18 federal budget and if passed by Congress as it stands, it spells out cuts to programs on which North Shore residents depend.

The draft includes more than $54 billion in cuts to federal programs and departments, with the biggest cuts to the U.S. Environmental Protection Agency and the U.S. State, Labor and Agriculture departments.

State officials on both sides of the aisle were quick to condemn cuts to the U.S. Department of Energy, to the tune of $1.7 billion or 5.6 percent less than last year’s funding, that could impact Brookhaven National Laboratory. BNL was established by the DOE in 1947 and has housed the work of seven Nobel Prize winners. The lab hosts public tours and special programs, as well as school science fairs and robotic competitions, also scientific lectures for community residents.

Trump’s budget blueprint intends to cut $900 million in funding to the DOE’s Office of Science, under which BNL receives its funding among other national labs.

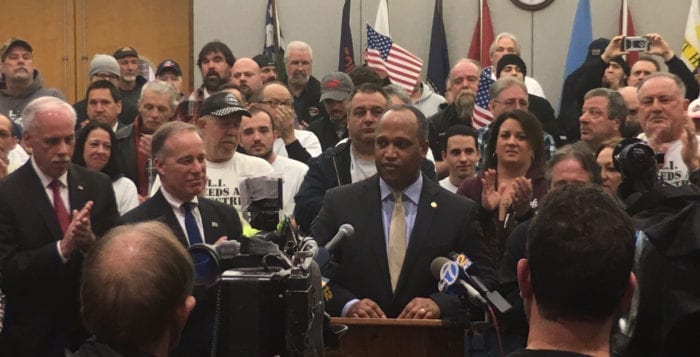

U.S. Sen. and Senate Minority Leader Chuck Schumer (D-NY) held a press conference on the front steps of the Brookhaven lab in Upton March 17, calling the proposed cuts a blow to the community since the lab supplies jobs for as many as 3,000 Long Islanders.

Schumer said in recent years BNL has received an annual $537.3 million in federal funds from the Office of Science budget, about $5 million in federal funds from the Office of Energy Efficiency and Renewable Energy and about $3 million from the Nuclear Energy Office.

“This major Department of Energy budget cut is a cut to our future, a cut to our knowledge, a cut to our research and a cut to good-paying Long Island jobs,” he said. “Brookhaven National Lab is home to some of the world’s brightest minds and most cutting-edge innovations, which both advance human knowledge and spur our economy. … These kinds of cuts not only hurt us today but they hurt the future jobs and the companies of tomorrow who would otherwise plant their roots on Long Island.”

Schumer was not the only member of Congress from the area to speak out about the president’s cuts. U.S. Rep. Lee Zeldin (R-Shirley) has voiced his concerns while also assuring constituents there are many parts of Trump’s budget that are beneficial to the United States.

“I strongly oppose the proposed cuts to Brookhaven National Lab, SUNY Stony Brook and other sources of scientific research in the 1st Congressional District,” he said in a statement. “Throughout the years, we have seen some of the world’s greatest science research conducted at these facilities.”

Zeldin made sure to reiterate Trump’s blueprint is a draft with nothing set in stone.

“Regardless of who is in the White House, the Constitution puts government funding strictly under Congress to initiate through the appropriations process,” he said. “The president’s budget request is just that — a request. It has no force of law or legislation.”

The U.S. Department of Housing and Urban Development’s budget could also see a $6.2 billion or 13.2 percent reduction, which means grants for certain local programs could be ended including the popular Meals on Wheels program that has branches in Three Village and Smithtown. Meals on Wheels is a national program providing meals to senior citizens who cannot leave their homes to shop on their own. Chapters in different states rely on funding from the Community Development Block Grant program through the H.U.D. In Trump’s budget blueprint he proposes eliminating the program, cutting $3 billion to community service organizations such as Meals on Wheels, among others.

Although the Three Village Meals on Wheels is not in jeopardy, as all of its funding comes from community donations, Susan Hovani, president of the Three Village branch, said it would be a shame for other communities to lose funding — like Smithtown Meals on Wheels, which relies on federal funding to operate.

“This major … budget cut is a cut to our future, a cut to our knowledge, a cut to our research and a cut to good-paying Long Island jobs.” — Chuck Schumer

“These programs are very necessary,” she said in a phone interview. “It’s sad to see [federal funding] could be cut, and I think it would be much better to cut from other places.”

Another heap of programs on the chopping block are those funded by the U.S. Department of Education’s budget. Compared to last year’s budget, the department’s funding would decrease by $9 billion, or 13 percent.

Trump’s blueprint proposes completely eliminating the 21st Century Community Learning Centers program, which supports before and after-school programs as well as summer programs.

“The Trump administration’s call for zero funding for the 21st CCLC after-school initiative is a betrayal of the millions of students and parents who depend on after-school and summer-learning programs,” Afterschool Alliance Executive Director Jodi Grant said in a statement.

Afterschool Alliance is one of the after-school initiatives from the 21st CCLC that is responsible for many New York students after-school hours.

“It is painfully shortsighted and makes a mockery of the president’s promise to make our country safer and to support inner cities and rural communities alike,” she added.

Grant said after-school programs enable many parents to work and cutting these programs could jeopardize their ability to hold a job, as well as create a safe space for kids when they have nowhere else to go or no other positive activities to turn to.

The president said the budget proposal is meant to advance the safety and security of the American people.

“Our aim is to meet the simple, but crucial demands of our citizens — a government that puts the needs of its own people first,” he said in the blueprint. “When we do that, we will set free the dreams of every American, and we will begin a new chapter of American greatness.”

Trump said the proposed cuts are crucial to streamlining government spending and operations.

“These cuts are sensible and rational,” he said. “Every agency and department will be driven to achieve greater efficiency and to eliminate wasteful spending in carrying out their honorable service to the American people.”